Dukes Bailiffs Debt: Find Out If You Need To Pay

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you being threatened by a bailiff company named Dukes Bailiffs? Or are you worried about your things being taken away? If so, you are in the right place. This article is here to help.

Every month, over 170,000 people, just like you, visit our site for guidance on debt problems. Here, we will explain:

- How to make sure the debt is really yours. If it’s not, you don’t need to pay!

- Ways to keep Dukes Bailiffs from being too pushy.

- Your choices to set up plans to pay bit by bit or even to wipe out your debt.

Our team members have had to deal with debt collectors like Dukes Bailiffs before, so we know it can be very scary when they chase you. But don’t worry, we have lots of useful tips to share with you.

Here are your options when it comes to stopping Dukes Bailiffs from bothering you today.

Why might they be contacting you?

You may be wondering why Dukes Bailiffs are reaching out to you.

If Dukes Bailiffs are contacting you, then it is likely you have unpaid debts.

Dukes Bailiffs recover debt for both public and private companies, so it could be that you owe a local council money or a private company.

Dukes Bailiffs have been known to collect:

- Council Tax debts

- Landlord debts

- Unpaid invoices

- Parking Ticket debts (Penalty Charge Notices)

They also work in High Court Enforcement, helping companies obtain and follow through with County Court Judgments.

Dukes are also involved in tenant evictions and evicting unauthorised trespassers.

Receiving contact from Dukes Bailiffs doesn’t mean you have a CCJ or there’s court action against you, but it might do because it depends on which rules govern specific bailiffs.

If you do not take it seriously it could result in more costs, more contact from enforcement agents and eventually some of your assets being repossessed.

Do you really owe the money?

The first thing to find out is whether you owe the debt?

Verifying the debt you owe is your right.

If you are unfamiliar with the debt, you should get some information on where it originated and how much you owe.

The original debt is likely different from the new charge, as various charges and interest may have been added.

It could be substantially more than the value of the loan you took out.

If you want to find out more about the debt, you can write to Dukes Bailiffs Limited and request that they provide you with a copy of the original credit agreement.

If they tell you they will not be able to provide this, you can stop payments and there is nothing else they can do, assuming they do not have a court order against you.

It is their responsibility to provide proof of the debt you owe.

» TAKE ACTION NOW: Fill out the short debt form

What if you don’t want to pay?

You may not want to pay. However, it is your debt, therefore, you have the responsibility to pay it back.

If the debt is yours, the best way to deal with it is to repay the debt if you can afford it.

However, if you can’t manage to pay it, or if paying the debt would stop you from taking care of other payments.

This includes your mortgage or rent, if so you could make a payment arrangement with Dukes Bailiffs.

They may even accept a partial payment to close off the debt.

That said, there are other options if you can’t pay Dukes Bailiffs Limited. I suggest you seek free advice from one of the debt charities.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Case study

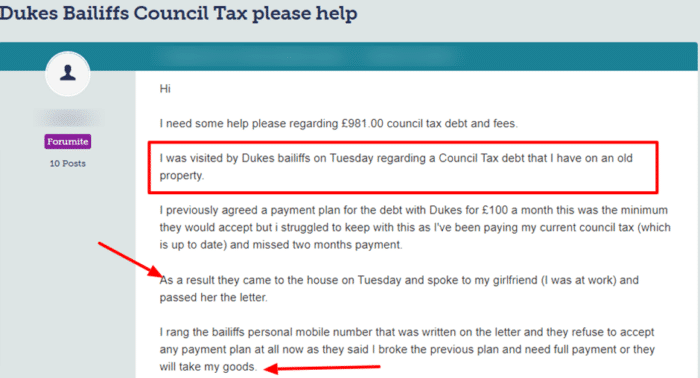

I’ve included a message posted by one concerned person who was contacted by Dukes Bailiffs Limited.

Source: Moneysavingexpert

When can they force entry?

Dukes Bailiffs can force entry to your home if a Liability Order has been issued against you by a magistrate on behalf of the local authorities.

The rules differ if you are a business.

In this case, Dukes Bailiffs can force entry if there exists an unpaid fine from a Magistrate, County Court or High Court.

Can you complain?

Filing complaints against bailiffs is possible.

You have the right to complain about bailiffs if they don’t follow the ‘rules’ or they treat you badly.

First, check who the money is owed to and file a complaint with them. Next, send a copy of the complaint to the bailiff.

If you’re not satisfied with a creditor’s response, you can lodge a complaint to a bailiff trade body.

It’s worth noting that bailiffs could continue to send you letters and visit you during this process.

Also, you can only file a complaint to the trade body if the bailiff has responded to your initial complaint.

But you can complain to a trade body if the bailiff hasn’t responded after 28 days.

I’ve listed which trade body to complain to here:

- For magistrates’ court fines and child support – the Civil Enforcement Association

- High Court Enforcement Officers – the High Court Enforcement Officers Association

Certain creditors have an ombudsman that oversees whether they are behaving correctly.

You have the right to file a complaint to an ombudsman if bailiffs are recovering debts for:

- A local council

- Magistrate’s Court

- HM Customs & Revenue (HMRC)

- Department for Work and Pensions (DWP)

- Energy, internet or phone providers

Make sure you file a complaint with a creditor first before contacting the ombudsman.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Dukes Bailiffs Debt Contact Details

| Website: | https://dukeslimited.co.uk/ |

| Phone number: | 01785 825 500 |

| Email address: | [email protected] |

| Pay online: | Pay here |

| Head office address: | 7 Newcastle Street, Staffordshire, England, United Kingdom, ST15 8JT |

References

Schedule 12, Tribunals, Courts and Enforcements Act, 2007

Part 1, Regulation 10, Certification of enforcement agents, 2014.