Average Debt to Income Ratio UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re feeling worried about your debt and are curious about the average debt-to-income ratio in the UK, you’ve come to the right place.

This is a common concern for many, and you’re not alone in wanting to understand your financial situation better. In fact, over 170,000 people visit our website every month for guidance on debt solutions.

In this article, we’ll explore:

- What the average debt-to-income ratio in the UK is

- How to determine if your debt-to-income ratio is good

- The latest debt-to-income ratio statistics

- How this ratio varies with age

- Frequently asked questions about debt-to-income ratios

We understand your worries, as some of our team members have also struggled with debt collectors. We know it can be tough, but with the right information and support, you can navigate through your financial worries.

So, let’s start learning about debt-to-income ratios, and how you can use this knowledge to better manage your finances.

What is the Average Debt-to-Income Ratio in the UK?

In the second quarter of 2022, the average debt-to-income ratio for households in the UK was 133.9%.

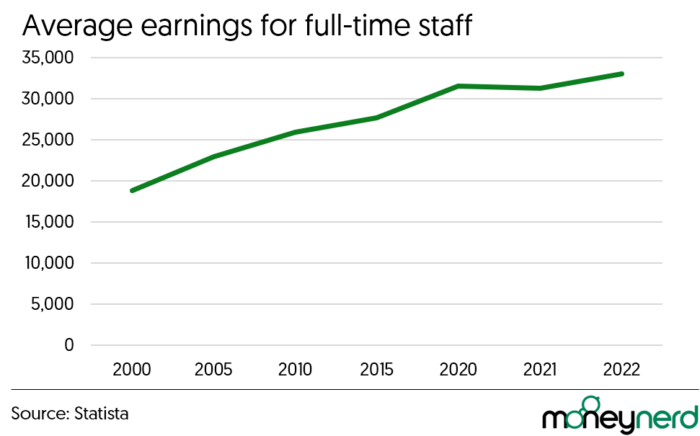

During this period, the average amount of personal debt for an adult in the UK was £33,410. In 2020, the average full-time income in the UK was £31,487 and the average amount of personal debt was £31,643.

These figures demonstrate that it has become normal for an adult in the UK to have more debt than their annual income.

In 2020, the average full-time income in the UK was £31,487

» TAKE ACTION NOW: Fill out the short debt form

Debt-to-Income Ratio Statistics

A debt-to-income ratio of over 50% is considered to be high. People in this bracket will likely struggle to obtain further personal credit or to apply for a mortgage.

If a lender does accept someone with this high a ratio, then they will be subject to high interest rates, and, in the case of a mortgage application, a larger deposit will likely be required.

- From the second quarter of 2020, the debt-to-income ratio of households in the UK increased significantly, reaching a peak of approximately 136% in the second quarter of 2021.

- The ratio of household debt to disposable income is projected to rise by 1.1% in 2023.

To understand why the typical debt-to-income ratio is so high, it pays to take a look at average income figures:

- As of 2022, the average full-time income for an adult in the UK rose to £33,000, which is only slightly below the average debt amount of £33,410.

- In the three years to March 2021, 45% of UK households had a weekly pre-tax income of less than £600, with 20% having less than £400 and 6% having less than £200.

- From March 2020 to August 2020 (the early stages of the coronavirus pandemic), the number of UK households claiming Universal Credit rose by 58.7%, from 2,699,140 households to 4,595,612.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Average Debt-to-Income Ratio by Age

The debt-to-income ratio fluctuates between different age groups, as seen below:

- 16-24 year olds have an average of 56%.

- 25-34 year olds have an average of 98%.

- 35-44 year olds have an average of 124%.

- 45-54 year olds have an average of 150%.

- 55-64 year olds have an average of 164%.

- Those aged 65 and over have an average of 152%.

Reaching retirement age with such a significant amount of debt naturally poses a big problem as income tends to decrease during this time.

After taxes and housing costs, the average UK retirement income is £304 a week, which equates to an annual income of £15,080.

If a person enters retirement with a high level of debt, then it may be hard to manage the payment on this level of income.

What is a Good Debt-to-Income Ratio?

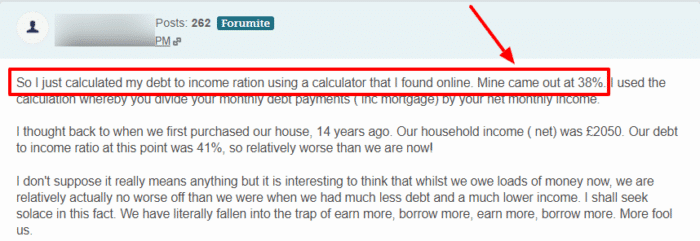

With the average UK debt-to-income ratio being so high, it might be easy to assume that an elevated figure isn’t so bad.

However, these ratios are considered unfavourable and will impact a person’s access to credit.

So, what is a good debt-to-income ratio? Under 20% is considered a very good number.

Achieving this figure will help you to get a favourable rate on a mortgage application or to secure other lines of credit.

However, anything under 50% should not be too concerning to a lender. Up to 39% is considered acceptable for most lenders, with those between 40% and 49% deemed to be ‘moderate risk borrowers’.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Debt to Income FAQs

For example, if you pay £300 in debt payments every month and your monthly income is £1500, then you calculate 300 divided by 1500, which equals 0.2. You can then times 0.2 by 100 to get 20%.

But again, it is always best to get support from an independent debt charity like Citizens Advice or StepChange. They can guide you to a debt-free life again.