Argos Debt – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering about your Argos card and if you should pay your catalogue debt? Or perhaps you’re unsure what to do if you can’t pay?

This guide is here to help. Every month, more than 170,000 people visit our website seeking advice on debt solutions.

In this easy-to-understand guide, we’ll share:

- What Argos debt really means

- The steps to pay back your Argos debt

- What may happen if you don’t pay your Argos debt

- Different ways to handle your Argos debt

- Where to find help and advice on debt

Citizens Advice says that catalogue shoppers who miss payment deadlines get charged very high fees, sometimes more than twice what they borrowed.1

We know how stressful it can be when you can’t pay a catalogue debt. It’s hard to know what to do or who to talk to. But remember, you are not alone. We’re here to help you understand your choices and decide what’s best for you.

Is Argos Card a Credit Card?

An Argos card is similar to a credit card, you have a credit limit and charged interest on your purchases. However, you can only use the credit card at Argos, Habitat and Sainsbury’s.

Argos runs a credit check when you apply for their card or a credit plan and will use your score to decide if they will offer you credit. In my experience it’s a good idea to check your credit score before applying. You can do this by visiting a credit reference agency or by using Clearscore.

An Argos Card carries an interest rate of 34.9% APR variable. You can opt for their flexible payments with the Normal Credit Option or their Buy Now, Pay Later deal.

So you don’t pay anything initially and get 12 months to pay what’s owed on the Argos Buy Now, Pay Later option. If you take out a Normal Credit Argos Card, you don’t pay interest when you pay off what you owe when your statement arrives. Otherwise, you’ll pay interest on the remaining balance until it’s cleared.

Unfortunately, it’s all too easy to fall into Argos Credit Card debt when you don’t use the credit options responsibly. Plus, Argos Debt and credit scores can make it hard to borrow money, get a credit card or a mortgage.

Argos Normal Credit

The Argos card works like a normal credit card. As such, you are allocated a set credit limit. You can avoid interest by paying off the full balance amount when you receive your monthly statement. Interest is added if you don’t clear the balance. As mentioned, an Argos Card has a 34.9% APR variable.

I Can’t Afford to Pay

Argos have a number you can call if you are experiencing Argos Card payment difficulties which is 03456 400 700. You should get in touch with Argos in the first instance and tell them about your financial situation. They should try to come up with a solution.

That said, it helps if you work out your monthly income and outgoings before calling the Argos support team. That way you’ll know exactly what you can afford to pay so you don’t agree to a repayment plan you can’t afford.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens If I Don’t Pay?

If you don’t pay your Argos card, interest is added to the amount you owe which is backdated to the date you made any purchases. You will also be charged a £12 late payment fee which is added each time your account falls into arrears. Your Argos debt will increase every time which can make it harder for you to settle.

» TAKE ACTION NOW: Fill out the short debt form

Missed Argos Card payments and unpaid debts negatively impact your credit score. This, in turn, makes it harder for you to borrow money, take out a loan, mortgage or credit card. It accounts for 35% of a credit score with the majority of lenders.

So, as you can see, the consequences of Argos debt could be far-reaching and stressful. In short, finding yourself with Argos Debt and Credit Score problems can cause you all sorts of all sorts of financial and psychological issues.

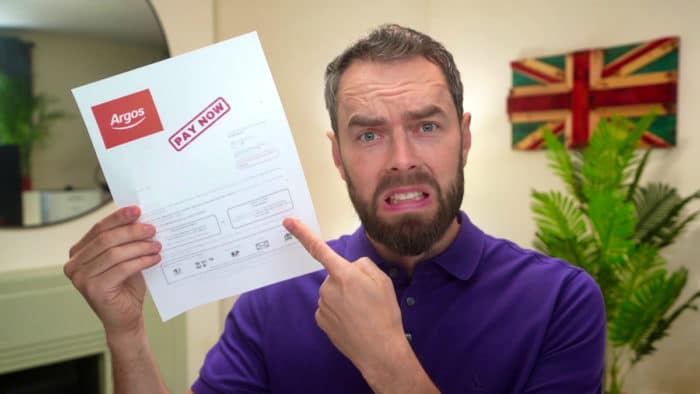

I Have a Letter from a Debt Collector, What Should I Do?

You’ll repay the Argos debt through the debt collector when you get a letter from Advantis. Again, I find that it’s a good idea to know what you can afford and discuss this with Advantis before agreeing to a repayment plan.

Never ignore the letter from the debt collectors. They will continue to contact you which can be stressful. Additionally, you could incur further costs which are added to the Argos debt you owe, making it harder to settle.

If you’re in debt and struggling to pay bills, it can lead to psychological issues. Just thinking about the money you owe could leave you feeling overwhelmed, sad or sick. Chances are you can’t eat properly or sleep well because of your debt worries.

That’s the Impact of Argos Debt on mental health when you don’t deal with it. In short, debt doesn’t just affect your financial situation; it could also lead to mental health issues.

You should seek advice from a debt charity as soon as you can. The sooner you get essential debt advice, the sooner your situation may improve. Plus, the sooner the Argos debt collection process is finalised.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

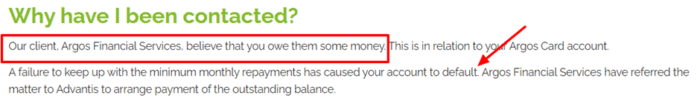

What Debt Collection Agency Do Argos Use?

Argos pass your details on to Advantis Financial Services, the debt collection agency that Argos uses when you don’t keep repayments up to date. In short, if you fail to pay or contact Argos support, you’ll be contacted by Advantis, who’ll attempt to recover what you owe on an Argos Card account. It’s part of the Argos debt collection process.

Source: Advantis Financial Services

It means that you failed to make your minimum monthly repayments which then sees your account enter into ‘default’.

If you’re struggling with your finances, in my experience, it’s best to keep in touch with the provider. And the same is true when debt collectors get involved. Advantis may consider arranging affordable monthly instalments to help you get back on track.

Will Bailiffs Come to My Home?

If you’re wondering about Argos debt and bailiffs, don’t. The only way a bailiff will come to your home for an Argos debt is if you get a CCJ and you fail to make the payments set out by the court in time. Argos can’t send bailiffs to your home, and neither can the debt collectors.

Debt collectors can turn up at your home, but their legal powers are limited. You don’t have to speak to debt collectors on your doorstep or invite them in. You also have the right to request that all contact is made by post.

If they continue to come to your home after you make this request, you can issue a formal complaint with the FCA. Debt collection agencies don’t have the legal power to visit you and seize your goods without a court order.

How to Make a Payment

You can pay your Argos debt online by visiting www.myArgosCard.co.uk. It’s possible to set up a direct debit via the website too. Alternatively, you can pay Argos Card by phone on the following number 0354 640 0700.

Managing Argos debt is essential to safeguarding your credit score otherwise, you may find it hard to borrow money, apply for a mortgage or a credit card.

As mentioned managing Argos debt can help you get back on track with your finances and life.

How Can I Clear My Argos Debt?

You still have several options if you can’t afford to clear your Argos debt through either a one-off payment or instalments. There are strategies to clear Argos debts you should consider.

For instance, speak to a debt advisor and ask how to get debts written off using a debt solution such as an IVA. This is a serious step because an IVA has advantages and disadvantages and is not the best debt solution for everyone.

A debt advisor may suggest other options, such as a Debt Management Plan, debt consolidation or a debt relief order. The other alternative is bankruptcy, which should only be used as a last resort. Again, you should seek legal advice first.

To learn more about the multiple debt solutions you can consider, please take a look at the following table.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

What is an IVA?

IVA stands for Individual Voluntary Arrangement. It’s a formally, legally binding agreement with creditors to repay what you owe them over time. An IVA is court approved, which means creditors must abide by the arrangement.

So, if an advisor suggests an IVA for Argos debts, it could be worth considering. But not before the advisor runs through it with you first.

What is a Debt Management Plan?

A Debt Management Plan is set in place to allow you to consolidate several debts into a single, affordable monthly payment. A debt management plan aims to help you meet any financial obligations you may have.

However, you discuss your situation with a debt advisor before entering into a Debt Management Plan for Argos debts.

What is debt consolidation and how does it work?

Debt consolidation loans are ways to refinance any debts you may have. Essentially, you apply for a loan to cover the amount you owe on your debts.

When an application is approved, the money goes towards paying off your debts. After this, you pay down the new consolidation loan over time.

Again, you should speak to an adviser before choosing an Argos Debt consolidation option.

What does a debt relief order do?

A Debt Relief Order is one of the solutions that help deal with unpaid personal debts. You must apply for a Debt Relief Order through an approved advisor. Plus, you must meet specific eligibility requirements.

The Order last for twelve months. It’s worth noting that while it’s in place, you don’t make any payments towards your debts or interest listed in the Order.

If you’re considering a Debt Relief Order for Argos debts, make sure you discuss your situation with a debt adviser first.

Argos Contact Details

| Website: | https://www.argos.co.uk/ |

| Phone number: | 0345 640 2020 (8am to 8pm) |

| Mail: | Argos Limited Royal Avenue, Widnes, WA8 8HS |

| Help Center: | Argos help center |

| Payment options: | Payment cards accepted by Argos |

| Pay Argos Card by phone: | 0345 640 0700 |

References

- Citizens Advice – Catalogue customers hit hard for missing interest free deadlines