Cheapest Car Insurance for Disqualified Drivers?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you searching for car insurance after a disqualification? We understand it can be tough. In fact, we’ve noticed that each month, more than 9,300 people look to us for help in this tricky situation. Let’s explore this topic together.

In this friendly guide, we’ll delve into:

- The reasons behind a driving ban.

- How such a ban can affect your car insurance.

- The difference between a disqualified and a revoked licence.

- Tips on securing affordable insurance even with a ban.

- The consequences of not informing your insurer about your ban.

What’s important is honesty with your insurer about your driving past. Failing to do so can lead to serious issues. But don’t worry, we’re here to provide the correct knowledge and advice to help you find a suitable car insurance deal, despite a ban. We’re in this together.

Let’s dive in.

What is a driving disqualification?

A driving disqualification is when you get banned from driving for a set period.

You will be given a driving disqualification if your driving licence is endorsed with 12 or more penalty points within a three-year period. This is called a totting-up ban. Or you can be disqualified for driving if a judge decides you should be.

As part of the driving disqualification, the court can also request that you resit your driving test to be allowed to drive again in the future.

Does being disqualified from driving invalidate insurance?

Most insurance policies state that the insurance becomes null and void if any driver named on the insurance gets disqualified.

This means the insurance can become invalid for all drivers named on the policy, not just the driver who receives the ban. If this occurs, the named drivers not disqualified will need to find new insurance to be allowed to legally drive.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Can I insure a car whilst disqualified?

Yes, you can insure a vehicle while you’re disqualified and you may be obligated to do so.

If your vehicle is parked on a public road while you’re disqualified, the vehicle will still need to be insured, although not insured for you to drive because this is illegal.

You can get around this problem by parking the car on private land or by selling the vehicle to someone else.

Can I get insured after disqualification?

Once your disqualification period has ended, and you’ve retaken your driving licence if applicable, you can get insured to drive once again. Previous disqualifications won’t affect the type of cover you can get (third-party, fully comp etc.)

However, you must disclose all previous driving convictions within the last five years when applying for insurance. With a previous driving ban, you’ll be considered a high-risk driver and could struggle to get insured at a reasonable cost.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How much more expensive is insurance after a disqualification?

Car insurance premiums are likely to increase based on the number of penalty points endorsed on your driving licence. Most people with a driving disqualification will have received 12 penalty points, which can have a significant increase in car insurance premiums.

Admiral has published data to suggest that the cost could increase from 75% to over 100%. It could even cause you to get rejected for insurance because you’re considered too high of a risk.

You can mitigate the chance of being rejected for insurance and try to find cheaper policies by searching for insurers that are willing to consider all circumstances. These policies can be known as high-risk driver insurance, convicted driver insurance or more specifically car insurance for disqualified drivers.

» TAKE ACTION NOW: Find the best insurance for drivers with points

Disqualified driver insurance explained

Disqualified driver insurance is exactly what it says on the tin. It’s a type of vehicle insurance marketed towards people who were previously disqualified from driving and are struggling to find affordable cover today.

Because this insurance is aimed at people with a previous driving ban, it improves your chances of being offered cover. Moreover, it can help some people get cheaper insurance.

What is the cheapest car insurance for disqualified drivers?

There isn’t a single disqualified driver insurance policy which is always the cheapest. Even after a disqualification, the cost of your insurance will depend on several personal factors, which will make one policy the cheapest for one person but not necessarily for another person.

The good news is there are ways to find cheaper car insurance after a ban…

How to get cheaper car insurance after a ban?

One of the most common questions among banned drivers nearing the end of their ban is: How do I get cheaper car insurance after disqualification?

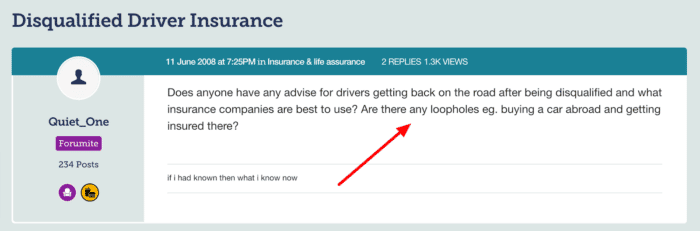

Just like the Quiet One asked on this reputable forum:

Source: https://forums.moneysavingexpert.com/discussion/968919/disqualified-driver-insurance

Unfortunately, there isn’t a magic loophole you can use to slash your insurance quotes in half, but there may be ways to find more affordable vehicle insurance after a ban.

Some top tips include:

- Search for vehicle insurance for people who have been banned, rather than the mainstream policies.

- Use the same search terms when you use comparison websites.

- Get help from a car insurance broker who is known to help people with a previous ban get affordable insurance.

- Consider the type of vehicle you wish to insure.

What is the cheapest car to insure after a ban?

After you’ve been banned, you may want to save money on car insurance by switching to a vehicle that’s notoriously cheaper to insure.

Several makes and models of vehicles are known to reduce your insurance premiums, including:

- Renault Clio

- Ford Ka

- Ford Fiesta

- Skoda Yeti

- Mazda-CX5