Interest on Debt – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re looking for more information on how interest can affect your debts, you’re in the right place. It can be worrying to think about the financial impact of interest on your debt, but don’t fret; we’ll help you understand it all.

Every month, over 170,000 people come to our website for guidance on debt solutions, so you’re not on your own in this journey.

In this easy-to-understand guide, we’ll cover:

- What is interest and how it works.

- How to calculate interest on your debt.

- What to do if the interest charged is too high.

- Ways to manage your interest costs effectively.

- And how to deal with the stress of interest payments.

We know how tricky it can be to navigate the world of debt and interest. Our team is here to help you, using their own experiences and understanding to guide you.

Let’s get started and learn more about interest on debt and how to handle it.

How To Calculate Interest On Your Debt

The calculation of the cost of debts is simple daily. As the rate is expressed in terms of a percentage, it is actually easy to calculate the costs attached to your debt.

The formula is

A= P( 1+ rt )

Here,

- P is the total amount you borrowed from the lender.

- R is the interest rate divided by 100.

- A is the amount that is to be paid.

- T is the number of time periods that have gone by

If you want to simplify this to a daily basis, you need to divide the rate by 365 to get the daily interest that you need to pay. And for the payment over 30 days, divide the rate by 12.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

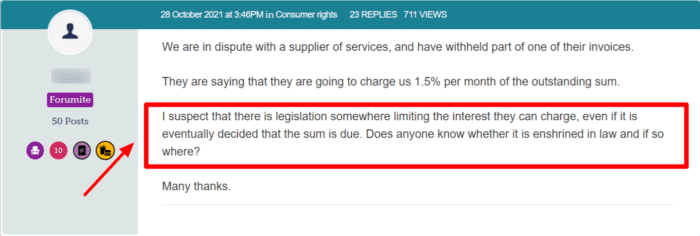

Charging Interest That Is Too High

While there is no legal maximum interest that can be charged, the Financial Conduct Authority has put measures in place to regulate unfair terms. If you feel that you are subject to unfair interest charges I recommend that you contact the FCA so that they can look into this for you.

» TAKE ACTION NOW: Fill out the short debt form

FAQs

Is Interest Mandatory On Debts?

Yes, if you have agreed to pay it already, as per the rules set by the Financial Conduct Authority, you cannot go against the contract for your loan.

However, there are legal avenues that you can explore such as debt restructuring that could change the terms of your interest payments.

If you own a business, it can be shut down due to non-payment. Businesses have an even stricter set of rules when it comes to debts. Your business can be made bankrupt if you decide not to pay the cost of your loan.

Is There A Limit On The Amount Of Interest That Can Be Charged?

There is no legal limit on interest rates, however, the FCA has introduced measures to regulate unfair charges.

Source Money Savings Expert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is There A Way I Can Get My Interest Rate Reduced?

Yes, you can talk to your creditors and explain your situation to them. However, if you have already agreed to pay a certain amount of interest, it can be hard to get your creditors on board for the agreement. Since it’s a contract, you are legally required to follow it.

You could be more successful if you have had the credit for a long time and have always made payments on time. Also regularly check your credit score because this will impact your interest rate offered when you apply for credit.

Other options, especially with credit could be transferring your balance to a lower-interest card, and ending the initial higher-interest card, this option however needs very careful consideration because there is no point in transferring your balance if you then decide to continue using the higher-interest card.

Other factors to consider are if the debt interest is fixed or variable, fixed rate remains the same throughout the agreement. They are often a little higher but you have the certainty of knowing exactly what you will be paying.

Variable interest rates are influenced by factors such as the bank base rate, economic climate and market fluctuations. Payments could increase or decrease and are not predictable.

Beware of predatory lending, many companies take advantage of people that have difficulties getting credit due to a low income or bad credit score. These companies then charge excessive amounts of interest.

The FCA has introduced measures to protect customers from such lenders by capping interest rates on payday loans and enforcing affordability checks. However, it is still essential to check the terms of any credit agreement to ensure that you are not paying excessively high-interest charges.

How Can I Manage My Interest Costs Effectively?

There are many ways to manage your interest costs. I would also recommend contacting one of the debt advice organisations for more guidance.

- Pay more than the minimum payment when you can, especially with credit cards.

- Look at the possibility of a consolidation loan and pay off all debts, it is essential to make sure that you will be paying less and avoid racking up more debt. Debt consolidation is often used to manage large amounts of debt.

- Switch to lower-interest credit cards and transfer the balance from high-interest cards.

- Refinancing with a lower interest rate option.

Can I Go To Jail For Not Paying Interest Charges?

No, you cannot go to jail for unpaid loans. Your creditor also cannot threaten you that he’ll take you to jail if you don’t complete your payments and pay him his money back.

Any unpaid loans, including credit card loans, payday loans and store credit cannot make you go to jail.

A debt is a contract and the law does not allow anyone to go to jail because of their financial circumstances.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Coping With The Stress Of Interest Payments

Debt is a worry for many and can impact emotional well-being. Sleepless nights over debts spiralling out of control can seriously affect a person’s mental health.

It is important to reach out before things go too far, debt counselling organisations can give advice and guidance and advice to help bring debts under control. I recommend contacting one of them as soon as you feel you are losing control of your debts.

Charities that can help are StepChange, National Debt Line and Citizens Advice Bureau

Is There Something Called Daily Interest?

Yes, statutory interest is charged on a daily basis. Moreover, If you want, you can adjust your interest rate over a period of 365 days for you to simplify your finances, but that doesn’t mean that it’s payable every day, you only have to pay it once a year.

However, in some contracts, there’s a requirement for a monthly payment of interest. Go over your contractual agreement to know when your interest is payable.