Average Mortgage Rate London

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re thinking about the average mortgage rate in London, you’re in the right place. This article will help explain everything.

Here’s what we’ll cover:

- The average mortgage rate in London now.

- What different types of mortgage rates mean.

- How the UK government can help home buyers.

- What rising interest rates could mean for you.

- Other ways to pay for a house.

If you’re worried about debt and how it might affect your mortgage, you’re not the only one. Every month, more than 170,000 people come to our website for guidance on their debt problems.

Everyone’s situation is different, but whatever you’re going through, we’ve seen it before. We know what you’re dealing with, and we’re here to help.

Let’s get started-

What is the average mortgage rate in London?

As of the time of writing (September 2022), the average mortgage rate in London and the rest of the UK is as follows:

- Variable: 2.59%

- Fixed: 2.32%

- Overall: 2.34%

What are the different types of mortgage interest rates?

There are several different types of mortgage interest rates offered by lenders, and it is important to do your research before taking out your mortgage to make sure you are choosing the right one for you. Each one has its advantages and disadvantages.

The main types of mortgage interest rates are fixed rate, variable rate, standard variable rate and tracker rate.

Fixed rate

No matter what happens to the market interest rate, whether it rises or falls, the interest rate on a fixed rate mortgage will stay the same. This usually lasts two to five years, although it can be as many as ten years. When the fixed rate period ends, you will generally move onto a standard variable rate mortgage. This is likely higher than the fixed rate, leading to higher repayments.

Variable rate

As the name suggests, the variable rate can change at any time. This can sometimes be for the better – rates can go down and up – but homeowners need to ensure they always have enough money to cover mortgage payments if they increase.

Standard variable rate

A standard variable rate roughly stays in line with the Bank of England base rate (which I’ll get into a bit further down), so it rises and falls.

Tracker rate

This is a type of variable rate mortgage. As mentioned above, the interest rates are directly impacted by the Bank of England base rate changes. However, unlike a standard variable rate, a tracker rate does not match it exactly – it is usually a tiny amount above it.

» TAKE ACTION NOW: Fill out the short debt form

Government schemes for home buyers

If you are looking to buy a home, you might be able to get some support from the UK government. There are several schemes that can help you own your own home. From the Help to Build Equity Loan to the mortgage guarantee scheme, take a look at the official government website to see if there’s a scheme that suits your needs.

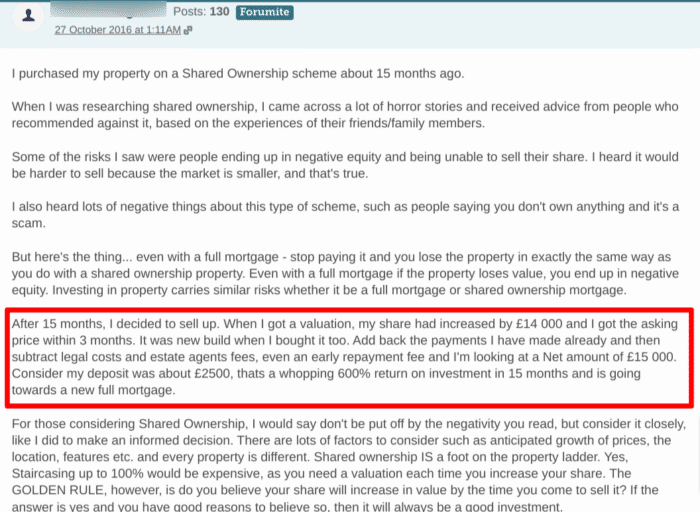

This MoneySavingExpert forum user purchased a property on a Shared Ownership scheme after much research. They decided to sell the property 15 months later, and their share had increased by £14,000.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What do climbing average mortgage interest rates in London mean for homeowners?

Two million homeowners with loans with variable interest rates, known as base rate trackers, will notice an almost instantaneous increase in the money they must pay back each month. An increase in the tracker rate from 3.5% to 4%, for instance, will result in an additional cost of roughly £60 per month for a loan of £200,000.

Mortgage costs will increase for remortgagers and first-time buyers. It might be time to choose a deal as the cost of new fixed rates has already factored in the most recent rate increase. The rising rates may also impact the rental market in London. An increase in mortgage rates may drive people towards rental properties.

Average property prices were 11.5% higher in August than the same month a year earlier. This challenges individuals trying to purchase a home or relocate because mortgage rates have also increased. However, the annual rate of house price inflation decreased from 11.8%, reported in July.

Other essential indexes of housing prices also point to a more general slowing in growth, partly attributable to a more balanced supply and demand.

According to the most recent data from Rightmove, there were 13% more sellers in June of this year compared to the same month a year ago. On the other hand, demand for properties is anticipated to decrease due to the increasing cost of living.

Alternative housing finance models

If you can’t afford a mortgage in London, there are alternative housing finance models to consider. These include shared ownership and rent-to-buy schemes. In light of changing mortgage rates, these alternatives could be a more attractive and realistic option for those looking to get on the property ladder.