What Happens To A Charging Order When Someone Dies?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about what happens to a charging order when someone dies? Let’s talk about it. We understand that dealing with debts can be scary, especially when the County Court is involved.

Every month, over 4,600 people turn to us for guidance on courts and debts. We have lots of experience in this area.

In this article, we’ll help you understand:

- What a charging order is.

- What happens to a charging order when someone dies.

- If you might have to sell your house to pay off the charging order.

- How to find out if there is a charging order on your property.

- How to remove a charging order from your property.

We know that dealing with debts can be a tough time. Some of us have been in your shoes before, so we know what it feels like and we’re here to support you.

Let’s dive in.

What does a charging order on your property mean?

If you owe a debt and have been issued with a charging order against your property, it means that if you sell or remortgage, the proceeds will be used to pay off the charging order to clear the debt.

Is a charging order a legal charge?

Yes, a charging order is legal.

The charge is registered with the Land Registry. If the court grants a charging order the unsecured debt becomes secured.

Essentially, a charging order is a court order which secures the property of a debtor against their debt.

» TAKE ACTION NOW: Fill out the short debt form

How can I find out if there is a charging order on my property?

The only way to check a debt against property is through the Land Registry.

Charging order records don’t show on your credit file, so it’s not as simple as checking your credit record online for free.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will I be forced to sell my house to pay off the charging order?

Once the creditor has a court order against you, they can apply for a charging order against your home or another property that you own.

At this point, you could lose your home if you don’t pay back what you owe.

Once there is a charging order in place, the creditor can usually apply for another court order to force you to sell your home in order to pay them back with the proceeds, This is called an ‘order for sale’. If you are issued with a CCJ, Charging order or order for sale, you can contact your local citizen advice for help.

How do I remove a charging order from my property?

This happens once the debt has been paid. At that point usually, creditors will inform the Land Registry that the debt has been cleared and the charging order can be removed from your property.

Once you’ve paid off the charging order debt in full you can ask the court for a certificate of satisfaction on your CCJ and include evidence of payment.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

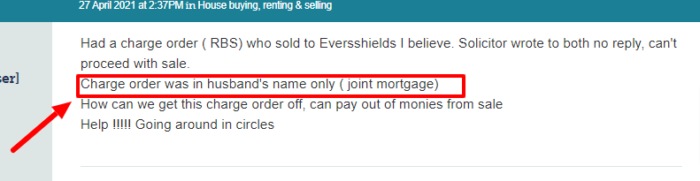

Can you sell a property with a charging order on it?

If you have a charging order on your property, you can’t sell your property without telling your creditor.

When your creditor applies for an interim charging order, they’ll also register a charge on your property at the Land Registry, if you can pay off the debt in full when you sell the property, then you can get the charge removed from the Land Registry.

How long does a charging order last on a property?

A charging order on your home is recorded in the Land Registry until the debt is paid in full.

It can then be removed by applying to the Land Registry. The 12-year expiry only applies in Scotland.

How long does it take to get a charging order?

In general, the process normally takes between 6-8 weeks.

An Interim Charging Order will generally be granted to the creditor when they make the application to the court for a Charging Order. An Interim Charging Order is the first stage in the process and is generally made automatically without a hearing.

Can I remortgage with a charging order?

You can remortgage with a charging order but the money you make will go to pay off the debt you owe.

As a charging order is a way of securing an unpaid debt against your home, any money you make from selling or remortgaging will go to the charging order.