Debt Validation Letter for the UK – Free Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you puzzled by a sudden letter from a debt collector? Unsure if you need to pay? Don’t worry; you’re in the right spot for clear answers. Every month, over 170,000 people look to our website for guidance on their debt issues.

In this article, we will help you to:

- Understand why you’ve received a debt collector letter.

- Learn about debt collectors and enforcement agents.

- Find out if a debt collector needs to show proof of debt.

- Discover what a debt validation letter is.

- Learn how to write one and why it’s important.

Debt can be confusing and scary. We know this because some of our team have been in the same boat. We understand your worry about not being able to afford to pay, which is why we’re here to help you learn about your rights and how to make sure the debt is real.

Let’s dive in and start to make things clearer.

Have you received a letter?

Debt collectors often send letters asking you to pay or get in touch to discuss a payment plan. These letters will simultaneously make threats if you don’t pay, commonly that you’ll be taken to court and subject to fees.

If you’ve received one of these letters there is a lot you need to know. Read on to armour yourself with the facts and your rights.

What is a debt validation letter?

A debt validation letter can refer to one of two letters within the same process.

It can either refer to:

- A letter you send in reply to a debt collection agency asking them to validate you owe the debt, or prove you owe the debt. This is why they’re also called prove-the-debt letters.

- The letter the debt collection business sends in reply to your letter, which should validate the debt.

For the rest of this post, we’ll refer to a debt validation letter as the letter you send in reply asking the debt collection agency to prove you owe the debt.

Why send one?

You should send a debt validation letter because the creditor is required to provide evidence that you owe the money before you’re obligated to pay.

The proof you receive should be a copy of a credit agreement or similar agreement when applicable. If the debt was bought from another company, the debt collector should provide proof that the debt was purchased.

If the debt collection agency cannot prove you owe the money you’re not obligated to pay the debt. This is why it’s important to send the letter by recorded mail and keep a copy for your records. Don’t sign the letter.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do they work?

A debt validation letter can work by proving you don’t owe the money, and it can sometimes prevent you from having to pay if you do owe the money but the creditor cannot prove it.

But that doesn’t mean you should always send one. There might be times when you should take other action…

Should I send it?

You should send a prove the debt letter if you dispute owing some or all of the money.

Do not try and dispute a debt that you believe was already fully repaid to another company/creditor. The debt collection agency won’t have information on this so you’ll need to contact the original company/creditor for proof it was fully repaid.

You may not want to send a debt validation letter if you know you owe the money and want to avoid further time and the possibility of more late charges added to the debt.

Moreover, you should not send a validation debt letter if the debt is too old to be collected. Statute-barred laws could get you completely off the hook of having to pay the older debt.

In this case, you should send a statute-barred letter in reply instead.

Debt validation letter UK template

If you’re going to send a debt validation letter to a UK debt collector, it’s important to do it right. Use this debt validation letter template to make sure you’re including all of the right information.

How long does a debt collector have to validate?

There is no strict timeline published via reliable sources online, but you should hear back within a couple of weeks at most.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Possible scenarios

What to do after sending a debt validation letter will depend on how the debt collection agency reacts to your letter. We discuss the three most common scenarios below.

- Collection agency did not respond to debt validation letter

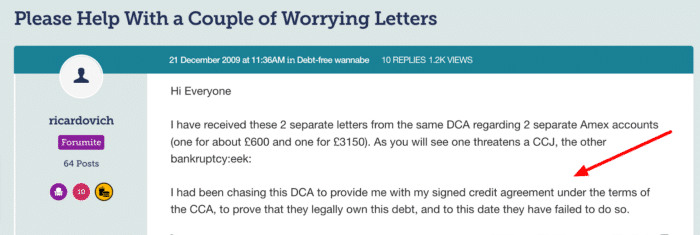

Sometimes the debt collection agency won’t respond to your debt validation letter. Just as this forum user experienced:

Source: https://forums.moneysavingexpert.com/discussion/comment/28045073#Comment_28045073

The debt collection agency might just not reply and not make any more requests. If the debt isn’t on your credit file, keep a copy of your validation letter and move on with life. Hopefully, you’ll never hear from them again.

- Collection agency didn’t respond and sent more debt letters

If the collection agency didn’t respond but then continued to make payment requests and legal threats, you should send a complaint reply.

Your complaint should state that you requested proof of the debt which hasn’t been supplied and state that you will escalate the complaint to the Financial Ombudsman if they ask for any more payments.

Sometimes the Ombudsman won’t deal with your type of debt, such as a phone debt. In this case, ask a debt charity to who you should escalate the debt – and include this group/organisation in your complaint.

If you’re taken to court you will need to show the judge all your requests for proof of the debt which weren’t acknowledged.

- Debt collector validated my debt

If a debt collector validates your debt with proof, you should discuss ways to repay with the debt collection agency. If you cannot afford the debt, you should seek immediate advice from a debt charity.

The debt charity could get you on a breathing space scheme to stop any further action while you arrange a suitable and affordable debt solution.