Consequences of Not Paying Phone Contract

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Not paying your phone contract in the UK can lead to serious problems. This includes being cut off from your service and even being chased by debt collectors. If you’re worried about this, you’re in the right place.

Each month, over 170,000 people come to our website for guidance on debt issues. We understand how scary it can be, especially when you’re not sure what could happen next.

In this helpful guide, we will:

- Explain what a phone contract really is.

- Tell you what might happen if you don’t pay your phone bill.

- Discuss if this could affect your credit score.

- Suggest what to do if you’re struggling to pay your phone contract.

- Finally, we’ll answer the big question: ‘Can you go to jail for not paying a phone bill?’

We know how hard this situation can be because some of our team members have been there. So, don’t worry; we’re here to help you understand your options and find a way forward.

Let’s dive in.

What happens if you don’t pay your phone plan?

Mobile phone contract breaches have consequences!

If you do not pay your phone contract you will go into arrears and receive payment reminders and possibly be disconnected from the service. If you still do not pay, you may be chased by debt collectors or taken to court for a CCJ forcing you to pay. And if you still don’t pay, the phone company might even use bailiffs or try to make you bankrupt.

We explain the consequences of not paying your phone contract (UK) in more detail below:

1. Your account goes into arrears

As soon as you miss a payment your mobile contract goes into arrears. Your provider may charge you fees for your mobile payment arrears or your overdue phone bill. Expect to receive calls, text messages or letters asking you to catch up.

2. Disconnecting your service

If you do not make arrangements to repay or miss further payments, your provider could disconnect your service until you have paid. A mobile service suspension may even happen after the first missed payment.

» TAKE ACTION NOW: Fill out the short debt form

3. Passing or selling the debt to a debt collection agency

If no payments are made and the account falls into bigger arrears, the mobile company may chase you for the money and start recording defaults on your credit file. Or they may sell the debt to a debt collection agency, which will do the same. These companies are not bailiffs.

4. Applying for a County Court Judgment (CCJ)

There are legal implications of non-payment too! If there are still no arrangements to clear the arrears, the mobile provider or debt collection company could take you to court. A judge will issue you with a CCJ forcing you to pay or make arrangements to pay.

5. Permission to enforce the CCJ

If no arrangements are made after a CCJ has been issued, the company could ask a judge to enforce the debt. This may include the use of bailiffs who can come to your home and repossess valuables.

There will be expensive bailiff fees to pay at this point – on top of your growing arrears.

6. Making you bankrupt

If your arrears have grown to several thousand pounds, the mobile provider could try to make you bankrupt, which can have a devastating effect on the rest of your financial life.

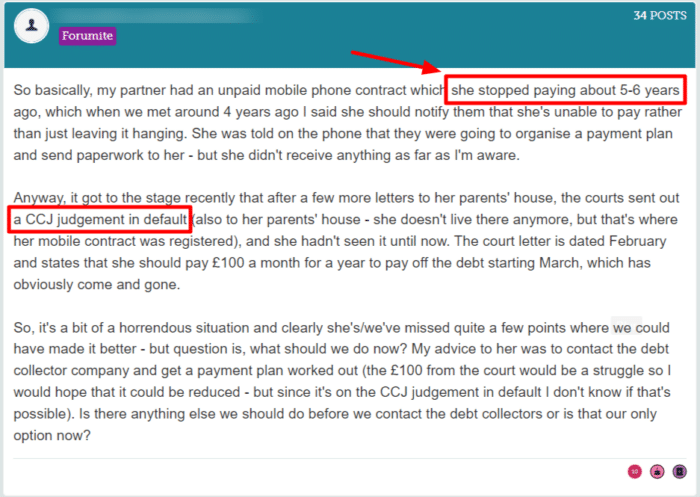

Fortunately, this is unlikely because it is a very complicated process and not many people rack up debt with their mobile phone provider to make bankruptcy a viable option for debt collection! If you owe a debt to your mobile phone provider, I recommend that you speak to a debt charity for some detailed advice. Take this example:

Everyone has forgotten to update their contact information at some point! But had this person spoken to a debt charity, they may have told him about statute-barred debt.

When a mobile phone debt has been ignored for 6 years in England and Wales or 5 years in Scotland, it is no longer enforceable. This means that there is no legal way for the phone company to make them pay – they might not have needed to worry about the debt at all!

If you would like some advice on dealing with your debts I have listed some debt charities at the bottom of this page.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can a contract phone be blocked if not paid?

Contract phones can be blocked if the contract isn’t paid. The provider can blacklist the phone itself, in addition to blocking the sim. However, this is usually a last resort. It is more common for a phone to be blocked as a consequence of the owner reporting it as lost, or if the provider suspects illegal activities, such as fraud.

Can a phone contract affect your credit score?

Yes, a mobile phone contract can affect your credit score.

Your mobile phone contract is a type of borrowing. This means that your monthly payments towards it will be visible on your credit report.

So, pay on time and your credit score can improve. Building a positive credit history is an easy way of improving your credit score.

But miss any payments or pay late and your credit score could drop. This is because your credit score is used to work out if you are a ‘high-risk’ customer who won’t be able to pay back their debt. If you show any difficulty paying your debts back, your score lowers which makes you look like high-risk.

Your mobile phone company are also likely to run a hard credit check on you when you open your account. This is done to see your credit history and if you are likely to make all of your payments. Lots of hard credit checks on your credit file can bring your credit score down temporarily.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you go to jail for not paying a phone plan?

It is extremely rare for someone to be sent to jail for not paying their debts, especially a phone contract.

This only really happens in rare situations when people cannot or refuse to pay council tax arrears or debts with HMRC.

What to do if you’re in arrears

If you are in mobile contract arrears you should not try to hide from the problem. Doing so will only make things worse, as illustrated above. Anyway, resolving mobile debt might not be as difficult as you think.

You should speak with your contract provider and try to negotiate an affordable repayment plan.

If you have delayed doing this, you might have to negotiate repayments with the company’s debt collector. At the same time, you should consider reducing your mobile package to a cheaper tariff. You could reinstate your previous package once the arrears have been repaid if you feel that it is necessary.

When negotiating a repayment plan, make sure you only commit to repayments you can afford. Do not agree to repayments you cannot keep to as it may make things worse in the long run. People who cannot agree or have more debts should speak with a debt charity. They could arrange a suitable debt solution on your behalf, which makes getting out of debt affordable and might even write off some debt for you.