Overdales – Everything You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

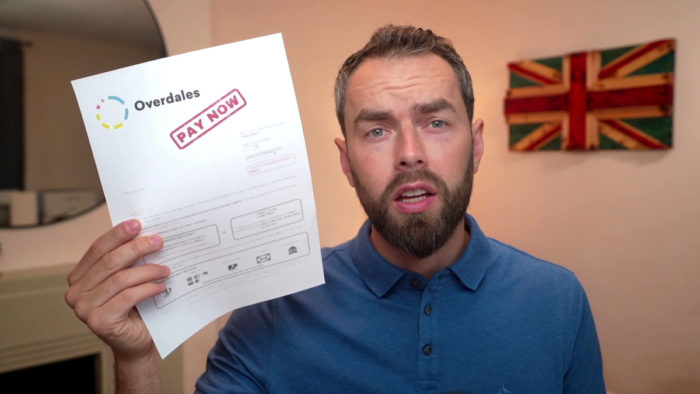

Are you concerned about a letter from Overdales Solicitors? We know that it can be confusing when a debt comes from nowhere. You might be asking yourself if you should pay or if this is even real. And what if you can’t afford to pay?

You’re not alone. Every month, more than 170,000 people visit our website for debt advice.

In this article, we’ll explain:

- Who Overdales Solicitors are and who they work for.

- What to do if you get a debt letter from Overdales.

- How to ask Overdales to prove that you owe the debt.

- What to do if Overdales doesn’t reply or proves you owe money.

- How to talk to Overdales and understand the law about not paying.

Our team knows how you feel, as some of us have been chased by debt collectors too. Research shows that nearly half of the individuals who deal with debt collection agencies have experienced harassment or aggression1. But don’t worry; we’re here to help you figure things out.

Have You Received an Overdales Debt Letter?

Overdales may try to contact you in different ways. They use whatever contact information they have. But remember, they can never discuss a supposed debt with another person, especially family, friends, or an employer.

One of the most crucial forms of communication is in writing. This is because Overdales Legal can send debt letters that are in fact Letters Before Action (LBA).

An LBA is a letter stating you must pay the debt by a deadline or you could be taken to court, which may incur additional fees.

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Do You Have to Pay the Debt?

You don’t have to pay an Overdales debt just because you received a scary letter. You might end up having to pay if you do in fact owe the money to their client. But there is something you can do to get you off the hook or simply buy yourself some time.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Ask them to prove you owe the debt

To potentially avoid having to pay, you should ask Overdales Legal to prove you owe the money they’re asking you to pay. You can do this by replying to their LBA with a prove-the-debt letter.

Your reply should firmly ask for proof you owe the money and state you won’t be willing to pay until they supply the proof.

They’re obligated to do this, and the proof should be a copy of a signed agreement when possible.

This is also a good way to reply if you think there has been a mistake or they have contacted the wrong person. Because they’ll soon realise this once they ask their client to dig out the proof of the debt.

StepChange found that two-thirds of people in debt have experienced some level of bad practice from a debt collector in the last two years2, so it’s important to confirm that the debt is actually yours.

What if they prove I owe the money?

If Overdales Legal does prove you owe the debt, you should consider paying to avoid legal action. You may be able to agree on a payment plan if the amount owed is significant or would cause financial instability.

It’s risky to assume they won’t take legal action and you won’t need to pay. But it’s not impossible that you could get away with not paying.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What if there’s no reply?

You’re not obligated to pay the supposed debt until Overdales Solicitors send you proof that you owe the money. If they don’t reply or don’t supply the proof, you might want to ignore their letters. And if they continue to legal action against you, you should tell the judge that your request for proof was ignored.

You should keep copies of your prove-the-debt letters for this reason.

Can You negotiate with Overdales?

If Overdales can prove that you owe the debt, you really should pay them. But that doesn’t mean you have to pay them in one lump sum if you can’t afford it!

You might be able to use a standard Overdales repayment plan, or you could negotiate and organise your own repayment structure.

Before you think about a repayment plan, you need to look at your finances and calculate what you can reasonably afford to pay.

Now you know the upper limit on what you can repay on a monthly basis. Knowing your budget also means that you will be able to work out what your best option is:

- Lump sum payment: If you have the money on hand, paying off your debt in one go will get Overdales off your back quickly.

- Smaller payments: If you can’t afford to pay the original debt payment, you can ask Overdales to accept smaller payments over a longer period of time.

- Wipe off some debt: If you are in dire financial circumstances, you may be able to negotiate a smaller debt amount. This means Overdales agrees to wipe out part of your debt and you pay what is left. You may be able to pay the remaining balance either in one go or in instalments. You can download our “write off my debt” letter template if you need help crafting the request.

Make sure you get any agreement in writing before you make any payments! This makes it much more difficult for Overdales or your creditor to accuse you of not fulfilling your agreement.

What are the legal implications of not paying?

Once Overdales have proved that you owe the money, you are legally obligated to pay.

The only possible situation where you wouldn’t need to pay is if Overdales took more than 6 years to answer your request to prove that you owe the debt. If the debt has not been paid or acknowledged for 6 years it becomes statute-barred and there is no way for your creditor or Overdales to make you pay.

However, this is quite unlikely! It is also important to remember that some debts – like those owed to HMRC – are enforceable for longer than other unsecured debts.

If you don’t pay then Overdales can take you to court.

Court action is more likely if you have not been in contact with Overdales when they have reached out to you several times. You will receive a final letter from Overdales telling you that they will take you to court unless you pay.

This final letter is usually a type of default notice. A default notice is a formal letter that gives you a final 14 days to comply with their request.

Pay in these 14 days and they can’t take you to court.

You could still negotiate a repayment plan during this time frame. If you still don’t pay, you will end up in court. Overdales’ claim will be heard in your local county court and a County Court Judgement (CCJ) will be issued against you.

You have now been ordered by the court to pay your debt. You must contact Overdales to organise repayment or a repayment plan.

If you still refuse to pay, Overdales may be able to apply for a High Court Enforcement Officer (HCEO) to enter your property and remove some of your belongings to sell and cover your debts. You need to be aware that there are some limits on HCEOs.

A HCEO can’t be used for debts that are less than £600, or not covered by the Consumer Credit Act. This means that Overdales cannot use HCEOs for any debt from overdrafts, credit cards, or personal or payday loans.

Will You be taken to court for an Overdales debt?

Overdales Solicitors will discuss the potential for court action with their client, and the client is the one who will decide whether they want to take you to court or not. However, even if the client doesn’t have an appetite for litigation, Overdales may still threaten court action.

This is a nasty tactic that is frequently used in the debt collection industry. Even though they’re not supposed to make legal threats without the real possibility of it happening,

Overdales could make these threats to scare you into paying. But as there’s no way of knowing if legal threats are tactic or genuine, it’s best to be cautious and assume you will be taken to court if you don’t pay.

» TAKE ACTION NOW: Fill out the short debt form

Overdales Contact Details

| Post: | PO Box 1399, Bradford, BD5 5GA |

| Phone: | 03331 110 800 |

| Text: | 07860 020977 |

| Email: | [email protected] |

| Website: | https://www.overdales.com/ |

Your rights when facing debt collection companies

Push back against Overdale Debt Collection by exercising your rights. We’ve discussed everything you need to know about dealing with debt collectors. Equip yourself with the correct knowledge to push back effectively.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |