CCMCC (County Court Money Claims Centre) – What You Can Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve been contacted by the County Court Money Claims Centre (CCMCC) about a debt you owe, you might be feeling worried. You’re not alone – every month, over 4,600 people turn to us for advice on dealing with debts and courts.

This article will share important information to help you:

- Understand what the County Court Money Claims Centre is.

- Learn what to do if you’re dealing with them.

- Discover how the CCMCC enforces debts.

- Find out how to stop a County Court Judgement from being granted.

- Know what to do if bailiffs are sent to your home.

We know that dealing with debt and courts can be stressful. Our team has been in your shoes, so we understand what you’re going through. We’re here to help you find the best way to handle your situation.

Let’s get started.

What Is the County Court Money Claims Centre?

The CCMCC acts as a kind of overall organisation for the centralising of debt-related legal matters. The CCMCC may get involved if a creditor attempts to make a court claim for a debt you owe them. It is the CCMCC that will handle most of the administrative side of the county court claims process. This includes dealing with claim forms, and the corresponding forms sent back by you. This includes:

- County court claim form packs.

- Admission forms.

- Counterclaim and defence forms.

- Acknowledgement of service forms.

- Issuing notice of default judgments.

» TAKE ACTION NOW: Fill out the short debt form

How Does the CCMCC Enforce Debts?

The CCMCC handles the initial part of the county court claims process. However, we need to describe the entire end-to-end process for your understanding. Which we have done below.

- Your creditor can approach the CCMCC (or the local county court) to have a judgment made on a debt. Before they do this, they will send you a letter before claim.

- The CCMCC will send you a claim form pack. In this pack are three forms. You have to select which is the right form for you to fill in and send back. These forms are:

- Admission form – to say you agree you owe the debt.

- Counterclaim and defence form – to contest the debt.

- Acknowledgement of service form – to buy an extra 28 days of breathing space.

- Once you have returned the appropriate form to the CCMCC, it will process your response. At this stage, the claim will be passed over to the actual county court to make a decision on the judgment.

- If the county court feels a CCJ is warranted, it will send you a notification that one has been issued.

- If you don’t pay the debt in full once the CCJ is in place, the court can sanction bailiffs to visit your home to collect the debt.

- You will receive a letter from the bailiffs (notice of enforcement) at least 7 days before they are going to visit your home.

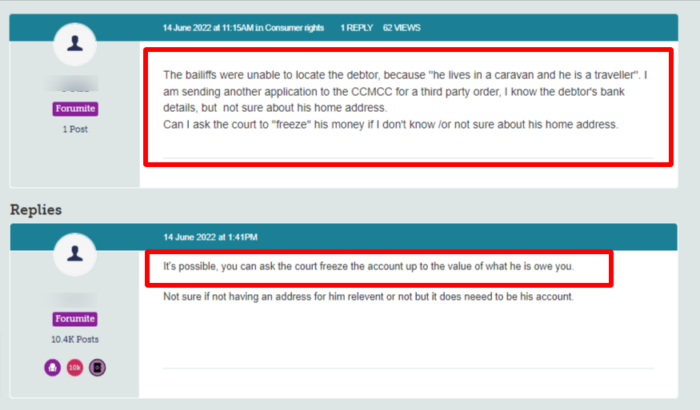

- In special cases, the court may take more immediate action, such as freezing your bank accounts until a debt is settled.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will the CCMCC Send Bailiffs to Your Home?

If you don’t pay the debt once a CCJ has been granted, the court is likely going to send bailiffs to your home to collect the debt. When the bailiffs visit, they will want you to pay the debt. If you can’t pay it, they will want to take goods from your home, which will be sold off to pay the debt. A bailiff collecting a debt has limited powers. As explained below.

- A bailiff cannot arrest you unless serving a criminal warrant.

- A bailiff cannot force their way into your home. They can only enter if you let them in, or they can find an unlocked door to use.

- If only children under the age of 16, or people with a registered disability are at home when the bailiff calls, they must leave.

- If asked, the bailiff must show you their ID and give you details of the debt they are collecting.

- A bailiff can’t push you out of the way or act aggressively or threateningly.

- The bailiff cannot use abusive or offensive language.

If the bailiff is going to take goods from your home, there are certain restrictions in place, as explained below.

- If the bailiff cannot get into your home, they can only take goods that are outside. Including vehicles parked on the road or on the drive.

- The bailiff can only take items that belong to the debtor.

- Pets, guide dogs, and support dogs cannot be taken.

- Items you need to do your job cannot be taken. Tools, a laptop, your work phone, etc.

- Items seen as a basic need cannot be taken. A cooker, fridge, bedding, etc.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Contacting the County Court Money Claims Centre

| Address |

County Court Money Claims Centre PO Box 527 Salford M5 0BY |

| Opening hours | No public walk-in access. Phone assistance is available Monday to Friday, 8:30am to 5pm. |

| Phone number | 0300 123 1372 |

| DX | DX 702634 Salford 5 |

| [email protected] |