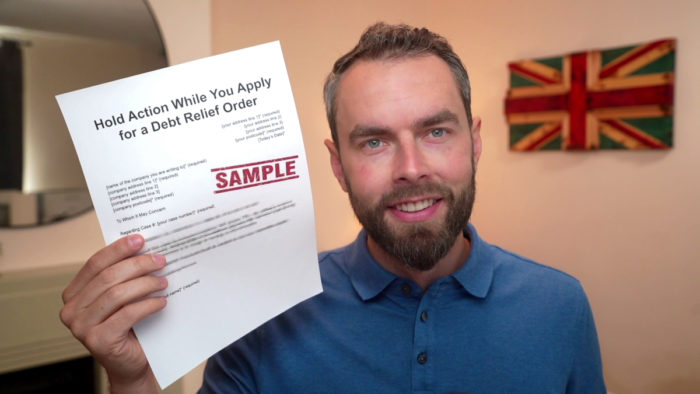

Hold Action While You Apply for a Debt Relief Order – Letter

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Introduction

If you have applied for a Debt Relief Order (DRO), you can use this letter template to ask creditors to hold action while you apply and get a decision. Our letter template is free to download, and we have two versions for individual debtors or people with joint debts.

Using a DRO should be an effective way to get out of debt. It shouldn’t create more financial worry and stress. Use our letter template and read on for more information on this subject.

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required

I am writing to inform you that I am setting up a debt relief order.

This process normally takes a few weeks but because of the impact of COVID-19 (Coronavirus), it may take up to three months for the DRO to be set up and approved.

Therefore, please hold action on the above account and freeze interest and/or other charges that are being added.

The Insolvency Service will send you further information when the DRO has been approved.

Thank you for your understanding and I look forward to hearing from you soon.

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

What is a Debt Relief Order?

A Debt Relief Order is one of many debt solutions available. It is for debtors with a low income and who do not own a home or expensive assets. It can help with combined debts up to a value of £30,000.

The Debt Relief Order will prevent creditors from requesting payments for one year. If your financial circumstances have not improved during the 12 months, your debt can be written off. This is why it is often compared as a small-scale bankruptcy.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How long does it take for a Debt Relief Order to be approved?

In normal circumstances, a DRO application will be reviewed and decided on within ten working days. However, recent applications have been held up due to the COVID pandemic and remote working. You might need to wait as long as two months to get a decision in 2021. Your application will be decided on by the Official Receiver working at the Insolvency Office.

» TAKE ACTION NOW: Fill out the short debt form

Why would a DRO be rejected?

If you meet the Debt Relief Order criteria, there would be no reason to reject your application. The four common reasons for rejection are:

- The applicant has an asset worth more than £2,000 (excluding a vehicle)

- The applicant has more than £75 of disposable income each month

- Your qualifying debts equate to more than £30,000

- A vehicle worth more than £2,000 (this is also in addition to other assets you may have)

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Why ask for creditors to hold action?

If you are expecting your Debt Relief Order to be successful, you could benefit by asking creditors to hold off taking payments or adding interest to the debt while a decision is made. A DRO could prevent you from ever having to pay that debt back again, so asking for the creditor to hold off taking payments could save you some money.

Moreover, asking for the interest to be frozen will prevent your debt from getting bigger in the event that your DRO application is rejected.

How to ask creditors to hold off while DRO is assessed?

The best way to ask creditors to hold off on payments or freeze interest is to put it in writing. Money Nerd has already created an effective letter template you can use to do this. Remember to download our free letter asking creditors to hold off while your DRO is decided. It’s polite, professional and could make all the difference!