Do Bailiffs Work Bank Holidays? Visiting Restrictions

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if bailiffs work on bank holidays? If you’re feeling worried about a visit from a bailiff, you’re not alone. Every month, over 170,000 people come to our website seeking answers to important questions about debt.

In this article, we’ll explain:

- What a bailiff does and when they might be used.

- Tips on how to talk to a bailiff if they come to your home.

- What laws bailiffs have to follow, including when and how they can visit.

- Ways to possibly reduce some of your debt.

- How you can get more help if you need it.

We understand that dealing with bailiffs can be scary. Some of us have been in your shoes before, so we know that it’s important to have good information and advice. Remember, bailiffs usually do not work on bank holidays, so you can relax a little on those days.

We hope this article helps you feel more confident and less worried about dealing with bailiffs. Let’s get started.

Do bailiffs work bank holidays?

Bailiffs won’t usually work or attend your property on bank holidays.

The bailiffs themselves are likely to be not working on these days. Moreover, as mentioned earlier, bailiffs should not visit debtors at their homes on religious days or holidays of cultural significance, which stops them from attending your home on some bank holidays.

Can bailiffs just turn up without warning?

No, bailiffs cannot turn up without warning. They must send you a Notice of Enforcement Letter encouraging you to contact them and discuss payment, otherwise to expect them to visit your home after at least seven clear days to collect payment or seize goods.

Bailiff fees are expensive, which is why you should avoid having to deal with them. They charge £75 just for sending you the Notice of Enforcement Letter.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

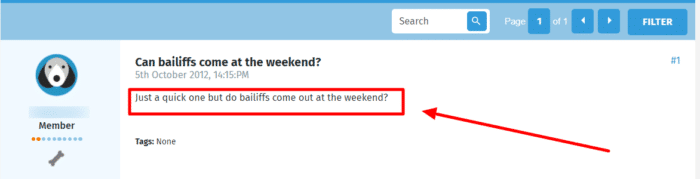

Do bailiffs work on a weekend?

Some bailiffs do work weekends. There are bailiffs who will work on Saturdays but very few work on Sundays.

This isn’t an uncommon question among worried debtors, which is why it frequently gets asked on online forums. See here:

Some might try to visit you on a Sunday to increase their chances of catching you while you’re home.

But are they really allowed to come to your home on a Sunday? Read on to find out.

What days can bailiffs come?

Bailiffs can attend your home on any day of the week. However, they aren’t supposed to come to your home during religious or cultural festivals unless their visit is absolutely necessary.

What time can bailiffs turn up?

Bailiffs can come to your home on any day of the week between 6am and 9pm.

It’s quite common for bailiffs to turn up in the early morning, as this increases their chances of catching you while you’re home, especially before you go to work.

There are some exceptions to the 6am-9pm ruling. They can visit you outside of these hours if:

- They have a warrant that states they can visit outside of these hours

- They are attending a business address whereby the business premises is only occupied or open outside of the standard visiting hours.

» TAKE ACTION NOW: Fill out the short debt form

Can you stop bailiffs from turning up?

You might be able to stop enforcement action with bailiffs, especially if you’re vulnerable, elderly, of ill health or are a single parent with young children.

A full list of reasons to stop them can be found here.

Act quickly to find out if you can stop them by calling Citizens Advice for a personalised discussion.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can bailiffs force entry into your home?

Bailiffs can only gain entry to your home peacefully, which means entering through an open or unlocked door.

Despite what you might have heard or seen on TV, they cannot block the door with their foot to stop you from closing and locking the door. And they cannot climb through windows to get inside.

They can use reasonable force to gain entry on some occasions, such as if you agreed on a repayment plan secured by your belongings (Controlled Goods Agreement) but then defaulted on this repayment plan.

But even then, they are likely to try and gain entry with a locksmith, which you would have to pay for!

How to deal with bailiffs at your door

If you do find bailiffs knocking at your door, you don’t have to let them inside. But ignoring them completely won’t make the situation better – or less expensive.

It can be beneficial to speak with them but only do so from your letterbox or from an upstairs window.