The Cheapest Car Insurance with CD20 Conviction

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

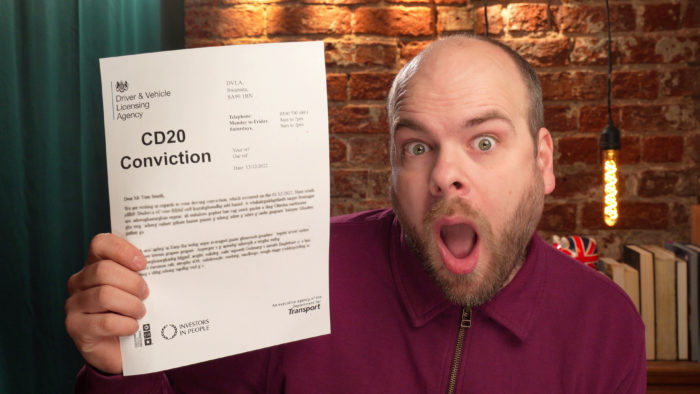

If you’ve been hit with a CD20 driving offence, you might be worried about the cost of car insurance. You’re not alone – every month, over 9,300 people turn to us for help and guidance on finding insurance as convicted drivers. We’re here to help you understand:

- What a CD20 conviction means and why it’s serious.

- How a CD20 conviction can affect your car insurance.

- The penalty for a CD20 conviction and how long it stays on your driving licence.

- Tips for getting affordable CD20 convicted car insurance.

- Which insurance companies do not ask about criminal convictions.

We know that the fear of high insurance costs or not being able to insure your car at all can be daunting. But take heart; we have the expertise and experience to guide you through this. Together, we can find a way to get you back on the road without breaking the bank. So, let’s get started on understanding and solving your car insurance worries after a CD20 conviction.

What is a CD conviction?

A CD conviction refers to a conviction for careless driving (CD).

There are different types of CD convictions ranging from driving without due care and attention (CD10) all the way to causing death by driving while unlicensed, uninsured and/or disqualified (CD90).

There are nine different categorisations of careless driving (CD) convictions, including the subject of this article – a CD20 conviction.

What is a CD20 conviction?

A CD20 conviction is when a driver is convicted of driving without reasonable consideration for other road users. For example, you might drive in a way that puts another road user in danger.

Is a CD20 conviction serious?

Getting convicted for any careless driving offence is serious.

However, a CD20 conviction is less serious than some other careless driving offences, including a C90 for causing death by careless driving.

How will a CD20 affect car insurance?

Having a CD20 driving conviction will negatively affect your ability to find competitive car insurance policies. You’re likely to have to pay higher car insurance premiums as a result of the driving conviction.

Source: https://www.thestudentroom.co.uk/showthread.php?t=6556716

The amount your car insurance premiums will be increased is tied to the number of penalty points that were added to your driving license. So if you received the minimum of three penalty points rather than the maximum of nine penalty points, your insurance premiums won’t increase as much.

Going forward you may need to search for car insurance specifically for people with a CD20 conviction, which may be blanketly advertised as convicted driver insurance.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How can I get CD20 convicted car insurance?

CD20 car insurance is a type of car insurance policy that is aimed at people with a careless driving conviction. It provides them with another option when they might not be able to get approved for standard insurance policies with other providers.

Convicted driver insurance is comparable to a bad credit loan in the lending industry. Bad credit loans are offered to people with unsatisfactory credit ratings because they haven’t managed their finances effectively in the past.

Similarly, CD20 car insurance is provided to drivers who don’t have the best track record when it comes to driving safely. It might also be known as high-risk driving insurance.

How long does a CD20 conviction stay on your driving license?

A CD20 driving conviction will stay on your driving license for four years from the date of the driving offence – not the date of the conviction.

What is the penalty for a CD20 conviction?

The repercussions of a CD20 driving conviction are summarised in this table:

| Conviction code | Nature of offence | Penalty points | Lifespan of the conviction | Fine amount |

| CD20 | Driving without reasonable consideration for other road users | Between 3 and 9 penalty points | Four years from the date of offence | A minimum of a £60 fine |

The number of penalty points you receive will be determined by the specific details of the events that resulted in the CD20 driving conviction. The details of the event will also influence your fine amount, which will take into account your income as well.

What is the cheapest car insurance with a CD20 conviction?

It’s not possible to say which car insurance provider offers the cheapest car insurance policies for people with a CD20 conviction. This is because several individual factors contribute to the cost of insurance, and policies are subject to frequent change.

However, the good news for drivers with a CD20 conviction is that there are many insurance companies offering convicted driver insurance, so you will definitely have more options than you may initially expect.

There are car insurance companies that specifically offer these types of policies at competitive prices, and there are car insurance brokers who specialise in helping people with CD convictions get insured.

You can start looking online by searching for CD20 car insurance and using dedicated car insurance comparison websites. You may also want to search for vehicle insurance brokers for relevant and personalised support.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Are there any tips for securing affordable CD20 conviction car insurance?

To secure more affordable insurance with a CD20 conviction, you will need to rebuild trust with your motor insurer. To do this, you should focus on maintaining a clean record. This will prove that you are less of a risk on the road.

It is possible for convicted drivers to take rehabilitation courses, which may reduce insurance premiums in the future. These are often intended for those who have drunk driving and drugged driving convictions.

Other tips for reducing premiums with a CD20 car conviction include:

- Taking advanced driving courses.

- Adding a more experienced driver to the policy.

- Increasing the voluntary excess.

Which insurance companies do not ask about criminal convictions?

It’s highly unlikely that any car insurance company would avoid asking if you have any recent driving convictions. The insurance company will want to know about any driving convictions and bans to decide whether they’re willing to offer you insurance, and at what price.

You must disclose all your driving convictions to a motor insurance company when asked. If you lie and don’t tell them about a careless driving conviction, it will likely invalidate your insurance, meaning you will be driving without insurance.

If this occurs and you’re stopped by a police officer, you will face further consequences, including a driving ban.

What is the cheapest car to insure after a ban?

Driving certain types of cars after a driving conviction or driving ban might help you secure car insurance with lower premiums than you would otherwise be offered. These vehicles include:

- Skoda Yeti

- Ford Fiesta

- Ford KA+

- Renault Clio

- Citroen C1

For more information on convicted driver insurance, it may be worth contacting Citizens Advice for free and impartial advice.