How to Get HELOC on an Investment Property in UK?

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Are you curious about secured loans, or maybe you already have one? Would you like to know how they work? You might also want to learn about the good and bad sides of these loans.

If so, you’re in the right place. Every month, over 6,900 people visit our site to learn about secured loans.

In this easy-to-understand guide, we’ll explore:

- What a Home Equity Line of Credit (HELOC) is and how it works.

- The meaning of an Investment Property.

- The process of getting a HELOC on an Investment Property.

- Other choices if a HELOC is not right for you.

- Tips on finding the best HELOC for your Investment Property.

You might be worried about the possible outcomes of a secured loan. You might even be in debt. But you’re not alone; we’re here to help you make sense of it all.

Let’s find out more about HELOCs on Investment Properties together.

Can You Get a HELOC on an Investment Property?

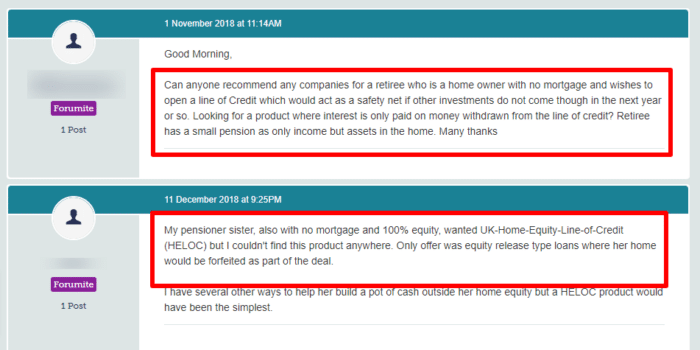

Having built up equity in an investment property in the UK, this may allow you to get a HELOC. Your credit score, income, and equity in your property may determine the availability of a HELOC and the amount you can borrow. However, you should note though, that not every lender offers HELOC-style products, and you may have to spend some time trying to find one that does.

What Is Considered an Investment Property?

Real estate investment properties are properties that are purchased for the purpose of generating income or profit. It is not the owner’s primary residence and is used to generate rental income, capital appreciation, or both. Vacation rentals, apartments, commercial properties, and rental homes are examples of investment properties. Most of these properties are purchased with the expectation that they will appreciate in value over time, and the rental income generated will cover the costs of ownership.

HELOC deals for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Finding the Best HELOC on an Investment Property

If you are looking for the best HELOC on an investment property in the UK, there are several factors that need to be taken into consideration. There are a few key steps you need to follow in order to achieve this, and we have listed them, below.

- Make sure your credit score is good before applying for a HELOC. Having a high credit score increases your chances of being approved for a loan and may also help you qualify for lower interest rates.

- Identify lenders that offer HELOCs for investment properties and compare their terms, conditions, interest rates, and fees. Consult a financial advisor or mortgage broker, check online reviews, and ask friends and family for recommendations.

- Find out how much equity you have in your primary residence and any other investment properties you own. You can then determine the amount you can borrow and the interest rate you will pay. You can use a HELOC calculator to do this.

- Getting the best deal on a HELOC requires comparing interest rates from multiple lenders. Interest rates may also be influenced by your credit score, income, and other factors.

- Additional fees may apply: HELOCs may have application fees, appraisal fees, and annual fees. Before signing any agreements, read the fine print and understand all the fees associated with the loan.

- Pay attention to the repayment terms of the HELOC and make sure that you will be able to comfortably afford the monthly payments. HELOCs are revolving lines of credit, so you’ll only be charged interest on the amount you borrow.

How To Apply for a HELOC

In order to apply for a HELOC, you’ll need to find a lender or financial institution that offers this type of credit. Your lender will assess your financial situation and determine how much you can borrow and the interest rate you will pay. Taking out a HELOC is a significant financial decision, and you should carefully consider your ability to repay it as well as the risks involved before making an application. A broker may be able to help you find the right HELOC for you, and agree the best terms.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders