The Cheapest Car Insurance with CU20 Conviction?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you searching for a better deal on car insurance after getting a CU20 conviction? You’re not alone. Every month, over 9,300 people visit our website for guidance on this very topic. Finding cheap car insurance with a CU20 conviction might seem tough, but it’s certainly possible.

This article will help you understand:

- What a CU20 conviction is and how it might affect your driving.

- The ways a CU20 conviction can change your car insurance cost.

- How to still get car insurance even with a CU20 conviction.

- The cheapest car to insure after a ban.

- Why you must tell your insurance company about your conviction.

It’s normal to feel worried about affording car insurance or being able to get it at all after a driving conviction. We understand these concerns and are here to help you through this hard time. We’re experts in the field, and we’ve offered guidance to many drivers in your position when it comes to finding the right insurance at the right price.

Let’s get started.

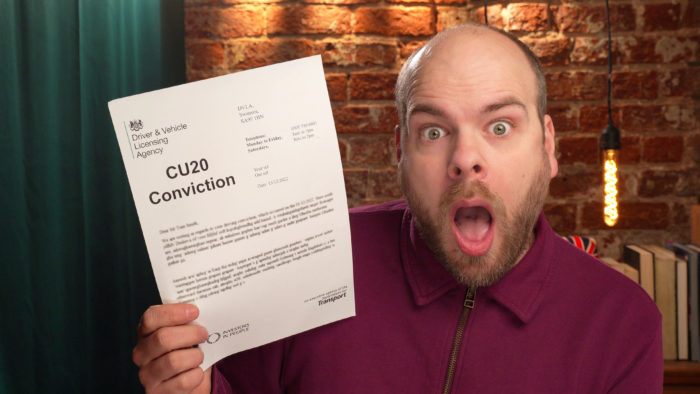

What’s a CU20 Conviction?

A CU20 conviction is given to a driver that is purposefully driving a vehicle that has parts or accessories (excluding brakes, steering or tyres) in a dangerous condition.

This can range from attempting to drive a vehicle you built in your garage, such as a bicycle powered by fireworks, to using banned or dangerous modifications, or simply driving with broken headlights.

Source: MoneySavingExpert

What’s the penalty for a CU20 conviction?

| Driving Licence Conviction Code | The Motoring Offence | Penalty Point Range | How Long Does the Conviction Stay on Your Licence |

| CU20 | “Causing or likely to cause danger by reason of the use of unsuitable vehicle or using a vehicle with parts or accessories (excluding brakes, steering or tyres) in a dangerous condition” | 3 penalty points | “must stay on a driving record for 4 years from the date of the offence” |

Can you get insurance with a CU20 conviction?

In short, yes. While it might be harder, there will be companies that are willing to offer you a policy. It’s very likely that your premium will be higher, but it’s totally possible to find all levels of cover even with a CU20 conviction.

You might find that you have to look at insurers who provide insurance for convicted drivers, or even one more specific to your conviction. You will find some providers will offer insurance to drivers who have previously had a CU20 conviction too.

Those types of insurance won’t differ in coverage, but you might find it easier to get approved by taking this route.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Do you have to declare all driving convictions for car insurance?

Yes. A driver is obligated to declare all driving convictions to insurance companies. If you don’t provide them with this information, your insurance will be invalid for yourself and potentially all named drivers, whether you purposefully held back the information or not.

It is worth noting that you don’t have to tell your insurer about convictions on your licence from 5 years ago or more. This is because they cannot increase your premium for convictions that were more than 5 years ago.

Will car insurance be more expensive with a CU20 conviction?

Yes. The amount insurance companies charge is based on how trustworthy they see you as a driver. That’s why a young driver who has recently passed will have a much higher insurance quote than a middle-aged man with many years of no claims on their insurance. Therefore, with a driving conviction a driver looks less trustworthy, hence the increase in price.

However, because a CU20 conviction only results in 3 penalty points on the licence, the price hike will be significantly lower than other drivers with a more serious conviction.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How to get cheap insurance with a CU20 conviction

There are a handful of ways you can find cheap insurance with a CU20 conviction:

- Switch to a vehicle that is much cheaper to insure

- Shop for convicted driver insurance or high-risk insurance

- Consider driving less. Lower annual mileage can help bring insurance costs down.

What is the cheapest car to insure after a ban?

There are some cars which are cheaper than others to insure, and this is one of the best ways to help keep costs down. Here are some vehicles to consider that will be cheaper to insure after a conviction:

- Renault Clio

- Mazda CX5

- Skoda Yeti

- Ford Fiesta

- Ford KA+