Average Credit Card Debt by Age UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you keen to learn about credit card debt in the UK? This is the right place. Each month, over 170,000 people visit our site seeking help and guidance on money matters. We are good at explaining debt and ways to handle it.

In this piece, we’ll tell you:

- How much credit card debt people in the UK have on average.

- How this debt changes with age.

- Facts about student credit card debt.

- Details about Gen Z and millennial credit card debt.

- How to manage credit card debt.

We know that dealing with debt can be tough. But don’t worry; we’ll show you the choices you have and help you find a way that suits you best.

By Age

The average credit card debt by age in the UK is £5,400. This means that the average person has a total of £1,600 in credit card debt at any time.

If you don’t pay off this debt, it will significantly impact your life. This is a lot of money.

Credit cards are often used for purchases from retailers but can also be used for online shopping or paying bills.

It’s important to be aware of your credit card limit so that you only spend what you can afford.

This could be an issue if you need to calculate how much debt is on your card or how much interest you’ll accrue if it isn’t paid off.

The oldest millennials have an average credit card loan debt of £8,100

By generation

Let’s look at some of the credit card debt trends by generation:

- The average amount of debt a millennial carries is £4,500. This is a significant increase from the £3,000 average held by boomers in 1991.

- The oldest millennials have an average credit card loan debt of £8,100, a figure that’s more than double that of their younger counterparts, who have an average of £3,600 on their cards.

Student debt statistics

How much student debt you will accrue is one of the most often asked topics among students, and the truth is that student credit card usage varies depending on age, university, and course preferences.

Here are some key statistics:

- Average student debt by age group: £18,000 (18-23 years), £20,000 (24-29 years), £22,100 (30-34 years), and £25,600 (35+).

- Average student debt by the university: £27k at Oxford University, Cambridge University; Warwick University; St Andrews University; Birmingham City University.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is the average held by Gen Z?

Gen Z’s statistics show that the average student loan debt is £26,200. This is up from the £24,000 average held by gen x and gen y, which makes sense given that they’re going through college at a younger age than previous generations.

However, it’s also important to note that this figure only includes some forms of student loans.

For millennials

The average credit card debt for millennials, at £5,000, is lower than that of Generation Z. This group’s average credit card debt is £6,000.

The average credit card debt for seniors in the United Kingdom is £8,200

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

For seniors

The average credit card debt for seniors in the United Kingdom is £8,200. There are secured and unsecured credit cards available to you. The first type, a “credit card,” requires you to pay upfront for the amount you want to borrow. Unsecured ones let you borrow as much money as your bank account can hold without requiring any collateral like an apartment or car to back them up.

Retirement often involves reduced income as individuals transition from earning a regular salary to relying on pensions, savings, and investments. This reduction in income can make it more challenging for seniors to manage credit card debt, especially if they are accustomed to a certain standard of living that may now be difficult to maintain.

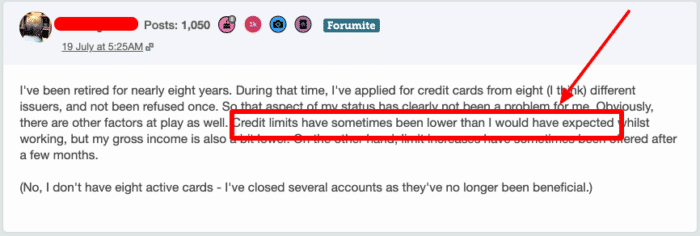

Some (not all) credit card providers may be more hesitant to lend to seniors or offer lower credit limits, due to their lowered income and the increased chances of death before it is paid off. However, this is not always the case, as shown in the forum entry below:

» TAKE ACTION NOW: Fill out the short debt form

Millennial debt statistics

The average credit card debt of the millennial generation is £5,200. This is more than double that of any other age group and significantly higher than that of previous generations.

Millennial debt statistics show a greater dependence on borrowing to finance their lifestyles and student loans, car loans, and mortgages. The average amount owed by millennials was 1 in every five adults aged 18-34 (between 20-39).

Millennials are also paying back their debts faster than previous generations: one-third of those not repaying their debts within one year will never repay them.