Hoist Sold to Lowell – What You Should Do Next

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you got a letter from a debt collector? And is the name on it Lowell Financial? If you’ve got debt that was with Hoist and it’s now with Lowell, then this article is for you.

You may feel confused. You may ask, “Where did this debt come from?” or “Should I pay this?” You may even worry if you can’t pay. If you have any of these questions, you’re not alone. In fact, over 170,000 people come to our website every month to find answers about debt.

In this article, we will help you to:

- Check if the debt is really yours.

- Find out if you can say no to Lowell.

- Learn how to make Lowell stop bothering you.

- Know your choices for paying back debt or even getting rid of it.

We know debt can be scary, as some of us have been in your shoes. We’ve had debt collectors like Lowell Financial chase us, so we understand how you feel.

Here’s how to stop Lowell Financial from chasing you today.

Your Account Is Being Moved to Lowell’s Systems – What Should You Expect?

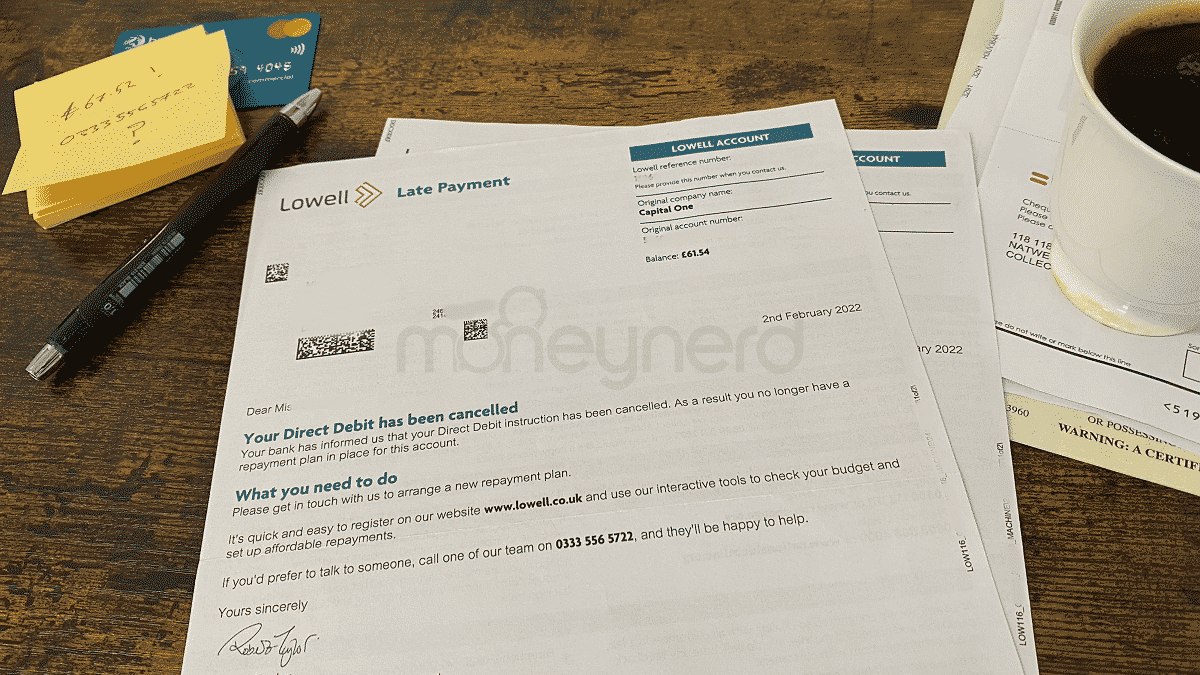

Now we need to talk about the impact that this acquisition will potentially have on your day-to-day life. As part of the takeover process, all debts will be transferred to Lowell’s back-end systems, which is no real surprise. Below, I have listed what you can expect if you previously had debt with Hoist:

- Your account information should be copied across accurately, but it’s worth checking your key details once this has been done.

- You might already have a direct debit payment set up with Hoist. If you do, this should be switched over to Lowell, automatically.

- If you currently make payments manually, you will need to find out the new bank account details to transfer your money.

- If you check your credit report, you should find the entry for the collection of debt by Hoist will be switched over to Lowell.

These are just a few things that you should check, because although the transfer process will likely work perfectly, you owe it to yourself to make sure that your account has been transferred successfully, and you are not making additional payments, or payments to the wrong payee.

Lowell Will Be Looking To Cash In on This Acquisition

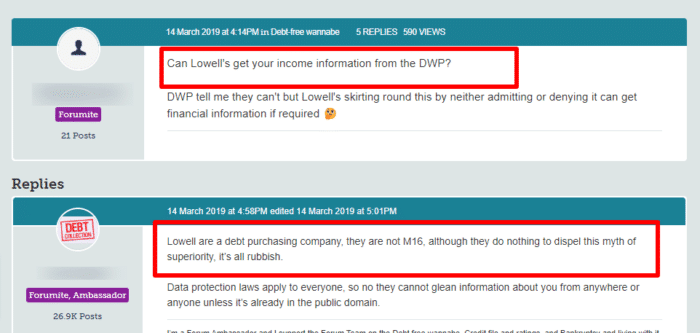

Now we have looked at the potential physical problems that this acquisition could present you, we need to look at how dealing with Lowell might be different. This means they will want all ex-Hoist accounts to begin paying as much back against their debt as possible. Lowell is known for being diligent in attempting to get you to reduce or clear your debt. You can expect the following.

- Phone calls, trying to get in touch with you to arrange repayment of your debt.

- Potential further negative records on your credit report, as Lowell tries to restructure your debt.

- If you have previously headed off court proceedings with Hoist, this won’t likely matter to Lowell, and you face an increased threat of being issued a County Court Judgement (CCJ).

- Potentially, if Lowell judges your debt to be reaching the end of the collection process, you may find that you are contacted by bailiffs trying to get you to settle the debt.

Expect To Renegotiate Payment of Your Debt

Regardless of any agreement you have come to with Hoist, you may need to go through the process of proving your income and expenditure, and how much you can afford to pay every month, as you likely did with Hoist originally.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Should You Do Now?

To pre-empt any potential problems, there are a number of actions you can take, to smooth this transition period. You will find some listed below.

- You could try to reduce your debt, so that Lowell does not begin keep contacting you for it.

- Contact Lowell, with information about your financial situation, and how much you can afford to repay every month. Make an offer for monthly repayments that you can afford to meet.

- Talk to Lowell and offer them an interim payment. Explain that you have other short-term expenses and debts you need to deal with, but that you are aware of the debt you owe them, and that you will begin making repayments as soon as you can.

- Try making an offer of settlement, and this might not need to be the entire amount you owe. Sometimes, debt collection agencies are willing to take less now, rather than face the expense of the full debt enforcement process.

» TAKE ACTION NOW: Fill out the short debt form

What Will Lowell Do if You Don’t Pay Your Debt?

If you don’t pay the debt, the company has a number of tools at its disposal that it can use to enforce payment. This includes approaching the County Court to have a judgement made against the debt. And in this case, if the judgement is granted, you are then deemed legally liable to repay the debt. If you don’t repay the debt once this happens, the County Court may send bailiffs to your home to take goods to be sold off to pay the debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Hoist Sold to Lowell FAQs

Below, you’ll find a short list of potential questions you may have about this takeover, and the impact it will have on your finances.