Coltman Warner Cranston Debt – Should You Pay Them?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling puzzled because you received a letter from Coltman Warner Cranston about a debt? Don’t worry; you’ve found the right place for help.

Every month, over 170,000 folks visit our site for advice on issues just like this one, and research shows that 64% of UK adults find interactions with current debt collectors stressful1. So, you’re not alone.

In this guide, we’ll talk about:

- How to find out if the debt they say you owe is really yours. Remember, if the debt is not yours, you don’t need to pay it!

- The reasons why Coltman Warner Cranston might be reaching out to you.

- What to do if you can’t afford to pay the debt.

- How to chat with debt collectors in a way that works for you.

- What could happen if you don’t pay your debt, and how to find help.

We understand how stressful it can be when a debt collector contacts you. Some of us have been in the same boat. So, we’re here to help you learn about dealing with Coltman Warner Cranston debt.

Why Are They Contacting You?

Even though most debt is written off after six years, it is very unlikely that a creditor will let a debt age for this long. And this is where a firm like Coltman Warner Cranston comes in.

Debt collection agencies like Coltman Warner Cranston buy billions of debt annually at rock bottom prices – at an average of 10p to £1!2

A creditor will pass the debt over to Coltman Warner Cranston, who will levy a fee for getting you to settle the debt. Forcing you to pay a debt that the original creditor has failed to get you to settle, thus, making a profit.

Should You Just Pay?

You will likely find that these debt collectors will try and get you to settle the debt in full, as quickly as possible. However, you must first make sure that you are actually responsible for the debt. Understanding your debt with Coltman Warner Cranston might not be cut and dry, so make sure you know all of the facts.

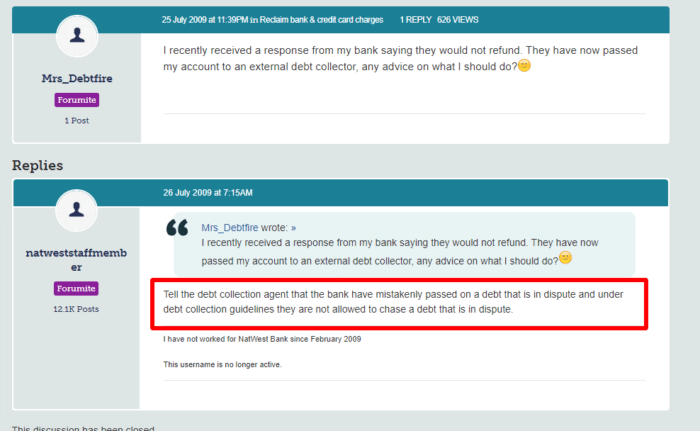

In some cases, such as if you were a second card holder but not the main signatory of the credit agreement, you may not be responsible. Or you may actually dispute the original debt, and in this case, the creditor should not yet pass the debt on to a collection agency.

Furthermore, you may be able to arrange an affordable payment schedule with Coltman Warner Cranston. A debt collection agency would prefer you to pay your debt, even if it takes some time to do so in instalments.

Ignoring the problem won’t make it go away. I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

If You Don’t Pay, What Happens?

If you don’t acknowledge the debt that Coltman Warner Cranston is chasing you for, the company will begin taking action against you. This is generally an increasingly serious series of events, as listed below.

- You will be sent letters repeatedly, demanding that you make payment, and threatening you with further action.

- The company will make phone calls to any number they think you could be accessible on. Often, these calls will be made outside of business hours, to try and catch you at home.

- In some cases, a collection agent may visit your home. These visits often happen in the evening or at weekends, to try and catch you at home.

- A default might be issued against you, and a record of this would be made on your credit history. Or more seriously, a County Court Judgement (CCJ) taken out against you. This would stay on your credit history for six years.

- A statutory demand might be issued. This is the first step in having you declared bankrupt. However, this is only an option for debts over £5000.

When someone is sent to your home, it’s important that they identify themselves as either debt collectors or bailiffs, as each one has different rights. To help you better understand the differences between debt collectors and bailiffs, here’s what they can and can’t do.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

What Is the Worst Thing That They Could Do?

Ultimately, being declared bankrupt would be the worst outcome of being in debt. A debt collection agency would seek to have you made bankrupt so that they can apply to collect your debt straight from your wages.

It obviously makes sense not to let things go this far if you have any way to stop yourself from being declared bankrupt. Consider for a moment, that a debt collection agency wants you to pay your debt. Having you declared bankrupt takes time.

If you contact Coltman Warner Cranston and offer to set up an affordable repayment plan, you will likely find that the company is willing to entertain such an agreement.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How to communicate with them

It can be a frightening thought to get in touch with debt collectors, but you actually have rights! Debt collectors cannot:

- Harass you with threatening phone calls and letters

- Contact you at work

- Threaten you with legal powers they don’t have

- Breach data privacy laws

- Lie to you

- Increase interest rates

So, when negotiating with Coltman Warner Cranston, you can request a time and particular number to be contacted on. It’s also a good idea to keep track of all contact made with a debt collector, whether they contacted you or vice versa.

Contact Details Coltman Warner Cranston

| Website: | https://www.coltmanco.com/ |

| Phone number: | 02476 627262 |

| Fax: | 02476 227691 |

| Email: | [email protected] |

| Online form: | contact form |

| Address: |

Unit 3, Coventry Innovation Village Coventry University Technology Park Cheetah Road, Coventry CV1 2TL |