I Have a CCJ but Don’t Know Who From – How To Resolve

For free and impartial money advice you can visit MoneyHelper.

For free and impartial money advice you can visit MoneyHelper.

Have you been told about a County Court Judgement, also known as a CCJ, but you’re not sure who it’s from? Don’t worry, you’re not alone. Every month, over 4,600 people visit us for advice on handling court matters and debts.

In this easy-to-read guide, we’ll help you:

- Learn what a CCJ is.

- Find out who the CCJ is from.

- Understand what happens if you ignore a CCJ.

- Learn what impact a CCJ can have on your credit profile.

- Discover ways to possibly lower your debt.

We know that finding out about a CCJ can be scary. You might worry about paying the debt or about bailiffs coming to your home. Our team is here to help. Some of us have faced debts and court actions too, so we understand how you might feel. We’re here to offer clear, simple advice to help you through this tough time.

Let’s dive in.

How do you find out whether you have a CCJ?

County court judgments as well as records of insolvencies such as bankruptcy are also recorded on your credit file.

If you believe you have a judgement or decree but it is not listed on your credit report, you can check the Registry Trust’s public register of judgments. You can apply for information at Trust Online.

The register will show the following if you have a CCJ

- The date of the decision

- The amount owing

- Name of the court that issued the judgment

The register will not tell you who the creditor is, but you can contact the court to find out. You can find the contact details of all the courts in England and Wales by clicking here.

There is a £6 fee to get this information, so I recommend searching your credit file first. The information will be kept for a maximum of six years.

» TAKE ACTION NOW: Fill out the short debt form

What can you do if you have a CCJ?

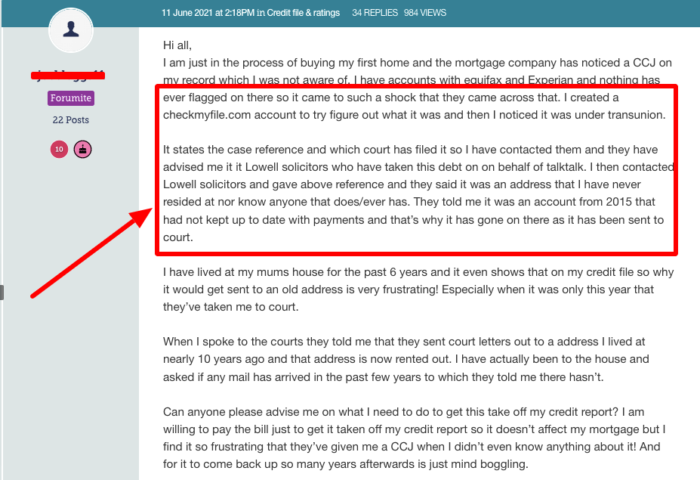

A court may decide to set aside a CCJ if you didn’t know anything about it, or it was not served correctly. How likely is this to happen?

Was the Claim Form served correctly?

In the vast majority of cases, the claimant is the one who is responsible for seeing to it that the claim form is sent to the defendant. The paper that explains what is being claimed and the reason behind it is called the claim form.

To “serve” the claim form means to bring it to the knowledge of the defendant by following the procedures that are required by the rules of the court. Part of this procedure is that it be sent to the defendant’s usual or most recent known address.

If you can establish that the claimant knew or ought to have known that you had changed addresses, then the claim form will be regarded as not having been served.

Nevertheless, if the claimant had no reason to assume you had relocated, then the claim form was probably properly served, even though it was delivered to an old address. This is true even if the claim form was submitted to an old address. Although it might not be your current address, the claimant will consider it to be your “usual or last known” residence if it is the address they have on file for you.

Under these specific conditions, the claim form was successfully served, and the CCJ would probably be upheld.

How to Get A CCJ Removed

Our partners at the CCJ Removal Service have a ton of experience with getting CCJs removed.

They will cover the whole process for you – listening your story and advocating for you every step of the way.

The Process

Step 1:

- Establish your legal grounds for removal.

Step 2:

- Mediate with your claimant to establish the terms they’d agree to “Set Aside” the judgement under.

Step 3:

- A barrister drafts the agreement between the parties to get your CCJ removed.

Step 4:

- The court removes or “sets aside” the CCJ from your public record.

It’s a surprisingly simple process.

Fill out our form to get help from our partners at CCJ Removal Services.

How can you find out how much you owe?

The first step is to review your credit report. Your credit file includes information on your debts, such as rent arrears, as well as other publicly available information given by lenders. It has details about your bank accounts, loans, credit cards, and any other forms of credit you have. It may also include information about other bills, such as those for mobile phones, electricity, and insurance. Your credit report is used to determine your credit score.

In the United Kingdom, there are three credit reference agencies:

| Credit Agency | Website | Contact phone number |

| Experian | www.experian.co.uk | 0800 013 8888 |

| Equifax | www.equifax.co.uk | 0800 014 2955 |

| TransUnion | www.transunion.co.uk | 0330 024 7574 |

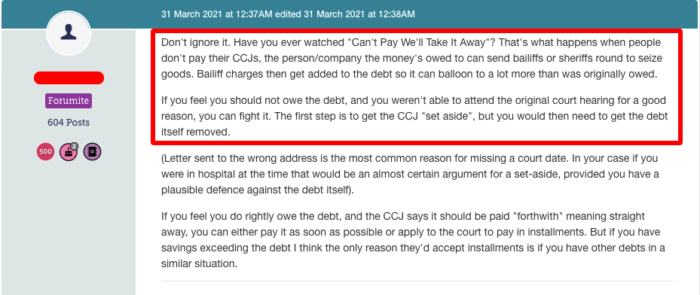

What happens if you ignore a CCJ?

If you are going to struggle to make your CCJ payments, you might be inclined to ignore it entirely. However, if you do not respond to it in some way, you may suffer further and more severe consequences.

If you do not pay your CCJ, your lender may take the following actions:

- Apply for an attachment of earnings, where the money you owe would come directly from your wages

- Send enforcement officers or bailiffs to your home; they will ask you to settle the amount, and if you are unable to do so, they may search your home for items that can be used to offset the shortfall. When High Court Enforcement Officers or Bailiffs visit you for the first time, they cannot force entry or push past you, but it is still a source of worry and distress that can be avoided. Find out more about bailiffs here.

Even if you are in financial difficulty, it is important to ask if you may pay the money back in smaller instalments or at a later date; ignoring a CCJ is never a good option.

So, now you know what a CCJ is and what the consequences of not paying are. I’ve talked about how ignoring a CCJ is a bad idea, but if you don’t know about the CCJ or who it is from, what do you do?

Who will know about your CCJ?

Your CCJ will be entered into the Register of Judgments, Orders, and Fines, which is a public database. This rule has two exceptions:

If you pay the whole amount within one calendar month of receiving the CCJ, it will not be recorded.

If you contest the CCJ and demonstrate to the courts that it was issued in error, your CCJ may be cancelled or “set aside, which means it will not be recorded.

Your CCJ will be kept on the register for six years if it is registered. For a small fee, anyone can search the public record and discover your name and address, the case and court number, and the amount owed. This CCJ check will not reveal who you owe money.

How do you apply to set aside a judgment or order?

You are required to fill out an N244 form and return it to the court.

It costs £80 to have a CCJ set aside unless you have the permission of the claimant or did not receive the court claim or any other letter, in which case it is £45.

If the CCJ was not issued in your local court, there may be a chance to have it transferred there before the hearing is arranged. If you don’t go to the hearing, your application to have the CCJ set aside could be rejected. If this happens, you will have to pay further costs and will still be liable for the original debt.

Final thoughts

To reiterate, if you have a CCJ and don’t know who it is from, check through your files to see if you have had any correspondence from creditors or courts. If not, find out which court issued your CCJ by looking at your credit report, and contact them to see which creditor it is from. Once you know that, you can take steps to start clearing your CCJ or getting it set aside.