Council Tax Debt Relief Order – Can It Be Included?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you struggling with council tax debts and wondering if a Debt Relief Order (DRO) could be a solution? You’re not alone. Each month, more than 170,000 people visit our website seeking advice on debt solutions.

This article will help you understand:

- What a Debt Relief Order is

- How a Debt Relief Order works

- Which debts can be included in a Debt Relief Order

- The impact of a Debt Relief Order on council tax debt

- Other options if a Debt Relief Order isn’t right for you

You might be worried about whether you’ll be accepted for a DRO, or what will happen to your council tax debt if your DRO is rejected. We understand these concerns and will guide you through the process.

Let’s get started.

What debts can be included in a DRO?

A wide variety of debt types and arrears can be included in a DRO, including but not limited to:

- Loan and credit card arrears

- Bank overdrafts

- Buy Now Pay Later debt.

- Bills for services, such as a solicitor or vet

- Utility account arrears

- HP Agreement arrears

- Benefit overpayments

- Rent arrears (you can still be evicted via a court order for not paying rent if your landlord seeks court permission for non-debt related reasons)

- Debts owed to other people, such as a family member

Note any debt that was gained from fraud cannot be included in a DRO.

Can you put council tax on a Debt Relief Order?

Yes, council tax arrears can be included in a Debt Relief Order.

If you have significant council tax debts (within the DRO total debt limit) and meet the DRO eligibility criteria, you could include council tax debt in the Debt Relief Order and potentially have the debt written off.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What debts cannot be included in a DRO?

Although council tax can be included in a DRO, some debts and arrears cannot be included.

These are:

- Student loan debts

- Social fund loan debts

- Magistrate Court fines

- Child support and maintenance arrears

- The compensation you owe for causing death or injury

All eligible debt has to be included in the DRO, so no debts can be included if they total above £30,000 or £20,000 in Northern Ireland.

» TAKE ACTION NOW: Fill out the short debt form

How long before the council tax debt is written off?

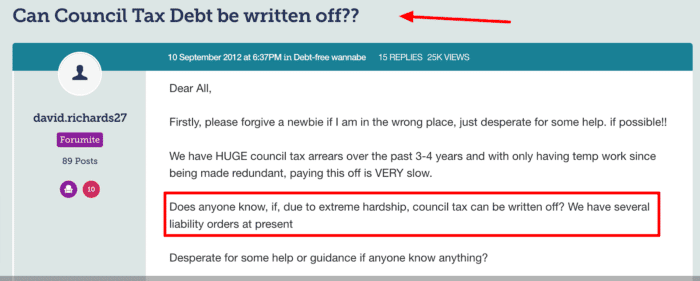

Scores of stressed debtors with council tax arrears ask if this debt can be written off after so many years. Here is just one example from a popular online forum:

Source: https://forums.moneysavingexpert.com/discussion/4171719/can-council-tax-debt-be-written-off

There is good and bad news to this question. Let’s start with the good news…

There is a time limit on how long can pass before a council tax debt can be collected. In the UK, this is known as a statute-barred debt, except for Scotland, which is known as a prescribed debt.

There is a key difference between a statute-barred debt and a prescribed debt. Statute-barred debts are too old to be enforced by a court, which means you can never be legally forced to pay. But a prescribed debt is automatically written off, so it no longer exists.

This is where the bad news starts to filter in…

The time limit for the debt to become statute-barred is six years, or it can become prescribed in Scotland after 20 years (five years for most types of debt, just not council tax!). Most councils will take legal action to collect the debt before these time limits are reached.

Did I mention that debt can never become statute-barred or prescribed if a court order to pay the debt has already been issued? This makes it highly unlikely that your council tax debt will expire and be written off this way.

But then again, it’s not entirely impossible!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do you have to pay back a Debt Relief Order?

You won’t have to pay any of the debts included in the DRO if your financial position didn’t improve during the moratorium period. They are written off instead.

Can council tax be included in a Debt Relief Order? (Quick Recap!)

Absolutely – council tax arrears can be included in a Debt Relief Order (DRO).

All qualifying debts must be included in the DRO. You can’t leave any out to keep your total debt below the eligibility threshold.