How Does Credit Card Debt Affect Getting a Mortgage?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

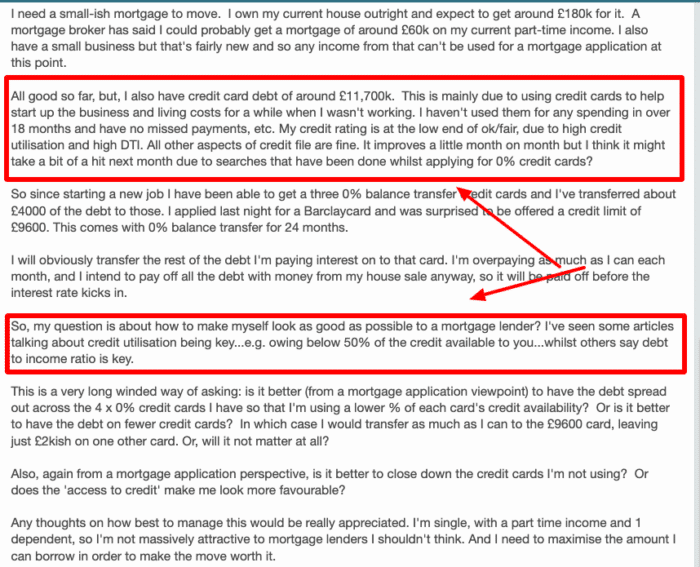

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re feeling unsure about how credit card debt could change your chances of getting a mortgage, this article is for you. Every month, over 170,000 people come to our site for help with worries just like yours. This guide will help you understand:

- How credit card debt might change your mortgage plans.

- What mortgage lenders look at when they see your application.

- The rules that mortgage providers must follow.

- How much credit card debt can change your application’s success.

- Other kinds of debt and how they might affect your application.

We know that dealing with credit card debt can be hard, and it can feel even harder when you’re not sure how it might change your plans for a mortgage. We understand your worries and are here to help you understand the process and make the best choices for your situation.

Let’s dive in.

What Factors do Mortgage Lenders Look at when Reviewing a Mortgage Application?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Legal and regulatory framework for mortgage providers

The legal and regulatory framework governing mortgage lending in the UK is stringent and is designed to protect both consumers and the financial system. The Financial Conduct Authority (FCA), the regulatory body in the UK, sets out guidelines and regulations that lenders must adhere to when considering mortgage applications to ensure fair, transparent, and responsible lending.

Lenders must also bear in mind that customers have the right to refer their complaints to the Financial Ombudsman Service if they feel they have been treated unfairly, and therefore, all processes, decisions, and documentation should be robust, fair, and transparent to stand up to potential scrutiny.

» TAKE ACTION NOW: Fill out the short debt form

How much Influence does Credit Card Debt have on the Success of an Application?

Other types of debt

In the UK, lenders scrutinize your credit history and various types of debts to ascertain your financial management skills and repayment capacity when evaluating your mortgage application. Here’s how credit card debt is perceived in comparison to other types of debt:

Student Loans:

- Perception: Generally, student loans are viewed somewhat differently than other debts because they are seen as an investment in your future and are often not required to be paid back until a certain income threshold is met.

- Impact on Mortgage Application: Lenders might be more lenient towards student loans in comparison to credit card debt. The monthly repayments will be considered during the affordability check, but it’s often not viewed with as much concern unless repayments are missed.

- Lender’s Consideration: As student loan repayments are typically deducted directly from your salary (once you’re earning above a certain threshold), they are considered more stable and less risky in comparison to credit card debt.

Personal Loans:

- Perception: Personal loans, especially if used for appreciating assets or value-building purposes like home improvement, are considered more favourably than credit card debt used for consumption.

- Impact on Mortgage Application: A personal loan with consistent, on-time payments can reflect well on your credit report. However, missing payments or defaulting will substantially impact your mortgage application negatively.

- Lender’s Consideration: The purpose of a personal loan and the regularity in repayments is crucial. If it’s utilised wisely and being paid back responsibly, lenders may view this as responsible financial management.

Comparative Impact on Mortgage Applications:

- Debt-to-Income Ratio: Regardless of the type of debt, lenders assess your Debt-to-Income (DTI) ratio, which indicates the portion of your income consumed by debt repayments. A lower DTI is preferable as it suggests a balanced financial condition.

- Payment History: Consistency in repaying any kind of debt is crucial. Lenders typically look for patterns in your payment behaviour to gauge your reliability in adhering to repayment schedules.

- Total Outstanding Debt: While the type of debt is significant, the total outstanding debt across all categories will also be thoroughly evaluated to understand your overall financial stability and obligations.

- Your Intent and Management: The purpose behind acquiring and managing various debts also informs lenders about your financial decision-making and management skills.

In a nutshell, while each debt type is perceived differently, the underlying theme is that lenders seek assurance of your repayment capability and financial management.

Does My Credit Score Affect My Chances of Securing a Mortgage?

Let’s take a look at some of the credit score bands:

| Credit agency | Fair | Good | Excellent |

| Experian | 721-880 | 881-960 | 961-999 |

| Equifax | 380-419 | 420-465 | 466-700 |

| TransUnion | 566-603 | 604-627 | 628-710 |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.