Bankruptcy Statistics in the UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying off your debts? Thinking about bankruptcy? You’re certainly not the only one. In fact, more than 170,000 people visit our website every month seeking advice on debt matters.

In this easy-to-understand guide on bankruptcy, we aim to answer important questions and help you feel less worried. We’ll talk about:

- What bankruptcy really is

- How people end up bankrupt

- How to work out if bankruptcy is the best choice for you

- How to apply for bankruptcy and what it will cost

- The ways bankruptcy will change your life and affect your credit file

Our team knows how you feel; some of us have been in the same tough spot with debt. But don’t worry; we’re here to help. There’s a solution to every problem, even with debt.

Bankruptcy Statistics – 2022

- The minimum debt required to declare bankruptcy rose from £750 to £5,000 in 2015.

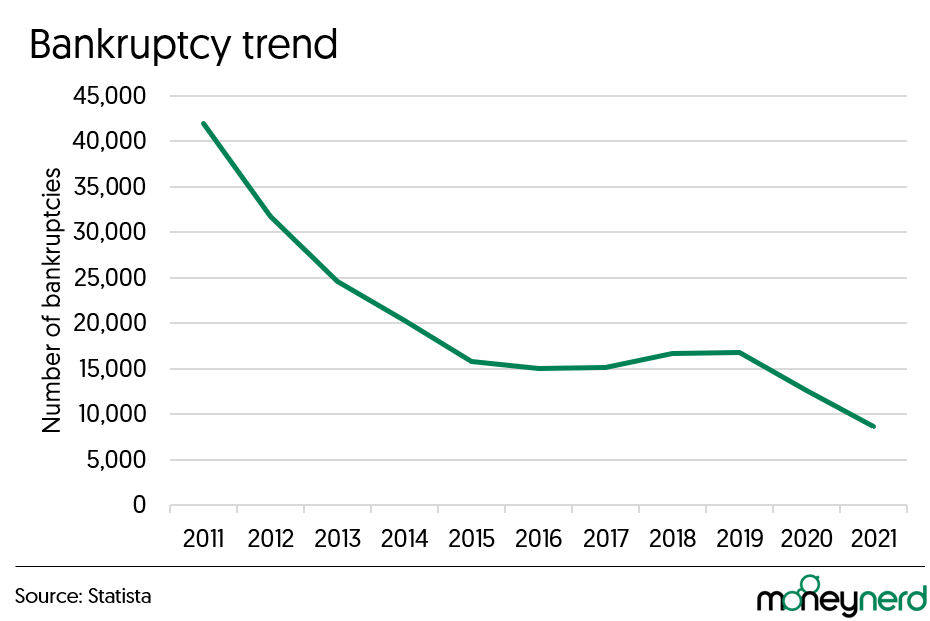

- During Q4 of 2021, the UK had 1,824 bankruptcies, down 1256 compared to Q4 of 2020.

- Since 2011 the UK has seen a steady decrease in the amount of bankruptcies. There were nearly 12,000 bankruptcies in Q1 alone.

- Other forms of debt relief such as DRO, insolvencies and IVAs have substantially increased.

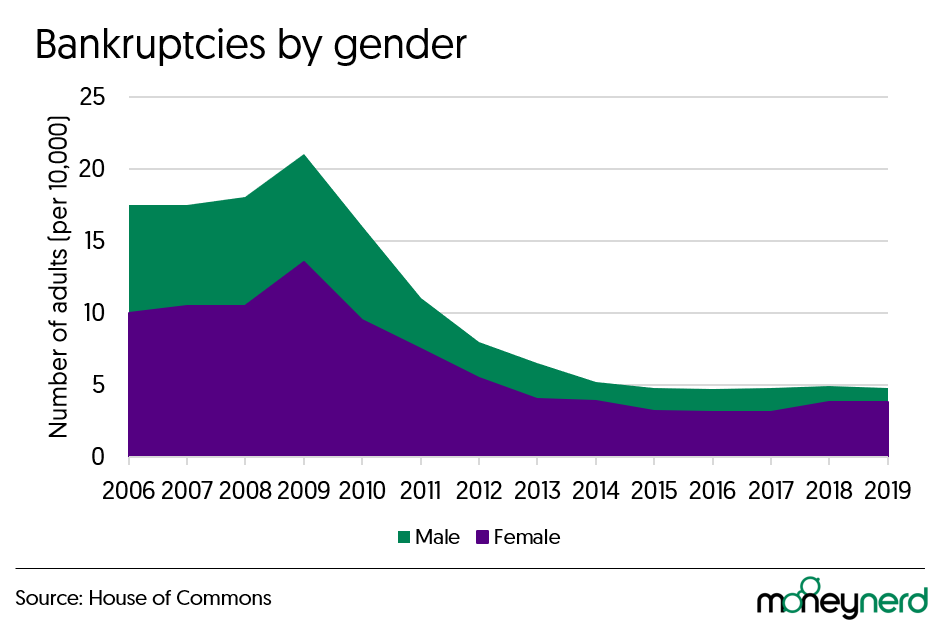

- The bankruptcy rate tends to be higher for males than females.

The minimum debt required to declare bankruptcy rose from £750 to £5,000 in 2015.

Regional Bankruptcy Statistics

With 4.5 bankruptcies per 10,000 adults in 2019, the South West had the highest rate of bankruptcies. This was slightly higher than the North East, which had the highest rate every year since 2011 (4.4 per 10,000 adults). London had the lowest rate, 2.7 per cent, and has had the lowest rate every year since 2006.

The East Midlands showed the biggest increase in bankruptcy rates compared to 2018, with a rise of 0.3 per 10,000 adults. The West Midlands, Wales, and Yorkshire and The Humber experienced the biggest drops in contrast, however, these drops were very marginal. Rates rose in five locations while falling in five.

Torbay was the local authority with the highest bankruptcy rate in 2019, with 7.3 bankruptcies per 10,000 adults. This was after the Isles of Scilly and the City of London were excluded due to their relatively small populations. Additionally, Torbay was the local authority that had the highest rate in the year 2018. Cambridge had the nation’s lowest rate of personal bankruptcies, with 1.6 filings for every 10,000 adult residents. Cambridge was also ranked in the top 10 for the lowest bankruptcy rates in 2018.

During Q4 of 2021, the UK had 1,824 bankruptcies, down 1256 compared to Q4 of 2020.

There was a larger rate of bankruptcy in 170 of 336 local governments (51%) in 2019 compared to 2018, while the percentage was unchanged in 16 local governments (5%) and decreased in 150 local governments (45%). The local authority with the biggest increase in bankruptcy, excluding the Isles of Scilly because of their small population, was Great Yarmouth (a rate increase of 3.3 per 10,000 adults compared to 2018). West Devon experienced the biggest drop, which was 2.7 per 10,000 people.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Gender and Age Bankruptcy Statistics

In 2019, bankruptcy filings were at their lowest among younger adults, at their highest among those aged 35 to 44, and then declined again among older adults. This pattern, which dates back to 2006, is consistent with the overall rise in bankruptcy rates. In all age groups, there were more males than females filing for bankruptcy per 10,000 adults, albeit the difference in rates varied depending on the age group.

The bankruptcy rate tends to be higher for males than females.

It seems that as people become older, the gender disparity grows more pronounced. Male bankruptcy rates were 1.2 times higher than female rates for those between the ages of 18 and 24. This increases with age; among 65-plus males, the bankruptcy rate was 2.2x the male rate.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Why are the rates of Bankruptcy dropping?

As you can see from the graph below, other forms of debt relief are available and tend to be a more preferable option. This is because options like a debt relief order (DRO), individual voluntary arrangements (IVA) and any other forms of insolvency are becoming more widely known.

Other forms of debt relief such as DRO, insolvencies and IVAs have substantially increased.

Opting for these alternatives are often preferred by many, particularly when considering the potential consequences, such as the risk of losing your house due to bankruptcy.