Charity Debt Advice – Top Debt Charities Reviewed

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re struggling to pay off your debt, then seeking advice from a debt charity is definitely worth a shot.

There are a number of independent debt charities currently operating in the UK with professionals who will provide you with free and impartial debt advice.

Here’s how you can approach these debt charities to get help with your debt problems as well as some things you should keep in mind when seeking debt advice.

Independent Debt Charities Operating in the UK

Private debt management companies and financial advisers typically charge for their services and advice.

Paying for debt advice when you’re already having financial problems is obviously a bad idea.

This is why, if you need advice on how to handle your debts, your best bet is to contact an independent charity and get help for free.

Examples of some debt charities currently operating in the UK are:

- Citizens Advice Bureau. They can provide you with free debt help both in person as well as on the phone. You can go to their website to learn more information on how to pay back your debt or get it written off.

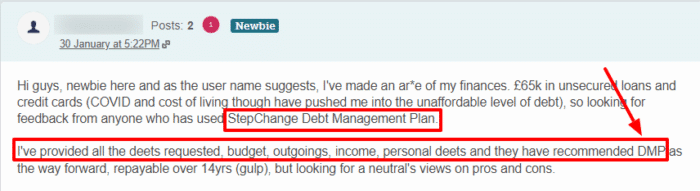

- StepChange Debt Charity. You can learn a ton of information about how to address your debts on their website. They can also provide you with free debt advice. If you need a debt management plan (DMP) set up, they can do that for you for free.

- National Debtline is an organisation that can help with free debt advice on the phone, and they can also help you set up your debt management plan (DMP) for free.

- PayPlan is a great charity and an independent provider of DMPs. They won’t charge you to set up your debt management plan.

- Shelter is a charity that primarily provides housing but can also provide you with free debt advice online, via phone or in person.

- Christians Against Poverty is a charity with professionals who can visit you at your residence to give you debt advice, and they can also help you organise your budget.

Why Should I Seek Debt Advice from a Charity?

It can be a good idea to seek debt advice from a charity regardless of whether you’re struggling with your debt or not.

Even if you feel that you have your debt repayments under control, a debt professional may be able to point out some steps you can take to reduce the amount of money you have to pay back.

If you’re struggling with debt repayments in the first place, then a debt professional can provide you with options on how to manage your debt.

Not only will they provide you with options on how to take control of your debt, but they will also help you set up whatever debt solution you choose.

For example, if you choose to opt for a DMP, then the charity will help you plan a budget for yourself, and they’ll also negotiate with your creditors on your behalf.

Once your DMP is put in place, you’ll have little to no contact with your creditors, as the charity will be the one who will be primarily responsible for dealing with them.

Furthermore, they would do all of this free of charge.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Charities can also help you out with:

Prioritising Debts and Distributing Payments

You may not be aware of how you need to prioritise your debt repayments. By prioritising, I mean determining which creditors you should pay off first and which ones should be paid later.

This can definitely get confusing if you have many different types of debt.

Prioritising between different unsecured debt(s) can be especially tricky since you have to calculate the interest rates in order to determine the one with the highest interest rate so you can pay that one off first.

On the other hand, if your payments are part of a DMP, then they have to be paid according to what you owe each creditor.

For example, if you owe a creditor 50% of your total debt, then that creditor will receive 50% of your monthly payment each month.

You won’t have to worry about this if you avail the services of a charity.

As part of your DMP, you’d only have to make a single payment to the charity. It would be the charity’s responsibility to distribute your payment appropriately among your creditors.

Providing Information on Debt Solutions

There are a number of different debt solutions available in the UK, such as Individual Voluntary Arrangements (IVAs), Bankruptcy, Debt Relief Orders (DROs) and ‘Full and Final’ Settlement offers.

While all of them serve to help you deal with your debt, not all of them are suited for every financial situation.

A debt solution that works perfectly for you may be disastrous for someone else.

This is why, if you’re thinking about opting for a debt solution, it can be a good idea to seek debt advice from a charity first.

They have trained professionals who will assess your financial circumstances thoroughly and give you advice on which debt solution would be most appropriate for you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Here are the pros and cons of using debt charity for advice on debt:

| Pros | Cons |

|---|---|

| Many debt charities provide free advice and support to those in need, ensuring that getting help doesn’t add to the financial burden. | Sometimes, the advice might not be tailored to the specific needs of an individual. |

| As charities, their main aim is to help rather than profit, ensuring unbiased advice. | Some charities might not offer a full range of services or solutions, meaning individuals may need to consult multiple agencies. |

| These charities typically have specialists knowledgeable about UK debt regulations, options, and solutions. | Depending on the demand, there might be wait times to access some services or speak to an advisor. |

| Many charities provide additional resources and support, such as budgeting tools, courses, or mental health resources. | With various charities offering advice, there might be differences in guidance or solutions which can be confusing. |

| Charities are bound by regulations to maintain the confidentiality of clients, ensuring personal and financial data are secure. | While many operate nationally, not all have physical branches, which might not be ideal for those preferring face-to-face consultations. |

What Are Some Things to Keep in Mind When Seeking Debt Advice from a Debt Charity?

Some things you should always keep in mind when seeking debt advice from a charity are:

- Ensure that the professional helping you is qualified to be giving you debt advice. They must be authorised and regulated by the Financial Conduct Authority (FCA).

- Make sure to ask a lot of questions and request the professional to repeat himself/herself if you don’t understand something.

- Take notes so you have a complete record of what was said during the meeting.

- Ensure that any personal information you provide is kept confidential by the organisation.