DVLA Debt Collection Agencies Guide – Past Due, Capital Resolve, etc

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you puzzled about a letter from a debt collector named Capital Resolve about a DVLA debt? You might be asking, where has this debt come from? Should I pay it? Is it real? Don’t worry; this guide is here to help.

Each month, over 170,000 people come to our website for advice on debt issues, so you’re not alone.

In this article, we’ll cover:

- Where DVLA debts come from and how to check if they’re real.

- The role of debt collection agencies such as Past Due and Capital Resolve.

- How to deal with a DVLA fine.

- Ways to handle too much DVLA debt.

- What happens if you ignore your DVLA debts.

We know that a letter from a debt collector can be worrying; some of us have been in your shoes. Research shows that 64% of UK adults find interactions with current debt collectors stressful1. Luckily, we’re here to help you learn more about how to handle your DVLA debt.

In a Nutshell

One of the most common debts that you have to cover are to do with the DVLA (Driving and Vehicle Licensing Agency). They are a governmental agency that maintains a database of drivers and vehicles across the UK. It is responsible for maintaining the licensing and registration of all drivers and vehicles in the UK.

Sometimes your debts just slip through the cracks, and nowhere is this more evident than when dealing with your car.

You will often receive a DVLA penalty letter if you haven’t insured your vehicle if you haven’t taxed it, or if you haven’t declared that it is off the road.

Declaring your vehicle as being off the road is also known as a Statutory Off Road Notification, or SORN for short. As soon as you take out a SORN, you will get a refund for any full months of remaining tax, and you won’t be able to use the vehicle on the road until you tax it again.

Paying a fine

Paying a DVLA fine before they start using the DVLA debt recover process starts is straightforward. If you follow this link, you will be able to find out all the necessary steps to settling your fine.

They offer several different ways of paying;

- an in-website option

- a telephone option (0300 790 6808, only available from Monday-Friday, 9am-5pm)

- or by post (if you send a cheque or a postal order with your vehicle registration number written on the back) to DVLA Enforcement Centre, D12 Longview Road, Morriston, Swansea, SA99 1AH.

Sometimes, however, everyone can forget to pay up the debts that they owe. When this happens, the DVLA may use a debt collection agency to recoup the money.

Debt collection agencies buy billions of debt annually at rock bottom prices – at an average of 10p to £1!2 This means that if the DVLA hires a collection agency, they’ll likely try to contact you through any means possible to make a profit.

Although there’s some variation between debt collection agencies and the nature of the debt, there’s usually a standard timeline that’s followed during the process. Please take a look at the table below to learn more about this.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

» TAKE ACTION NOW: Fill out the short debt form

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens when I don’t pay?

When you forget to pay a debt that you owe, the company you owe the money to will often contact a debt collection agency to collect the money.

It is often a cause for stress when you receive a letter from a company you probably haven’t dealt with in the past. More so if they’re asking you to pay a sum of money you may not even realise you owe, but in the initial letter they send they will tell you who they are collecting on behalf of.

When it comes to the DVLA, they have been known to use a host of different debt collection agencies to collect fines and DVLA penalties – everything from SORN to road tax evasion!

The official Gov.UK website has a whole section about paying the debts you might owe (you can find that here) and they list some of the debt collection agencies they use. These include:

- Advantis Credit Ltd

- Bluestone Consumer Finance Limited

- BPO Collections Ltd

- CCS Collect

- Oriel Collections Ltd

- Past Due Credit Solutions

In a Freedom of Information request dated 5 July 2010, the DVLA provided the details of debt collection agencies that they used to recoup their debts (see more here). These include:

- Inter-Credit International Ltd

- JB Credit Recovery

- Legal & Trade

- Moorcroft Group

- Philips Collection Services Ltd

So as you can see, they use a range of different agencies to get their debts paid.

What to do next

If you’ve received a letter from one of the debt collection agencies listed above, in relation to a debt you might owe to the DVLA, you may be a little worried and suspicious.

One of the first things you should do is to make sure that the company who has sent you the letter is legitimate.

Legitimacy

There are all sorts of stories about debt collection scams out there, so it’s better to be safe than sorry.

The best way of checking the legitimacy of a company is to head over to Companies House and searching for the company directly.

The DVLA debt collection agencies are highly likely to be legitimate owing to the DVLA being a government body, but it is still worth double-checking.

Follow our ‘prove it’ guide with letter templates and get them to prove that you owe the money.

Information

From the moment you receive the first piece of correspondence from the DVLA debt collection agencies, you should start gathering as much information as you can.

Go through all your correspondence from the DVLA and cross-reference the amounts with the letter from the debt collection agency.

If they have made any sort of mistake in the letter, you will not have to pay the debt. You should also note down the times and the dates of each letter and phone call you receive, as well as the names of the people you speak to.

If any problems arise further down the line, you will be able to present essential evidence.

Payment

If you are certain the debt is yours, that the figures match up, and that you have the funds to pay in full, you should pay the DVLA debt collection agencies.

This will immediately stop them from sending letters and calling your home.

If you can’t pay in full, you should get in touch with them as soon as you can. You may be able to arrange some kind of repayment scheme where you pay the debt back in agreed instalments.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What if you ignore it?

If you ignore your DVLA debts, you will have to deal with the consequences of unpaid DVLA fines which means that the situation is only going to get worse!

Your debt and information may be passed onto a debt collection company. This company will then chase you for the debt on behalf of the DVLA. If you ignore the debt collection company, they may be forced to take legal action. This means that they will get a County Court Judgement (CCJ) against you.

A CCJ is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

But of course, this is just one option. If you ignore the DVLA, they could just get your vehicle seized or even crushed.

Ignoring your DVLA debts is really not a good idea!

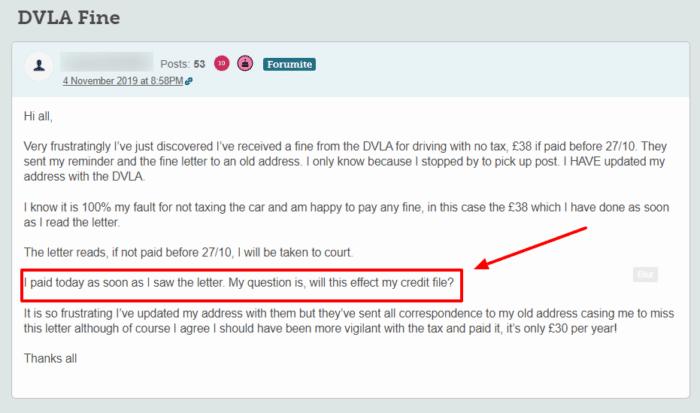

Will It Affect Your Credit Score?

Dealing with DVLA debts can be stressful enough without worrying about your credit file.

But unless you let your fine drag on to the debt collection company or even the legal action stage, no, a DVLA fine will not affect your credit score.

From our experience, this is a common concern!

A DVLA fine will not affect your credit score because a Penalty Charge Notice (PCN) from a County Court is entirely separate from a County Court Judgement (CCJ).

How Can You Avoid It?

You can avoid DVLA debts with some simple organisational techniques:

- Set automatic reminders for key dates

- Set up automatic payments for your vehicle tax and insurance.

Being a little bit organised is the easiest way to prevent DVLA debts. Accidental vehicle tax evasion is probably quite common – everyone has forgotten that date once!

DVLA Debt Collection Agencies Contact Information

| Address: | DVLA Enforcement Centre D12 Longview Road, Morriston, Swansea, SA991AH |

| Phone: | 0300 790 6808 Monday-Friday, 9 am to 5 pm |

| Website: | https://www.gov.uk/pay-dvla-fine |