Fixed Penalty Notice Driving Without Insurance – What happens?

Just received a Fixed Penalty Notice for driving without insurance? This article will provide the guidance you need. Every month, more than 130,000 people visit us to get advice about fines and parking tickets.

In this article, we will explain:

- What a Fixed Penalty Notice for no insurance means.

- When you might need to pay it.

- How to challenge the notice.

- Cases where you might not have to pay.

- What happens if you don’t pay the notice.

Getting a Fixed Penalty Notice can make you worried and confused. We understand that, which is why we’re here to help. Take a deep breath, and let’s get started on discussing what your options are in this situation.

Most Appeals Succeed

In some circumstances, you might have a legitimate reason not to pay your fine.

It’s a bit sneaky, but the last time I needed legal advice, I paid £5 for a trial to chat with an online solicitor called JustAnswer.

Not only did I save £50 on solicitor feeds, I also won my case and didn’t have to pay my £271 fine.

Chat below to get started with JustAnswer

*Around 35,000 people dispute their tickets each year with the Traffic Penalty Tribunal, and a striking 64% of those appeals are successful, so it’s well worth a try.

Why is driving without insurance illegal?

Driving without insurance is taken seriously because there’s always a risk of being involved in a road traffic accident.

Even when a car is parked on a public road and there’s no insurance cover, another vehicle could collide with it.

Passengers and drivers could be seriously injured and vehicles written off which must be covered by insurance.

Is it always illegal to drive without car insurance?

It is against the law to operate a motor vehicle on a public road or in a public area without having at least minimum liability coverage.

Even though the vehicle and covered by insurance, if you do not possess the proper insurance to operate it, you run the risk of being prosecuted for driving without insurance and receiving a fine.

You also need to make sure that your insurance policy covers you for the appropriate use.

If you use your car for work, you will not be covered automatically in this situation.

How do police know if a car is uninsured?

The police use Automatic Number Plate Recognition (ANPR) to identify uninsured vehicles.

The technology taps into a database and the police can verify whether a car has valid insurance and that it has a current MOT.

Successful Appeal Case Study

Situation

| Initial Fine | £100 |

| Additional Fees | £171 |

| Total Fine | £271 |

The Appeal Process

Scott used JustAnswer, online legal service to enhance his appeal. The trial of this cost him just £5.

| Total Fine | £271 |

| Cost of legal advice | £5 |

JustAnswer helped Scott craft the best appeal possible and he was able to win his case.

Scott’s fine was cancelled and he only paid £5 for the legal help.

In partnership with Just Answer.

What’s the penalty for driving without insurance?

The penalty for driving without insurance is detailed below.

A fine

The authorities may impose a fixed penalty of £300.

If your vehicle is parked on the street but not being driven, you could face a fine of up to £1000 if it is not insured and the police find it.

If the matter is taken to court, you run the risk of receiving a substantially higher fine.

Seize your vehicle

The authorities can take possession of your vehicle.

If you fail to buy appropriate insurance or provide proof of coverage within seven working days of getting the warning letter to reclaim your vehicle, it is possible that the car will be scrapped

Points on your licence

You can get six penalty points on your licence for driving without insurance.

Your driving record will reflect these points for a period of four years.

Driving ban

You could be prohibited from driving if the matter is brought before a judge and you are found guilty of the charge.

The length of the driving prohibition will be determined by the court.

However, repeat offenders who are banned from driving for more than 56 days will be required to submit an application for a new licence and may be required to retake the exam.

It is also important to keep in mind that getting caught driving without car insurance will have an effect on the overall cost of your future premium payments.

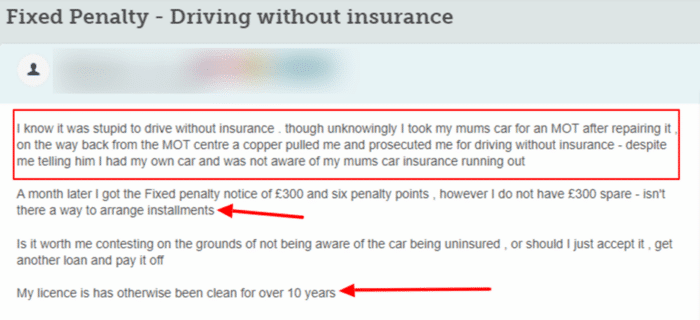

Check out what happened to one motorist who didn’t realise a parent’s insurance cover had run out.

Source: Moneysavingexpert

Will I get a criminal record for driving without insurance?

Because driving without insurance is not a crime that can result in incarceration on its own, a conviction for this offence will not show up on a criminal record.

On the other hand, if you are found guilty of driving while uninsured, you will have an IN10 endorsement placed on your driver’s licence for a period of four years.

You will be required to report this information to insurance providers for an additional year.

What are ‘special reasons’ for driving without insurance?

Arguments based on so-called “special reasons” can occasionally be used to get a more lenient sentence handed down to a person.

Although it is unlikely to get the charges waived altogether.

It is not like receiving a ticket for driving in a bus lane, where you may be able to appeal.

Even though the person is legally responsible for driving without insurance, it is possible to claim that there are extenuating circumstances that should be considered.

The following are some examples of this:

- An insurance company that terminates a policy without giving the policyholder any prior notice

- Because of problems on the part of the provider, there is no policy currently in effect

- A person who has been advised (by the owner of the car or the policyholder) that they are permitted to operate the vehicle legally

- A person who has valid grounds for believing that they are covered by insurance

Do I still need insurance if I am test-driving a car?

Yes – even if you are just taking it for a quick spin around the corner, you need to have at least third-party insurance.

In my experience, the overwhelming majority of commercial dealerships will have their own dealer’s insurance coverage which should cover you.

However, if you are buying from a private seller, you need to ensure that your policy covers you driving other cars – which is becoming a rarity, or take out temporary insurance.

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

My car is parked on the road but I don’t drive it. Does it need to be insured?

Even if you do not plan on driving your car, it is essential to have insurance if you own a car as of June 2011.

This is true for vehicles parked on a public road, in a driveway, or in a garage on your property.

This is because of a law called Continuous Insurance Enforcement (CIE), which was made to reduce the number of drivers on the road who don’t have insurance.

If, on the other hand, you are not currently operating your uninsured vehicle, you may be able to avoid having to face legal consequences.

Simply get in touch with the Driver and Vehicle Licencing Agency (DVLA) and register for a free Statutory Off-Road Notification (SORN).

You must keep your car off the road, in a garage or private driveway, if you SORN it. It can’t be left on a public road.

» TAKE ACTION NOW: Get legal support from JustAnswer

Can I drive on private land in an uninsured vehicle?

If you are driving on private property that is not open to the public, you don’t need car insurance.

However, despite the fact that the law states that you are not allowed to drive in public locations without cover, the phrase “public” can refer to more settings than you might assume.

Therefore, before you go there, you should make sure that the area in which you intend to travel is actually private.

The following are some examples of areas in which you might make a mistake:

- Car parks and camping areas that are privately owned yet are nonetheless open to the general public

- Estates that are privately owned but open to the public

- Farmland that is open to the general public

When don’t I need car insurance?

If any of the following apply to you, you do not need car insurance

- You have a valid Statutory Off Road Notification (SORN)

- Your vehicle has been kept off a public road since before 1 February 1998

- Your vehicle has been scrapped, stolen or exported and you have given notice of this

- Your vehicle is between dealers or is being held in stock by an authorised dealer

What if I’m hit by an uninsured driver?

It is terrible enough to be involved in an accident; it is far worse to find out that the driver who caused the accident does not have insurance.

When you are involved in an accident with another driver who is at fault and who has insurance, your insurance company will, under normal circumstances, negotiate with the other driver’s insurance company.

They determine who will pay for the damages to your vehicle and any personal injuries you may have sustained.

Thankfully, the insurance industry is aware that this is a significant problem and has a procedure in place to deal with drivers who do not have insurance coverage.

As long as you have comprehensive auto insurance, you are able to file a claim with your own insurance company for reimbursement of the costs of repairing your vehicle.

It is possible that you will have to file a claim with the Motor Insurers’ Bureau if you are also claiming compensation for personal harm.

What happens if I’m stopped by the police for driving without insurance?

First of all, you are going to hope you have comfy shoes on because the chances are you are going to be walking home!

Once the police have done their checks and confirmed that you do not have any insurance, or the appropriate insurance, they will seize the car.

In most situations, you will need to find your own way home.

The police will take the car to a storage facility, and you will be charged for the transportation and storage.

You are normally given a timeframe in which to pay for and collect the car, usually a couple of weeks, after which time the car may be scrapped.

You will also be given your FPN on the spot or receive it in the post very shortly, along with the details of the actions to be taken against you.

Hire a Solicitor for less than a coffee.

If you’re thinking about appealing your FPN then getting some professional advice is a good idea.

Getting the support of a Solicitor can make your appeal much more likely to win.

For a £5 trial, Solicitors from JustAnswer can look at your case and help you create an airtight appeal.

Try it below

In partnership with Just Answer.