Do I Have to Declare Spent Convictions to Insurance Companies?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you unsure about telling car insurance companies about old driving problems? This worry is normal. Over 9,300 people use our website each month to find answers about getting car insurance with past driving troubles.

In this easy-to-understand guide, we’ll explain:

- The difference between spent and unspent driving problems.

- How driving problems affect your car insurance.

- How car insurance companies check your driving record.

- How long you must tell insurance companies about your driving problems.

- Special insurance companies that help drivers with past problems.

Did you know that according to Unlock, insurers can legally adjust prices based on perceived risk, potentially making insurance seem unattainable with a conviction? 1

I know it can be scary to think about how old mistakes can affect your future. But don’t worry! We’re here to help you understand your options.

Why Do Convictions Have an Impact on Your Vehicle Insurance?

If you are convicted, you are going to receive penalty points on your licence. You must inform your vehicle insurance firm of this.

When it comes time for you to renew your insurance policy, the insurer will factor in the conviction when deciding a) whether to actually insure you, and b) working out the cost of your insurance premium.

You will now be seen as a high-risk for insurance purposes.

This means that you have been flagged as being more likely to be involved in an accident, or commit further driving offences. And this will remain the case until the conviction is spent (more on this later).

What Impact Do Convictions Have on Your Vehicle Insurance?

The level of impact a conviction has on your insurance premium, will be driven by how serious the offence was.

For example, a criminal conviction for drunk driving resulting in a ban, would have far more impact than being caught speeding.

It isn’t just motoring convictions that come into play when the cost of your insurance premium is being calculated.

Other factors such as where you live, how old you are, what vehicle you drive, and what job you do, all contribute to the algorithm.

But adding a driving conviction to the mix is definitely going to increase the cost of your vehicle insurance significantly.

Convicted Driver Insurance Increase

Here’s a quick table that explains how points on your license affect insurance costs.

| Points on License | Estimated Average Rate Increase |

|---|---|

| 1 – 3 Points : This range usually covers minor offenses. Insurance rates may increase but not excessively. | 5% – 20% |

| 4 – 6 Points : This range might indicate repeat offenses or a more serious violation. Insurance premiums are likely to rise more significantly. | 20% – 40% |

| 7 – 9 Points : At this level, the driver is considered high-risk. This can lead to substantial rate increases. | 40% – 60% |

| 10 – 12 Points : Accumulating this many points might lead to a driving ban. If insurance is offered, it would likely be at a very high rate. | 60% – 100%+ |

Do Insurance Companies Check Your Convictions?

Your insurance company will ask you about criminal and driving convictions, but may not actively check the information you give them.

Why is this? Because if you are found to have lied, and you are involved in an incident whereby you want to make an insurance claim, your policy will be void.

Put simply, if you don’t tell the truth, you are not insured, and you won’t be getting a refund from the insurance firm.

This holds true for everyone who is a driver insured on the policy.

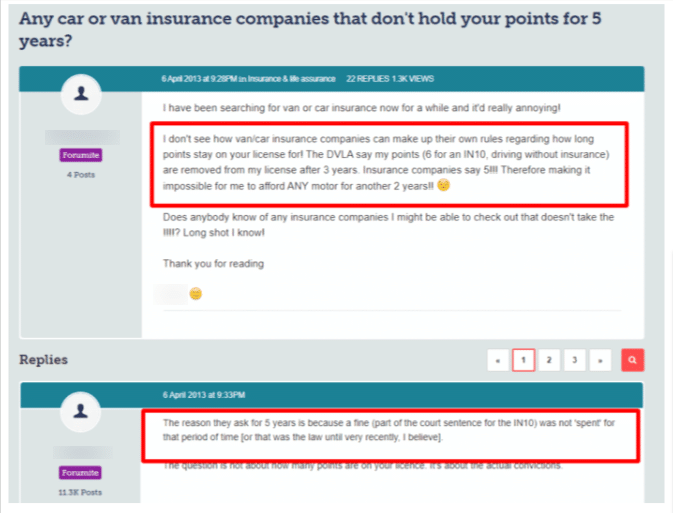

How Long Do You Have To Declare Convictions for Insurance?

Convicted drivers only have to inform an insurance firm about any driving convictions that are not considered spent.

The Rehabilitation of Offenders Act 1974 lays out the schedule for when different types of convictions become spent.

If a conviction is spent, you do not need to tell your insurance company about it, even if they ask you.

In general, a driving conviction becomes spent five years after you were convicted, if you were over 18 years old at the time.

If you were under the age of 18, the conviction is considered spent after 2 ½ years.

Are There Any Special Insurers Who Deal With Convicted Drivers?

Yes, there are special insurance firms that will offer vehicle insurance to some convicted drivers.

Note we say some here, there are convictions that are just too serious for an insurer to consider you to be an acceptable risk.

However, if you fall under this category, you likely already lost your driving licence for a number of years. And by the time you get the licence back, your driving conviction will probably be sent.

But, and this is a very big but, if you do find an insurance firm that is willing to insure you with driving convictions, you can expect to be paying a much larger premium.

You are a known insurance risk, and this is reflected in the cost of your vehicle insurance.