Can You Write Off Unsecured Loan Debt? Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you have loan debt that you’re finding hard to pay? You’re not alone. There are ways you might be able to write off unsecured loan debt. This guide is here to help you understand how.

Every month, over 170,000 people come to us for advice on debt solutions. We understand how worrying not being able to pay your debt can be, but there’s always hope.

In our friendly guide, we’ll explain:

- What is unsecured debt.

- If it’s possible to write off some debt.

- How to avoid getting into more debt.

- The catch to getting your debt written off.

- Some debt solutions that are available in the UK.

We want to help you understand your options and find a solution that suits your needs. We’re here to guide you each step of the way and help you tackle your debt today.

Let’s dive in.

What is Unsecured Debt?

Unsecured debt is defined as debt that does not have any type of collateral linked to it. This means that if you default on your debt, then there would be no asset that your creditor could take to settle the money you owe.

Some examples of unsecured debts include:

- Credit card debts

- Unsecured personal loans

- Payday loans

- Bank loans

- Utility bills

- Medical bills

- Some tax debts

Some examples of secured debts are:

- Mortgages

- Car loans

Is it Possible to Write Off Unsecured Debt?

The short answer to this is ‘yes’.

The first thing you can try to do is ask your creditor to write off your debts using our free letter template.

However, creditors are under no obligation to write off your debts so you may have to try entering into a debt solution with them. But they should consider debt management plans you set in place to settle your debts.

There are a number of different debt solutions that you could opt for. However, you may not qualify for some as it would depend on your financial situation and circumstances.

There are a lot of debt solutions which involve writing off some or all of your unsecured debt.

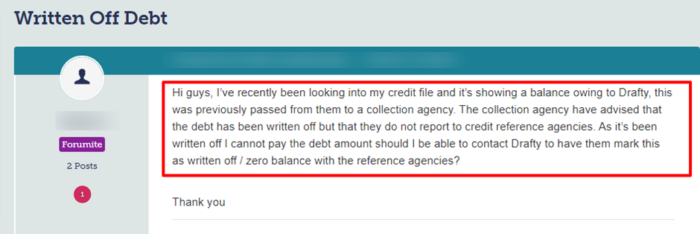

Check out the message posted on a popular forum regarding writing off unsecured debts.

Source: Moneysavingexpert

These solutions are typically granted to individuals who are unable to pay off their debts within a reasonable time frame.

It’s very important that you do your research and assess your financial situation thoroughly before opting for any one debt solution. You should seek advice from an expert before making a decision.

You may end up in a worse financial position than before if you opt for the wrong debt solution.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Getting My Debt Written Off Sounds Great. Is There Any Catch?

There is one thing that you should definitely be aware of if you’re thinking of opting for a solution which involves you writing some or all of your debt off.

The effects of debt write-off on credit scores is considerable. In short, it’s going to have a negative impact on your credit rating.

Having a poor credit score will mean you’ll have trouble securing any type of credit in the future. You’d have to spend time improving your credit score to improve things.

In short, you should thoroughly assess your situtation if you’re thinking of getting your debts written off. Preferably with the advice of a debt expert.

Ways to improve your credit score

There are ways to improve credit score which I’ve listed here:

- Offer proof of where you live (electoral roll registration)

- Build up your credit history

- Make payments on time

- Use your credit cards carefully preferably staying well below your limits

- Check if you’re eligible for an instant ‘score boost’

- Keep older accounts open which proves a long credit history

- Don’t move house a lot

- Check your credit report for fraudulent activity and credit report errors

- Think about getting a credit builder card

A loan payoff calculator might be a valuable resource if you have a loan debt in the UK and are struggling to meet repayments or just want to stay on track.

What are Some Debt Solutions Available in the UK?

I will be detailing some debt solutions that you can opt for if you’re struggling with debts and you reside in the UK.

If you’re having trouble choosing which solution would be most suitable for you, I suggest getting debt advice from a registered charity such as Stepchange.

They have trained professionals who will look at your financial situation and give you free debt advice UK about which solution would suit you the best.

Not only that but they will help you navigate through the application process as well.

But to start you off, you can use my free pay off calculator to get an estimate of your debt repayments, including interest.

I’ve listed some debt solutions below:

» TAKE ACTION NOW: Fill out the short debt form

Individual Voluntary Arrangement (IVA)

This is a formal and legally-binding agreement between you and your creditor(s). The agreement states that you will keep making monthly payments to them over a specific time which is typically five years.

Your creditors will agree to write off any debt that may remain at the end of the agreed-upon time period.

An Insolvency Practitioner handles your IVA. He/she will be the mediator between you and your creditors and will ensure that you’re being treated fairly.

The role of an insolvency practitioner is to help people (and businesses) when they’re in financial difficulty. They administer more complex insolvency processes. They provide support until a full insolvency solution is reached.

Your creditors can’t pursue court action against you while the IVA is in place. Plus, all your assets are protected while it’s in place.

However, as I mentioned earlier, an IVA will definitely have a negative impact on your credit score. It stays within your credit file for six years after it commences.

Plus, you should seek advice from an expert before entering into an IVA.

Bankruptcy

If you’re insolvent, you can opt for bankruptcy but not before getting professional advice.

Bankruptcy lasts for a lot less time than an IVA (typically 1 – 3 years). At the end your debt is written off.

While a bankruptcy definitely lasts for a shorter time, it can cost you a lot more than an IVA does. This is because none of your assets are protected.

You may lose your home and other valuable assets which includes your business or your car.

These assets are distributed among your creditors to pay off your debts.

Just like an IVA, bankruptcy also has a negative impact on your credit score and you will have a lot of trouble securing any type of credit (such as credit cards) once it’s over.

Again, going bankrupt is a huge step that shouldn’t be taken without first seek professional advice. For example, Not all debts are discharged which includes fines, some student loans, alimony and child support.

Then there’s the impact on credit and employment opportunities.

Debt Relief Order (DRO)

A debt relief order is a solution offered to people with few assets.

If you have assets totalling no more than £2,000 (£300 if you reside in Northern Ireland) and your debts total no more than £30,000, you may qualify for a DRO.

There are criteria that need to be met as set out on the Government website. A DRO lasts for 12 months and at the end of the order, you are debt-free.

It’s worth noting that a DRO remains on your credit file for 6 years from the date it was set in place. It will impact your credit score.

As a result, it will make it very difficult for you to secure any type of credit for that amount of time.

You may also have trouble securing any type of rental agreement if your landlord performs any type of background credit check.

I suggest you seek advice from an expert before choosing to go down this route. There are the pros and cons to consider such as tight debt, asset and income restrictions.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Full & Final Settlement Offer to write off 70 of unsecured debt

A full & final settlement offer may be a prudent option if you have a large lump sum of money but don’t have a lot of disposable monthly income.

It allows you to deal with your debt all at once by giving your creditor a lump sum of money. You could pay less than you actually owe.

In return for this one-time payment, your creditor could agree to write off the rest of your debt.

Creditors are likely to agree to a full & final settlement offer if they feel that you can’t repay your debt within a reasonable amount of time.

Just like all other solutions, a full & final settlement offer has a negative impact on your credit rating.

Although you may have come to an agreement with your creditors, any action they may have taken against you stays in your credit file for six years from the date they were registered.

Again, I suggest you seek advice from a debt expert before choosing this option.