Should I Help my Spouse with Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Is your wife in debt, and you’re not sure what to do? Don’t worry; this guide is here to help. Every month, over 170,000 people visit our website for advice on dealing with debt, so you’re not alone in this.

In this helpful guide, we’ll cover:

- How debt can harm a marriage.

- If you are responsible for your spouse’s debt.

- Ways to spot if your spouse has a debt problem.

- The different types of debt.

- How to help your spouse manage their debt.

We understand that debt can be a big worry. Maybe you’re scared about what could happen or feeling unsure about the best way to help. Our team has been there too, so we know how hard it can be when someone you love is in debt.

Let us guide you through this tough time and help you understand your options to make the best choices for you and your spouse.

Are you responsible for the debts of your spouse?

How to spot your spouse has a debt problem

Financial infidelity can cause more issues than having an affair.

How to ask your spouse if they have debts

Legal consequences of ignoring debt

The legal consequences of ignoring debt could lead to court action.

A County Court Judgement (CCJ) could be registered against you. It would ruin your credit history.

Enforcement agents (bailiffs) could seize possessions to recover the amount owed. Or an attachment on earnings could be issued. An employer deducts an amount from your wages.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should I help my husband pay off his debt?

Marital financial planning could be the first thing to consider.

What do you do when your husband is in debt?

Provide them with emotional support

- Depression

- Anxiety

- Suicide

Is wife paying debts a good idea?

Make a household budget

Put them in touch with a debt charity

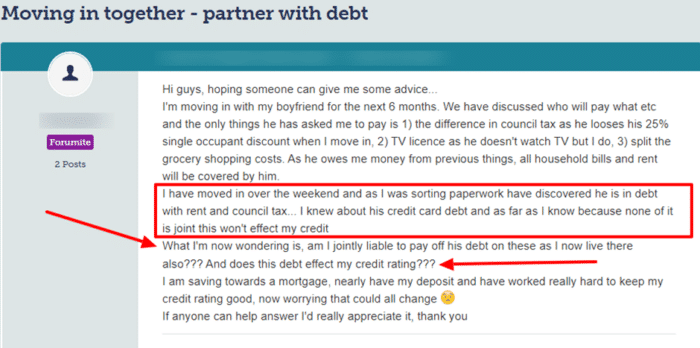

Case study: partner has debts

I’ve included a message posted on a popular forum by a concerned person.

Source: Moneysavingexpert

Debt Management and Consolidation Options

There are various debt management and consolidation options worth considering.

However, I suggest you seek debt advice from an expert before choosing one.

That said, I’ve listed some here:

- Debt relief orders (DROs)

- Individual voluntary arrangements (IVAs)

- Debt management plans (DMP)

- Bankruptcy

A debt repayment strategy must be carefully considered. Preferably with the help of a debt expert.

» TAKE ACTION NOW: Fill out the short debt form

What is a DRO and how does it work?

A DRO is a debt solution that helps you deal with personal debts you can’t afford to pay.

You must apply for a DRO through an approved adviser. Plus, there are specific criteria that must be met.

DROs typically last for 12 months. If you’re eligible, you won’t have to pay anything towards debts (and interest) if they’re listed in a DRO.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What is an IVA and how does it work?

An IVA is a legally binding formal arrangement between debtors and creditors.

You agree to pay back debts over time. It’s a court-approved arrangement, therefore creditors must abide by it.

What is a DMP?

A DMP agreement is an informal debt solution between creditors and debts.

You pay back non-priority debts in one monthly payment that’s divided between creditors.

Most of these debt solutions are managed by DMP providers who deal with creditors on your behalf.

What is bankruptcy?

Declaring bankruptcy allows debtors to start afresh when they can’t repay the money owed.

Debts must amount to over £5,000 to qualify for bankruptcy.

However, this route should only be considered as a last resort as the ramifications are considerable.

Plus, the effects of bankruptcy on credit scores should not be overlooked.