HMRC Debt Collection Process Explained – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with an unexpected letter from HMRC debt collectors can be a bit scary. But don’t worry, we’re here to help.

Every month, over 170,000 people find answers to their debt questions on our website. You’re not alone.

In this easy-to-read guide, we’ll explain:

- What HMRC debt is and how the collection process works.

- How to check if your HMRC debt is real.

- Ways to get help if you can’t afford to pay.

- What a Time to Pay Arrangement is.

- Other solutions for dealing with debt.

We understand that dealing with HMRC debt can be hard. We have lots of information to help you make the best choices.

Ready to learn more about how to handle your HMRC debt? Let’s get started.

What is HMRC?

How to Dispute

HMRC sends you a ‘decision letter’ letting you know whether you can appeal a tax decision.

It’s worth noting there’s a procedure to follow when appealing HMRC Debt.

You could appeal against:

- A tax bill which includes Income Tax, VAT, Corporation Tax

- Claims for tax relief

- A request for details or to check through your business records

- A penalty you received for late tax payments or late tax return submission

An appeal can be made by an accountant or someone else who manages your taxes. This can be helpful as understanding Tax Codes is important.

You typically have to pay the costs of appealing a tax decision. Plus, it may be possible to delay payment of your taxes or a penalty until the appeal is resolved.

» TAKE ACTION NOW: Fill out the short debt form

Consequences of ignoring it

The consequences of ignoring an HMRC debt could lead to more stress and anxiety.

I’ve listed what may happen here:

- Enforcement officers (bailiffs) will enforce the debt

- An application for a County Court Judgement (CCJ) could be made against you

- A summons to appear in a magistrates’ court could be issued

- Bankruptcy proceedings could be started against you

- Money could be taken directly from your wages

- Money could be taken from your savings

What other debt solutions are there?

If you can’t afford to pay what’s owed, seek advice from a debt expert.

I’ve listed other debt solutions that could be worth considering as well as HMRC Debt Relief Options.

Formal solutions are legal processes which include:

- A Debt Relief Order (DRO)

- An Individual Voluntary Arrangement (IVA)

- Bankruptcy

Informal solutions are options if you can repay creditors in full and which allow them to agree on an arrangement with creditors to pay repayments over time.

They are not legally binding which means creditors can demand full payment if they change their minds.

Informal solutions are:

- A consolidation loan

- A debt management plan (DMP)

- Paying each creditor individually but with payment plans

Is extra help available?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is a Time to Pay Arrangement?

A Time To Pay Arrangement lets you pay back what you owe to HMRC in monthly instalments over 12 months.

That said, some arrangements can be longer depending on affordability and circumstances.

The role of independent financial advisors

A financial advisor will look at your circumstances and financial plans before recommending which product meets your unique needs.

They also provide advice on self-assessment HMRC Debt for the self employed.

There are two sorts of financial advisors which I’ve listed here:

- An independent financial advisor (IFA) provides unbiased advice on a whole range of financial products. It includes tax arrears

- A restricted advisor provides advice or a limited range of financial products which is typically in one area such as pensions

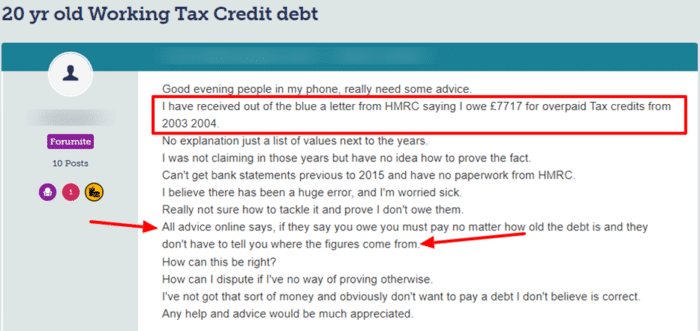

Case study

See the message a person posted on a popular online forum.

Source: Moneysavingexpert

Other Debt Collectors

You should check for more outstanding debts that you may have with other companies or debt collectors. Here are four steps you could take:

- Check your credit report for other defaults

- Check your email and post for reminders or overdue notices

- Check the court records for CCJs against you

- Check your bank statements for the names of other debt collectors

There are hundreds of debt collectors in the UK and each works with different companies to collect debts.

For example, Cabot Financial have been known to collect for the DVLA while Lowell Financial and PRA Group buy debts from various credit card companies like Barclaycard.

If you see a name on your bank statement that you don’t recognise then you can search MoneyNerd to see if they’re a debt collector.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.