Struggling to Pay Court Fines? 3 Things You Can Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about court fines you can’t pay, you’re not alone. Each month, over 170,000 people come to us for information about their debt problems. This article is here to help by covering key concerns like:

- What a court fine is and why you might have one.

- Steps to take if you can’t pay your fines.

- How a judge decides the amount of a fine.

- Ways to potentially reduce or write off some debt.

- Options for appealing against a court fine.

We understand it’s tough dealing with court fines. It’s even tougher if bailiffs are threatening to take your things. Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1. Our team has been through similar situations, so we know how you feel. What happens if you can’t pay a fine in the UK? Don’t worry, we’ve got the answers you’re looking for.

Our advice is based on our experience. We’ll guide you through asking for a reduction, finding other ways to pay, or even getting an extension.

So, if you’re troubled by unaffordable debt, struggling to pay court fines, or just need to know more about your situation, we’re here to help.

Let’s dive into what your options are.

What is a court fine?

Must I pay my fines?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if I don’t pay?

I don’t recommend just ignoring your court fines, even if you can’t afford to pay them.

If you are facing financial hardship and can’t afford to pay your court fines, you should follow the steps that I have talked through above. This includes:

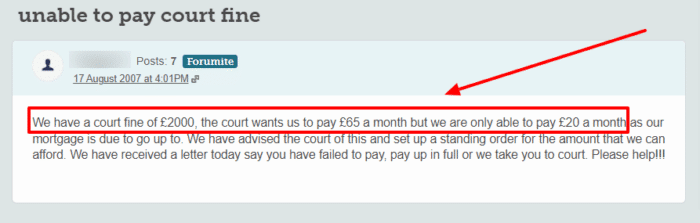

- Asking to pay in installments

- Asking to pay over a longer period

- Asking to pay at a later date.

Our financial expert, Janine Marsh, advises: ‘If a bailiff has proven you owe money and you don’t have cash to hand, you’re within your rights to suggest a payment plan. It’s not a guarantee, but many will accept this as it’s easier than repossession.

But if you just don’t pay, your situation is going to get worse.

If you have not communicated with the courts or paid by the deadline you were given, you are going to get a letter explaining the steps that the courts will take.

If you don’t respond to this letter, the court will usually instruct bailiffs to collect the debt.

StepChange found that 90% of people who have been visited by a bailiff in the last 2 years identify as vulnerable. With over 50% reporting depression and more reporting stress and anxiety2.

You might get a court summons for not paying a court fine instead of bailiffs. You must go to this hearing unless you have already paid off the fine in full before you’re due to appear in court.

You can be arrested if you don’t go to the court summons. This hearing is your chance to show the court how much you can realistically pay without falling into severe financial hardship.

With this in mind, I recommend taking a detailed budget with you. This budget should go through your income and all of your outgoings.

If you are in this situation, I recommend speaking to a debt charity.

» TAKE ACTION NOW: Fill out the short debt form

What does the court fine you for?

- Fixed Penalty Notice – which is issued for minor driving offences such as overspeeding, traffic light offences, performing a restricted turn, failing to use the seatbelt, driving without insurance, etc

- Penalty Charge Notice – which is issued for parking offences like parking on double yellow lines, refusing to pay parking fees, turning in a prohibited direction at a junction, etc

- Parking Charge Notice is not technically a fine because it’s given by a private company rather than a judge for parking infringements.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How does a judge determine fines?

- The fine amount

- Payment deadline

- Payment method(s)

- The officer to contact if you’re unable to pay

Can I appeal against a court fine?

Things I can do if I’m unable to pay

1. Ask for a reduction

2. Ask for an extension

3. Look for alternative payment options

- offering to pay in instalments

- taking the fine from your benefits

- deductions from your income

- applying for a hardship order.

Paying in instalments

Taking from your benefits

- Jobseeker’s Allowance

- pension credit

- Income Support

- Employment and Support Allowance