Do Penalty Points Affect Your Car Insurance Premium?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you wondering if penalty points affect your car insurance premium? You’re not alone. Each month, over 9,300 people visit our website for guidance on this very issue.

In this easy-to-read guide, we’ll address the following questions:

- Can you drive with 9 points (UK)?

- What happens if you get 9 points on my licence?

- How long do 9 points last on your licence?

- Will you get insurance with 9 points?

- How to get cheaper car insurance with 9 points on licence?

- What cars are cheaper to insure after penalty points?

We know it’s hard when you have points and are facing high car insurance costs; some of us have been in your shoes. Don’t worry; we’re here to help you understand your options.

What are the main factors in car insurance?

As mentioned risk is one of the most important, But here is the general list:

- The value of the car. Higher prices usually come with higher premiums.

- The time it takes to acquire parts for repair. If they need to give you a replacement car while the other is being fixed, the time they need to pay for this is usually considered.

- The cost of the parts for potential repairs. The more they might need to pay to repair your car if you claim, the more compensation they might want.

- The safety of the vehicle. Good airbags, seatbelts and bumpers can reduce the premium.

As you can see, the above is also considered alongside your points. This is why penalty points can impact the amount you pay differently than someone else. They are never considered in isolation.

How do penalty points affect how much you pay on car insurance?

Penalty points usually affect your car insurance in two ways:

- The price can increase more based on the number of points that you get. There is a school of thought that displays the predicted price increases. This is shown in the table below

- Some insurance companies might decline your application for insurance entirely. This may result in you only being able to apply through “High-Risk Insurance” businesses. These offers will usually be higher. Details are listed in the table below.

| Number Of Points On Licence | Predicted Premium Increase |

| Three Penalty Points | 5% Predicted Increase |

| Six Penalty Points | 25% Predicted Increase |

| Twelve Penalty Points | 90% Predicted Increase |

In many cases, it can more than double. This will depend on three broad factors:

- The way an individual insurance company calculates the compensation they want for each risk factor

- The combination of high or low-risk factors that you bring with your penalty points during the application process

- The insurance group that your car belongs to

This is why offers can vary so much for each person. For example, a conviction for drink driving won’t mean that the same insurer that offers premiums for this area will offer everyone the same.

The conviction is one part of what you bring to the table. If you are a “lower perceived risk” in other areas, then this might get you a better deal than someone else with the same conviction.

Please seek the advice of a professional before making any important decisions. While you can receive general info on the web, only a specialist can give you individualised feedback.

» TAKE ACTION NOW: Find the best insurance for drivers with points

Can I get insurance with Points on my licence?

Yes, you can get insurance with a conviction. Many people have gone on to continue driving after a potential ban. Just expect to pay more than you did previously. Unless you have received a lifetime ban, you will be able to drive again at some point in the future.

What are the risk factors considered by insurers

Aiming at reducing these is one way to aim at reducing the increases as much as possible. Not all of them are within your control but think about the ones that are.

- Demographics: Is the area you live in a high crime area? Is there a higher level of claims made in your location? The young tend to pay more too.

- Insurance Group: Insurance group 1 consists of the cheapest cars to insure. See below for examples.

- Past behaviour: How many times have you made a claim? How recently? How many points do you have?

- Safety: Solid bumpers, good seatbelts and a responsive air bag can reduce premiums. This also directly ties in with insurance groups.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

What are the cheapest cars to insure in the UK?

These are the cars that belong to insurance group one, as mentioned above. Anything between groups 1-10 is in the cheaper range. They have the potential for further research. Here are a few examples to look at:

- The Hyundai i10. GROUP 3. It’s small with a range of safety features.

- Kia Picanto. GROUP 3. A small engine is a reason for the low group here.

- Seat Ibiza. GROUP 3. Well constructed and modern.

Use a range of car dealers for their individual recommendations. You might start by searching for “car models in group 1 insurance group”.

This might get you on your way to finding those on the lower end of the insurance premiums if you are worried about the points on your licence.

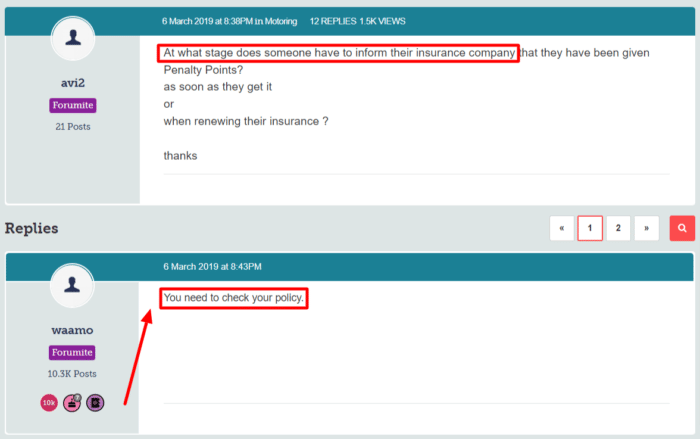

Do I need to tell insurance as soon as I get points?

It is generally recommended that you should tell your insurance company of any important changes to your situation. Not doing so can invalidate your agreement if the information comes to light without your own disclosure.

Legally speaking, it isn’t required that you disclose this information until your application and if they request the information.

But an insurer’s terms and conditions are usually different to the legal guidelines. Because of this, as discussed in the image below, the only answer for your particular situation can come from the T&Cs that were sent to you when you accepted the offer of insurance.

Image src: https://forums.moneysavingexpert.com/discussion/5974073/penalty-points-insurance

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Consider searching for convicted car insurance

On your journey of learning about where the most reasonable premium might come from. Whether it is from drink driving, or from any of the other conviction codes, making a start to find out what opportunities are available in your personal situation could be a positive step.

There are insurers out there who will make offers to people with points.

What is the cheapest car insurance for people with penalty points?

There is no single insurance provider who can offer everyone the best rate. In fact, many might reject your application.

At this stage, there are a few actions you can take for your continued research:

- Search for high-risk car insurers and compare the offers from multiple providers

- Use the various comparison websites as another tool to compare more results

- Search for insurers using the conviction code you received. Add these in to your research