How to Pay a CCJ with No Paperwork? Step-by-Step Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a County Court Judgment (CCJ), you might be wondering how to pay it off without paperwork.

Luckily, you’ve come to the right place for answers. Every month, over 170,000 people visit our website to get guidance on debt solutions.

In this article, we’ll:

- Explain what a County Court Judgment is.

- Discuss how it might affect you.

- Guide you through the process of getting and paying a CCJ.

- Explain how to find out who you owe a CCJ to.

- Share tips on how to prove you have paid a CCJ.

It’s common to feel unsure about seeking help when dealing with debt. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry! We’re here to explain your options. We’ll also talk about what happens if you ignore a CCJ, and how to deal with things like bailiffs or debt you can’t afford.

Let’s get started.

Received a claim form?

Without getting approved for an extension, you have 14 days to respond to a CCJ claim form.

Your reply will need to include evidence of your financial circumstances and possibly an offer of a payment plan.

However, you might disagree with the claim and want to fight it.

In any case, it’s best to get advice and support dealing with these forms. You can do so by speaking with Citizens Advice or any reputable UK debt charity.

These groups might be able to help you get the CCJ set aside. They will also assist you with finding legal aid for dealing with CCJs.

How do I find the details?

You can find details of a CCJ issued against you by searching the register of judgments. Each search of this register will cost a small fee between £6 and £10.

How do I find out who I owe money to?

You can find out who you owe money to via a CCJ by searching the register of judgments.

However, this register doesn’t provide extended details about the claimant.

How do I pay it off?

If a judge decides to issue the CCJ after looking at all the paperwork, you will be made to pay your CCJ by:

- A judgment forthwith

- A judgment by instalments

A judgment forthwith is where you have to pay all the money owed as a lump sum. This will only be requested if it’s understood you can afford the payment.

By paying it all within one month, you won’t have the CCJ recorded on a register, also known as a discharged CCJ.

Otherwise, you will be told to pay the CCJ money owed in affordable instalments based on your financial situation. Still, you can apply to change the payment terms if you’re still struggling to keep up with payments.

Apart from the CCJ payment methods discussed, you can also have the CCJ ‘set aside’ or cancelled if you think it should not have happened.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if you can’t afford the debt?

You might receive a judgment forthwith or a judgment by instalments that you believe is unaffordable based on your income and expenses.

In either case, you can ask the court to look at the judgment again and reconsider. This is called a redetermination.

From my own experience, the CCJ redetermination process kicks on only if the following conditions are met:

- The CCJ was a ‘judgment after determination’. This means you returned your paperwork on time, the claimant refused your offer, and the court made a decision or ‘determination’ about the rate of payment.

- You applied for redetermination no later than 16 days from the date of judgment on the CCJ judgment letter.

That being said, it’s usually cheaper and easier to ask the court to set affordable monthly payments. This is called ‘varying’ a judgment. To do so, simply complete form N245 to apply for a “variation order.”

Budget Advice

If you’re struggling with debt, reviewing your budget can help identify areas where you can cut back on expenses.

Here’s a quick table that provides ten budgeting tips:

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

Ways to pay without paperwork

There are multiple ways to pay a CCJ without having to complete heavy paperwork.

I found that the options available include paying by bank transfer or sending a cheque in the post. You won’t need to submit a form with the payment, but you will need to include:

- Your name

- Your address

- The claim number

- The claimant’s reference

You should not send cash in the post.

» TAKE ACTION NOW: Fill out the short debt form

How do you prove that you have paid?

Once a CCJ has been fully repaid you can get proof by applying for a Certificate of Satisfaction from the court using form N443.

There is currently a £14 fee for this certificate.

You must also provide proof of CCJ payment, such as a receipt from the claimant or a copy of your bank statement. The court will then ask the claimant to confirm you’ve settled the debt.

Don’t worry too much if they fail to reply. The court will accept that you’ve paid in full and update the Registry Trust.

If you pay the CCJ amount in full within a month of the date of the CCJ, it will be removed from the public register, though it may still be visible in court records.

It’s as though it was never entered in the first place. As I see it, this is probably the best option if you admit to owing the money and CCJ is less than a month old.

However, if the CCJ was fully repaid more than one month after it was issued, it will be marked as satisfied. But it will remain on the CCJ register for six years from the date it was issued.

How Does It Affect Me?

Many people often ask: how long does a CCJ last? The truth is a county court judgement will appear on your credit report for 6 years.

This means that banks and other lenders will see that you have a CCJ and might deny you credit. Therefore, a CCJ on your credit file may affect your ability to obtain further credit.

In addition to the credit report, your CCJ will also be added to a database called the Register of Judgments, Orders and Fines within 30 days. This register is run by the Registry Trust. CCJ on credit history will be removed from this database after 6 years.

Lastly, a CCJ on your credit report may also impact your ability to rent a property in the UK.

From my experience, many landlords sadly refuse a tenant with a poor credit history. Unless you come with a guarantor or agree to pay rent in advance, you likely won’t get approval.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if you ignore it?

If you ignore a judgement forthwith to pay the CCJ debt in full or miss a repayment as part of a judgment by instalments, the claimant can take further action.

Here are some of the ways the claimant may force you to pay the money owed in a CCJ:

- Take money directly from your earnings through an attachment of earnings order.

- Freeze your bank account through a third party debt order.

- File a charging order to collect money from the proceeds of the sale of a property or shares.

- If you owe more than £5,000 and fail to repay, the claimant can apply to make you bankrupt.

The claimant can ask the court for permission to enforce debt collection using other means, such as through bailiffs, an Attachment of Earnings Order or a Charging Order.

Bailiffs

A warrant could be issued for bailiffs to come to the debtor’s property and recover the payment or seize goods to an equal value of the debt, which would then be sold to pay it off.

Bailiffs charge expensive fees for their services, which get added to the debt rather than covered by the claimant.

Attachment of Earnings

An Attachment of Earnings Order is when the court instructs the debtor’s employer to send some of their wages to the court each payday.

This money is then passed on to the claimant repeatedly until the debt is cleared. Your employer will need to be informed about the CCJ if it gets to this.

Charging Order

A Charging Order is less common but still possible. It’s a charge added to a property you own, preventing you from selling it without paying off the debt before or as part of the process.

I’ve seen some cases where the claimant even forced the sale of a property to get their money back.

Can a debt become too old to be collected?

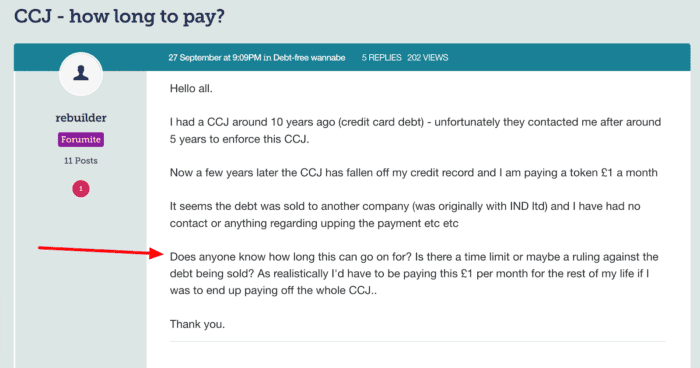

Some people don’t pay their CCJ, but no further action is taken for a long time, or they make smaller repayments for an extended period, as this forum user is experiencing:

Source: MoneySavingExpert forum.

The forum poster asks how long this can go on for – is it possible that the CCJ has become too old to have to be paid?

Unfortunately not. Some debts become too old to be enforced before legal action is taken, but as soon as a CCJ is issued, there is no time limit to recover the debt.