Full and Final Settlement Offer – Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you finding it hard to pay off your debts each month? You might have heard about a Full and Final Settlement Offer. It is a way to ask the people you owe money to if you can pay a smaller amount in one go. This can help you clear your debts faster.

But, you might worry they won’t accept your offer. You’re not alone! In this guide, we’ll help you understand:

- What a Full and Final Settlement Offer is

- How to make a sensible and acceptable offer

- The things to look out for when making an offer

- Where to get more advice if you need it

Over 170,000 people visit our website every month looking for guidance on debt matters. We understand how hard it can be to deal with money issues, and we’re here to help.

Ready to learn more about how a Full and Final Settlement Offer can help you deal with your debt? Let’s dive in.

What Is a Full and Final Settlement Offer?

A full and final settlement offer, also known as a debt settlement offer (DSO), is a debt solution whereby you offer your creditor one large, lump sum payment to pay off your outstanding debt. This helps you get out of your usually unaffordable debt situation.

Debt Repayment Example:

Let’s say you’re paying £200/month to repay a £5,000 debt over three years. Suppose you’re halfway through the loan period, and you have £2,500 outstanding on the debt. And let’s say that you receive a windfall of £1,500.

If you’re struggling to find £200 each month to make the repayments, your lender might accept that £1,500 as a full and final settlement of that debt. The creditor will then write off the remaining £1,000. That way, you’d have cleared what you owe in a lump sum debt repayment and would no longer be paying £200 each month.

The lender will also be happy with the debt write-off because they get a guaranteed £1,500 repayment earlier than they were expecting.

The alternative from the lender’s point of view is that they will potentially get nothing because you cannot afford the monthly repayments, so you will likely default on the debt.

To ask your lender to accept your full and final settlement offer, download our free letter template.

» TAKE ACTION NOW: Fill out the short debt form

Negotiating the Agreement

The first thing to bear in mind is the fact that your lenders are not obliged to accept any full and final settlement offer that you make.

This means that you have to make sure that it is in their interest to accept by offering a realistic debt settlement deal.

Therefore, the amount you offer in full and final settlement of the debt may need to be fairly close to the outstanding amount so your lenders don’t have to write off too much debt. But don’t push yourself too hard. Only offer what you can reasonably afford.

You also need to convince your creditors that they risk receiving nothing if they do not accept your offer since there is a chance you will become insolvent and will be unable to keep up with the repayments.

If you have more than one debt, you might decide that you want to make more than one full and final settlement offer rather than simply paying off one or more of your smaller debts.

The problem with this is the fact that if your lender sees that you have a pot of money available, they might decide that they want a larger share of that pot.

In this scenario, you would need to decide whether you want to arrange a one-off debt management plan that cancels some or all of your debts via DSO or whether it is simpler to pay off the ones you could afford and then repay your remaining debts conventionally.

As an alternative, I suggest you negotiate with one lender – possibly one of the ones with a higher interest rate – and hope that by giving them “preferential status”, they would be more inclined to accept your offer.

Remember that in any negotiation, your starting point is not usually where you will end up concluding the deal. If the maximum amount you can afford as a full and final settlement is £1,500, it might be in your interest to offer a slightly lower figure first.

Try to test the waters so you have room to compromise if your lender insists on a slightly higher figure.

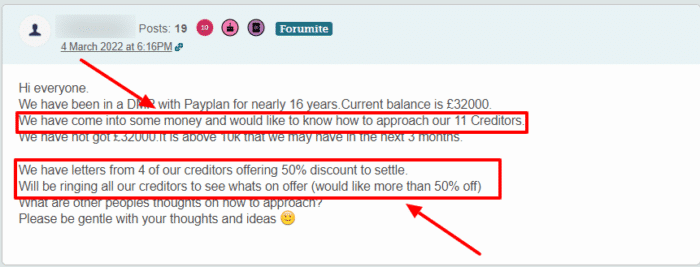

You can use a full and settlement offer to settle multiple debts. For this forum poster, they can use a windfall of £10,000 to pay off the total £32,000 (it’s even better with some of the creditors offering a discount). Offering them a proportional amount of the available funds might help convince the creditors to settle the debts.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Making Sure the Agreement Is Watertight

If you are considering a full and final settlement deal, it can be worth seeking legal advice. This is even more important if the amount of money involved is substantial.

Be sure to keep all your discussions, including your offer and their acceptance, in writing. Keep copies of everything safely.

This avoids any misunderstandings at a later date. Otherwise, you could find that once you have paid the lump sum, your lender might claim that they weren’t aware that you intended that the amount you have paid was in full and final settlement of your debt.

The lender could claim later that it was merely a contribution towards your debt and that they still expect you to continue with your monthly repayments.

You should also ensure that the agreement clarifies what happens if your financial situation changes.

For example, if you won’t be able to repay your debt because you have been made redundant, what happens if you get another job? So safeguarding against future debt claims is critical.

Lastly, a full and final settlement offer will affect your credit score. After making the payment, you should ask your creditors to update your credit file. Check that your account is marked ‘closed’ and your balance is ‘zero’.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

The Downsides of a Full and Final Settlement Offer

The first, and perhaps obvious downside, is the fact that not everyone has a windfall that they can use to make a full and final settlement offer.

However, this type of arrangement can suit someone who has just been made redundant. If you find yourself in this situation, it could be that you have a redundancy payment that can be used to make a one-off payment to settle the debt.

Since you won’t be having any income coming in each month and could therefore struggle to meet the monthly repayments, it’s best to settle the debt once and for all.

A full and final settlement offer can also be suitable for someone who has just received an unexpected inheritance.

Again, you won’t be getting an inheritance each month, so it would be in the lender’s interest to accept a full and final settlement offer if it is unlikely that you will be able to make the monthly repayments.

It’s also an option for someone who won’t be able to work again because they’ve been injured or have an industrial disease. If you have been awarded compensation, your lender may agree to a DSO.

If your lender accepts your full and final settlement offer, this means that they won’t chase you for any further monthly repayments.

However, unless you have agreed on something specific with your lender, the debt will show on your credit history as only having been partly settled for six years.

This means that it will affect your credit score as a partially settled debt tells lenders that you did not pay the full amount of your debt. So it might be difficult for you to get credit(e.g. mortgage, credit card, etc.).