Amigo Loans Refund, Complaints & Claims

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your Amigo loan debt? This is the right place for you. Every month, more than 170,000 people visit this site for advice on their debt issues.

In this simple guide, we’ll share:

- What an Amigo loan is and how it works.

- What to do if you can’t afford to pay your Amigo loan.

- How to claim a refund if you think your Amigo loan was mis-sold to you.

- The new laws that Amigo Loans must follow.

- The role of the Financial Conduct Authority in setting prices.

Debt Justice estimates that 10 million people in the UK are struggling with over-indebtedness. This means they’re falling behind on bills, making debt payments a significant financial burden. 1

If that’s your case, don’t worry. We’re here to help you find a way forward.

You might not have to pay Amigo Loans, and you may be due a refund!

Amigo Loans is no longer lending. They are winding down the business and paying off customers who are due a redress with their surplus assets.

The deadline for making a claim has ended, and you can no longer make a claim to Amigo Loans. You should speak to a debt advisor if you have any questions.

‘In due course, Amigo Loans Limited will be liquidated’, a statement said.

On the Amigo Loans website, the company states:

- All outstanding loans remain subject to the existing payment terms agreed with Amigo. Customers should continue to make payments in the usual way.

- Our call centre remains open to customers for continued support. All payment methods and support facilities remain available to customers.

Scheme creditors who are due a redress can expect an initial payment before the end of 2023. Final payments will be delayed until the business enters liquidation, estimated around May 2024.

What will happen to my Amigo Loan?

Amigo Loans is going into liquidation, and they are using the rest of their assets to pay off their customers due a redress.

There is no change to current loans.

If you have a loan with Amigo, you can still clear your balance or get it reduced. Your credit score may be affected if you do not repay them on time.

How Do Their Loans Work?

What Is an Amigo Guarantor Loan?

What Is the Interest Rate?

Are Amigo Loans in Trouble?

On 23 March 2023, Amigo Loans announced it would stop lending and the business would wind down. Also, they announced that the Scheme of Arrangement would switch to the fallback solution and that they have less money to pay back cash refunds.

What Happens If I Can’t Pay?

Debt Solutions Comparison

If you find yourself unable to repay your Amigo loan, there are different debt solutions available to help you manage your payments.

I’ve put together this table to help you better understand these solutions and how they may affect your credit score or assets.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

Will I Need the Help of a Claims Management Company?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Financial Conduct Authority New Laws

Law #1: Is the Amigo Loan Affordable?

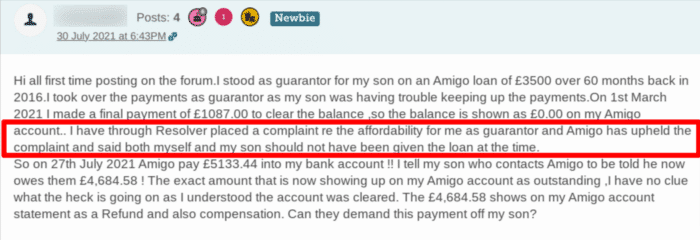

As you can see, this MoneySavingExpert forum user was a guarantor for their son. They filed an affordability complaint and managed to get a refund.

Law #2: Financial Conduct Authority (FCA) Price Cap

Law #3: Taking Your Money

» TAKE ACTION NOW: Fill out the short debt form

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

I Can’t Afford My Next Payment…

Want to Claim a Mis Sold Loan Refund?

Complaint process

When filing a complaint, you first need to contact the firm to submit details of your complaint and give them a chance to make it right.

If you don’t hear back from them within the right timeframe or are unhappy with their decision, you can use the FOS online complaint checker to see if the FOS can help.