I Can’t Pay My Debts – What Are Your Options?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about not being able to pay your debts? You’re not alone, and help is at hand. Every month, over 170,000 people come to our website to find answers to their debt problems. This article is here to guide you through the steps you can take when debt becomes too much to manage.

We’ll explore:

- The importance of not ignoring your debts.

- How to ask for proof of your debt.

- Ways to get help with your debt.

- Choosing the right solution for your debt.

- Steps to secure and stick with your debt solution.

Our team understands your worries, as many of us have faced debt issues too. We know it can be scary, but we’re here to help. By following our advice, you can find a way out of debt and prevent future debt problems.

Let’s get started and explore your options when you can’t pay your debts.

I Can’t Pay My Debts! What Next?

If you think you can’t pay your debts, you will be surprised about the options available to you. Even people with limited or no disposable income can find debt solutions.

1. Don’t Ignore Your Debts

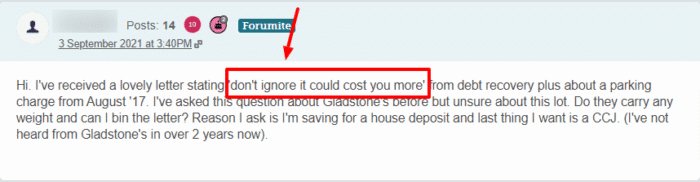

The first step is never to ignore your debts. Even when you think someone is claiming you owe them money and it is a mistake – do not ignore their claims or letters.

Ignoring debt can make the situation worse and increase the amount you owe through interest and administration fees.

You might have an urge to bin letters or believe something is inaccurate, but taking action is essential.

2. Ask for Proof of the Debt

Now that you know taking action is necessary, what action do you take? Well, you need to get anyone claiming you owe money to prove you really do.

You don’t have any obligation to pay until they present this evidence to you. When we say evidence, we mean documents that tie you into an agreement that you have defaulted on, typically with a signature.

To request proof of the debt, you need to send what is called a prove the debt letter. Any letter requesting proof and asking the creditor not to contact you again unless they provide proof is sufficient.

However, most people choose to use the detailed prove the debt letter templates you can find online. These refer to specific laws and give the letter more punch.

A common question at this stage is if you should send a prove the debt letter if you know 100% that you do owe the debt.

Yes – you absolutely should! This will buy you some time to do some of the following steps and take the pressure off while the company goes looking for your documents.

» TAKE ACTION NOW: Fill out the short debt form

3. When You Shouldn’t Ask for Proof…

There is only one instance when you should not be sending a letter asking for proof. And that is when the debt they are trying to collect is not legally enforceable and cannot be judged in court.

Most debts that are over six years old will qualify for this, technically known as statute barred debt. There are other criteria you must meet to not have to pay your older debts, so it is worth investigating first.

If you find your older debt does not have to be paid, instead of sending a letter requesting proof, you can send them a letter telling them the debt is statute-barred and never to contact you again, or it will be classed as harassment.

4. Source Debt Support

At any point, you can always ask for help and support at debt charities. The UK has some phenomenal debt charities available and ready to provide you with 100% free debt advice.

One of their services is to evaluate your situation and tell you what debt solutions are available.

Sometimes, they can even process these debt solutions for you. These solutions range from monthly repayments to bankruptcy, with many other options in between.

Many organisations and charities offer emergency funding or hardship programs to help those in severe financial distress. Check if you qualify for these support programs.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

5. Decide On a Debt Solution

Don’t jump into a debt solution without careful consideration.

You might be applicable to more than one solution, which allows you to space our repayments and make them affordable. For information help on making a decision, check out this debt solutions comparison page!

6. Secure Your Debt Solution

The method to secure an affordable debt solution will depend on the solution itself. Sometimes, you can secure them yourself by calling creditors and often, the same solution is available through debt charities.

There are formal solutions that can only be agreed upon with the help of a certified insolvency practitioner, and you will have to pay ongoing fees for their service.

If you are paying for their help, it is likely that you will be saving money elsewhere in the debt repayment.

Look up the best debt management companies to find these services!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

7. Stick to Your Debt Solution

Stick to your new debt solution by making payments of the correct amount and on time.

Debt Management Plans are not legally binding, which means defaulting on payments may mean the creditor pulls out of the agreement and decides to take legal action instead.

And formal solutions like an IVA are legally binding, which could make the situation a lot worse if you miss payments, and could even lead to bankruptcy.

8. Prevent Future Debts

Sometimes, it is hard for us not to fall into debt. We might lose our jobs because of reasons out of our control, or be forced into costly purchases to keep the family home going, like a washing machine repair.

But we can mitigate the damage of any unforeseen events by becoming more financially literate, and understanding how to make our money grow with savings accounts and investment.

Start to create a financial cushion to soften any unavoidable blows in the future.