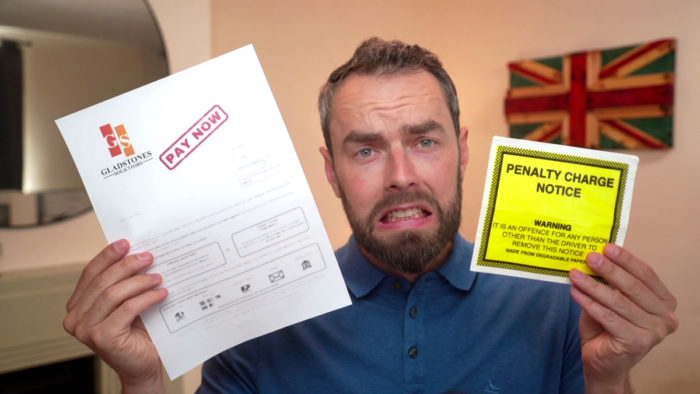

Gladstones Solicitors Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve had a letter from Gladstones Solicitors about a debt, you might be unsure what to do. Don’t worry, we’re here to help.

Every month, over 170,000 people come to our website to find answers to their debt questions.

This article will help you understand:

- Who Gladstones Solicitors are and who they collect debt for.

- How to respond to their letters and what to do if they take you to court.

- If you should pay the debt, or if you could write some of it off.

- The consequences of ignoring debt collectors.

Research shows that 64% of people in the UK find dealing with debt collectors stressful1. Some of us have even been there.

Don’t worry; we’re here to make it easier for you. So, let’s get started on understanding more about Gladstones Solicitors and how to manage this situation.

Letter Before Action

How to respond

#1: Claim statute barred

#2: Ask for proof

Typical Debt Collection Process

As mentioned above, Gladstones Solicitors will send a letter or call if you’ve missed a payment. This is part of the first stage of the debt collection process.

We’ve put together this table that explains the key stages and actions involved in the debt collector timeline. If you’d like to learn more, be sure to read our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

They sent proof – what now?

Should you pay?

» TAKE ACTION NOW: Fill out the short debt form

Should you Ignore Them?

We always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will they take you to court?

Consequences of ignoring them

The consequences of ignoring debt collectors are far-reaching.

For example, when you miss important letters and documents things can quickly escalate.

You could miss:

- A letter saying your debt has been passed to a debt collector

- A Default Notice

- A Letter of Claim or Court Action

- A Statutory Demand which is the first step in bankruptcy filings

There are strict deadlines that must be met to avoid things from escalating. In short, ignoring debt collectors is never a good idea.

Instead, try to set up payment arrangements with the debt collector.

Parking fine

Gladstones Solicitors Contact Details

Glossary of legal terms

Letter Before Action – also referred to as a ‘letter of claim’ or ‘letter before claim’ is the initial step in the formal debt recovery process. Solicitors or debt collection agencies send them out to let debtors know that court action is being considered against them.

Statute barred debt – a debt that’s covered by the Limitations Act and is therefore no longer enforceable.

Charging Order – an order issued by the courts against an asset, typically a property.