EON Debt Collection – Should you Pay

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about paying your EON debt, this guide is for you. Every month, we guide over 170,000 people to find solutions to their debt problems. Paying energy bills can be tough, but we have lots of useful tips to help you.

In this guide, we’ll explain:

- How to understand your debt with EON.

- Ways to deal with EON debt collectors.

- What happens if you don’t pay your EON bill.

- How EON can affect your credit score.

- How to tell if the EON debt is really yours.

We’ll also share how long EON can chase you for payment, and what to do if you’re struggling to pay. We’ll guide you on how to legally get rid of some of your debt. We know times are hard right now, as Citizens Advice reports a record number of people seeking help for energy debts, with almost eight million borrowing money to pay their energy bills in the first half of 2023.1

But remember, you’re not alone. Let’s get started.

Be Sure The Debt is Yours

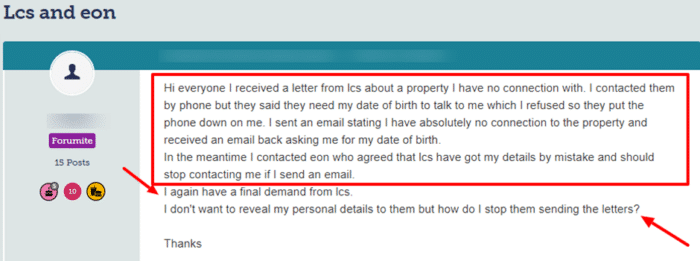

Although it’s not common, there have been cases where an EON debt collector has been chasing payment from the wrong person, or for a bill which didn’t exist.

Mistakes can and do happen, so you’re perfectly entitled to ask for proof of the debt before agreeing to pay. Confirming EON debts are yours to pay is your legal right to do.

You can use our MoneyNerd template which asks debt collectors to prove what you owe. This means you can be confident that the debt is genuine before starting to negotiate a repayment schedule.

So, the first thing you should do is ask the debt collector to ‘prove’ the debt is yours, which they must do. It’s your right to request this; the debt collector must respect it.

This screenshot shows that mistakes happen:

Source: moneysavingexpert

Can I Avoid Paying Them?

EON debt collectors are not bailiffs but if you ignore their attempts to contact you, the case might be referred to court. This could result in a CCJ which allows bailiffs to become involved. Bailiffs have more powers than a debt collector and can remove items from your home to sell.

Once a case is referred for debt collection, it’s a good idea to take action swiftly because it’s too late if you’re thinking of avoiding EON debt collection issues.

Debt collectors won’t just disappear if you ignore them. If you delay, the EON debt collection agency may make an application to the court and can refuse to halt the action unless you settle the debt in full.

It’s usually possible to make an agreement for a repayment schedule with a debt collector. Their goal is to get the EON debt paid with the least amount of hassle, so getting in contact quickly can save a lot of worries.

Your EON bill or unpaid debt would be overdue before the energy provider sends your details to a debt collection agency. In short, the energy provider would have attempted to contact you by sending payment reminders and payment demands first.

Staying in touch with the provider means finding out about any EON debt repayment options you could have.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens If You Don’t Pay?

EON bill non-payment consequences are far-reaching. For instance, your service may be disconnected or a prepayment meter could be fitted, even if this isn’t what you want.

If you have an energy debt and haven’t made an agreement about how you’re going to repay it, companies like EON have the right to apply to the court to force the fitting of a prepayment meter.

You will also have to pay what you owe. EON has various options and the size of your debt may determine their course of action. For example, a smaller energy debt may be added to the meter tariff and gradually recouped.

However, generally for most energy debts where you haven’t agreed on a repayment plan, EON will use a debt collection service. This doesn’t happen instantly but if you don’t contact EON about how to repay what you owe, a debt collection service will eventually get involved.

In short, it’s best to negotiate an EON debt repayment plan with the provider before things escalate to a debt collection agency. Like this, you avoid the negative effects of unpaid EON bills.

» TAKE ACTION NOW: Fill out the short debt form

How Long Can They Chase For Payment?

In the UK debts can only be chased for six years (five years in Scotland) if you haven’t made payment or acknowledged the debt during that time. Debts which are older than this are statute barred – providing no legal action has been taken already.

In short, there is a time limit on EON debt collection although certain criteria must apply.

If a debt is statute barred, it means no legal action can be taken. It’s too late for EON to apply for a CCJ or enforcement action once debt reaches this point. But remember, debts only become statute barred if no legal action has been taken.

If a CCJ is obtained before the six years (or five years) expires, it can be chased indefinitely.

Plus, you must not have admitted owing the money or paid anything towards settling the debt for it to be statute-barred. EON debt statute of limitations would only apply if this applies.

If you owe the money, try to negotiate an affordable repayment plan with the energy provider. But seek independent debt advice first so you don’t commit to a plan you can’t afford.

There are many ways to manage your energy debt, and knowing your options is a key step in doing so.

| Energy Debt Solution | How It Can Help Pay Off Your Energy Bills |

|---|---|

| Installment Plan | Pay in smaller and more manageable monthly amounts until the debt is cleared |

| One-Off Payment | Reduce debt, and possibly get a discount, by paying a lump sum |

| Appealing for a Bill Reduction | Get a reduction by providing evidence of errors in your energy bill or a detailed explanation of your situation |

| Negotiate Contracts | Ask for a temporary reduction in tariffs, a pause on payments, or a longer-term payment plan |

| Switch Providers | If your current energy tariff is too high, consider switching to a cheaper provider |

| Energy Supplier Hardship Funds or Schemes | British Gas Energy Trust EDF Energy Customer Support Fund OVO Energy Fund Scottish Power Hardship Fund npower Energy Fund E.ON Next Energy Fund |

| Government Grants and Schemes | Winter Fuel Payment Warm Home Discount Scheme Cold Weather Payments Local Council Support Child Winter Heating Assistance Breathing Space Scheme |

| Support for Alternative Fuels | If you utilise alternative fuels like oil, LPG, wood, coal, or biomass to heat your home, you may qualify for extra financial help. Speak to an adviser or check with your local council for potential grants or schemes. |

| Seek Advice from Debt Charities | Debt charities offer free advice and practical solutions – they can help you understand your options, negotiate, and set up payment plans with energy providers. |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Eon Contact Details

| Address: | Westwood Way, Westwood Business Park, Coventry, CV4 8LG |

| Website: | https://www.eonnext.com/ |

Can I Get Help With My Bill?

Energy bills are one of the biggest costs in a household and there are several grants available that can help. It’s an option when managing EON energy debts that could build up. But there is help with EON bill payments available.

The Citizens Advice Bureau keep an up to date list of the available grants. Here are some available grants:

- Warm Home Discount

- Cold Weather Payment

- Winter Fuel Payment

There are different criteria for the various grants, and some types of grants are only open for applications for part of the year. Energy firms like EON often have their own energy fund to help customers who are struggling to pay so it’s worth checking regularly to see if any new schemes have been made available.

You can get free, impartial advice from a number of debt charities such as StepChange, Citizens Advice and National Debtline if you need to enquire about EON energy bill support.

I also have a comprehensive range of articles and information available in our Debt Centre.