Can You be Responsible for Someone Else’s Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Worried about being responsible for someone else’s debt? This is a common fear, and you’re not alone. Each month, over 170,000 people visit our website seeking advice on debt solutions.

This article will explain:

- When you might be responsible for someone else’s debt

- Steps to take if this happens

- Times when you might have to pay for someone else’s debt

- How to legally write off some debt

- What to do if you’re struggling with debt

We understand that debt can be scary — our team has experienced what it’s like to be chased by debt collectors.

Our goal is to help you understand when you might be liable for someone else’s debt and how to manage these situations.

Responsibility for someone else’s debt

Lots of people might worry that getting married, entering into a long-term relationship, or the death of a spouse will mean then that they are then shouldered with any debts that are still unpaid.

If you’re worried about this, you can relax – this isn’t the case.

It’s worth being aware of some situations where you agree to share or take on all the responsibility for someone else’s debt though.

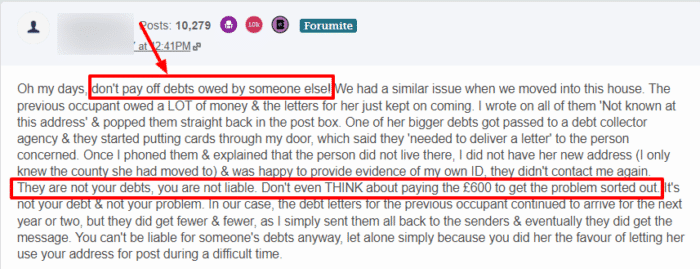

Do not pay for someone else’s debt if you’re not responsible. If you’re being hassled by creditors demanding you pay someone else’s debt, you should check your obligations. Inform them in writing that you are not the debtor they seek and request they cease contact. If the harassment continues, report the agency to the FCA.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Instances when you can be responsible for someone else’s debt

There are a few instances when you might be responsible for someone else’s debt, and it isn’t simply limited to one debt ‘type’ either.

You can be accountable for someone’s credit card debt, loan debt, or another sort of debt for the following reasons:

1. You have a joint account

If you and your partner, or another person, have opened a joint bank account or a joint credit account, you will both share the responsibility for any debt incurred.

It doesn’t matter as to who contributed to the debt – as you share the account, you’ll both be responsible.

This will continue even after you have separated or divorced the person you might have opened a joint account with.

If your partner or ex-partner has incurred debts on your shared account, and has reduced or stopped payment on these debts, the creditor will be able to pursue you for payment.

Both of your credit scores will be affected by this as well.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

You opened an account for someone else in your name

While it is advisable not to sign up for a credit card or a loan or anything else that involves finances using your own personal details when the account itself will be used by someone else, sometimes it is a necessity.

When this happens, the person you have opened the account for has no legal obligation to keep up with repayments, and you’ll be solely responsible for someone else’s debt.

» TAKE ACTION NOW: Fill out the short debt form

You signed a guarantor agreement

This is another inadvisable agreement to sign, but occasionally circumstances necessitate it.

If you have signed a guarantor agreement, whether it is for a rental situation for someone else, a credit card, or a personal loan, you will be agreeing with the lender that any debt incurred will be transferred to you and will become your responsibility.

If the person you are the guarantor for falls behind on payments, you will start to receive letters about this.

Do not ignore these letters, as you could end up making matters worse for yourself and the other person if you do.

Information about your responsibility for someone else’s debt

You may now wonder whether one of those instances applies to you. If you’re not sure whether you signed as a guarantor or whether you are a joint account holder, you should get in touch with the lender directly.

If the lender can prove that the account bears your signature, you will be responsible for the debt.

You could also end up being responsible for someone else’s debt if you made a written or verbal agreement to pay someone’s debt for them.

Signatures on agreements

If your signature is not present, and no other agreement was made, you won’t be responsible for the debt.

Your relationship with the other person is irrelevant if you’re signature or proof of agreement is not forthcoming.

Even if you yourself used the account as an additional cardholder, if your signature or other agreement is missing, you will not be responsible for someone else’s debt.

Deceased persons – can you be responsible for their debt?

Another frequently asked question is whether you can be responsible for someone else’s debt even when that person is deceased.

If someone dies with outstanding debts to their name, the debt is usually settled using assets from their own estate. If this is not enough to cover the whole amount, the debt is usually written off.

If their creditor contacts you about their outstanding debt, despite settling a sizeable wedge from their estate, you do not have to pay them.

If, however, you signed as a guarantor for their credit card, for example, and there are still outstanding payments on that, you will then be responsible for the debt.

This also happens on joint accounts or if you co-signed any agreements on anything debt-related.

Complaints procedure

Debt collectors and creditors are now required to follow quite strict rules in their dealings with customers. If they’re found to be in breach of these rules, they can face steep fines.

To complain about their conduct, you should reach out to them first of all, detailing the nature of your complaint.

If they are not forthcoming about placating you, you should escalate your complaint to the Financial Ombudsman Service, detailing why you are making this complaint.