Attachment of Earnings for Council Tax – Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

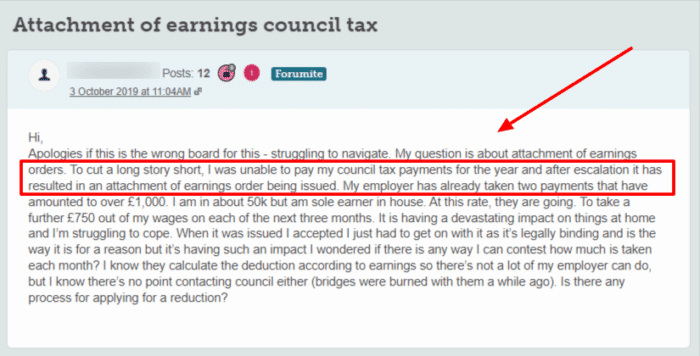

If you can’t pay your council tax and are worrying about legal action, our guide to ‘Attachment of Earnings for Council Tax’ is here to help. Each month, over 170,000 people turn to our website for clear and simple advice about debt solutions.

In this article, we will help you understand:

- What an ‘Attachment of Earnings for Council Tax’ order is and how it works.

- How much money can be taken from your pay.

- If you can stop the order and how to appeal it.

- If having an attachment of earnings will affect your credit score.

- What happens if you don’t comply with the order.

We understand the stress and worry that comes with not being able to pay your council tax. So, we have made sure that our guide is easy to understand and answers the questions you may have. We’re here to help you navigate through this tough situation.

Let’s dive in.

What exactly is it?

An attachment of earnings is used as a way to enforce a debt repayment. The court tells the employer to send a percentage of their employee’s wages (the debtor’s wage) to the court to repay a debt. The court will then send the funds to the party that is owed the money back.

This will continue until the full amount is paid back.

If your debt is for council tax, the money will go to the council to whom you are indebted.

As it is a method to enforce the money owed, it is only used after enforcement action has been allowed by a judge. The local authority could apply to find out if you have an income before taking this route, known as a statement of means. You will be sent a form to fill out in this situation. The form needs to be returned in eight days. Not filling in the form is an offence.

You need to make sure that the information you include on this form is accurate, or you could end up paying more per month than your income allows. Take a look at this example.

Before it goes this far, the debtor will have opportunities to repay what is owed or come to an affordable arrangement.

What is a council tax AOE?

If you have a council tax debt and were told to repay what’s owed – in these cases via a liability order rather than a CCJ – the council can use an attachment of earnings to take back the money you owe.

This is just one way to enforce council tax debt, along with bailiffs, charging orders and even making you bankrupt.

It is possible for your employer to take additional deductions, namely £1 each month as an admin cost during the process. These admin fees will stop once you have repaid in full.

You can be issued with two attachment orders at one time to cover two council tax arrears. If you have more than one year of debt, a larger amount of money can be deducted than normal.

What happens when you get one?

When you are subject to an attachment of earnings because of council tax debt, the amount you have to repay will be set at a fixed amount of your income above the protected rate.

This is different to other debts where you will have to submit a statement of means form.

» TAKE ACTION NOW: Fill out the short debt form

What is the protected rate?

The protected rate is a minimum amount of money after tax that you must receive for essential living expenses. You will need this to buy groceries, cover bills and other essentials.

If your wage goes below this amount, no order can be issued.

If you change employment or stop work, you must tell the council within good time.

Can you stop it?

It is still possible to stop the enforcement action if you have received a liability order. You will need to be able to agree to a full repayment or repayment plan within good time.

Tell the local authority this is what you want to happen quickly.

Once it is active, you cannot stop it.

How much will be deducted from my pay?

The deduction that will be taken by your company is calculated as a proportion of your weekly or monthly pay.

For example, if you earn between £185 and £225 per week after tax is paid, you will be deducted 7% of your wage. This means you would repay between £12.95 and £15.75 per week.

If you earn <£75 or <£300 per week or monthly respectively, you will not pay anything.

If you have agreed to a DMP for other debts, you may need to update your financial circumstances with the provider so you only repay what you can afford.

Online calculator

Your local authority website may offer a special calculator or tables so you can work out what your employer deductions will be.

If you want to know how much will be paid from your income, use one of these calculators.

You don’t have to use your local authority’s website to find them. If it’s not there, try another site or a charity instead.

For example, the West Northamptonshire Council has a helpful breakdown of how your weekly deductions are calculated, right here!

Or you could contact the local authority directly to find out what deduction will apply to your circumstances.

When will my employer start deductions?

Your company will begin to take a payment from your wage and send it to the county court as soon as possible.

You should expect to see the payment being taken on the first payslip after the order has been applied.

You should keep your slips sent by your employer as evidence of payment, and remember that it is possible for your company to take a £1 admin fee each time.

They are not obligated to apply the £1 fee.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will overtime payment be taken into account?

If you decide to work overtime to increase the amount you are paid each month, your company will have to take more from your salary as your income has increased.

However, this can be one way to clear the full debt back quicker.

What if I Don’t Comply?

Attachment of Earnings Orders are legally binding.

This means that failure to comply with an AEO may result in a fine or, in extreme cases, even imprisonment.

Can I ask my company not to do it?

Once an attachment of earnings has been applied, the debt must be paid back through your salary.

Your company has to action these deductions.

Are redundancy payments included?

No, any redundancy remuneration you are sent at the end of a job is not subject to an attachment of earnings and is 100% yours to keep.

Can money be taken from maternity payments?

An attachment of earnings cannot be used to take money from statutory maternity.

However, it can be used to deduct from any contractual maternity payments received.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can my employer take money out from sick pay?

If you are off work due to poor health and receive sick pay from your company each week or month, this will be treated as your income and subject to debt enforcement as per the attachment of earnings.

Most people will be paid less than their full standard income when receiving sick pay.

Therefore, they could pay less towards their debt during this time, and some people won’t have to repay anything back.

Can you be sacked for having one?

Most people cannot be sacked because of an attachment of earnings.

However, some people working in professional financial jobs may face employment trouble.

Can you challenge it?

Can you appeal an attachment of earnings?

It is unlikely that an attachment of earnings will have been made wrongfully in your name. A lot of work goes beforehand that administration mistakes are highly unlikely, but it is still possible.

If you think there is a mistake, contact the council first and get support and advice from a charity.

There are lots of places to turn when you need help!