Intrum Debt Collection – Should You Pay? UK Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving an unexpected letter from Intrum Debt Collectors can be a stressful event, but don’t worry, you’re not alone. Each month, over 170,000 people seek help from our website on debt matters, just like this one.

You may be confused about where this debt has come from and if you should, or indeed have to, pay it. This guide will provide clear and simple advice to help you understand your options and rights, answering common questions, such as ‘Is this a genuine debt?’ and ‘Could I write off some Intrum debt?’

In this article, we’ll cover:

- Who Intrum Debt Collectors are, and why they may be contacting you.

- Your legal rights when dealing with debt collectors.

- How you might be able to write off some of your debt.

- Understanding if the debt is money that you owe.

- Where to get free advice if you’re struggling with unmanageable debt.

We’re here to assist you with our expert knowledge on debt solutions, backed by data from Intrum. Since research shows that 64% of UK adults find interactions with current debt collectors stressful1, our aim is to help you feel less worried and more confident about handling this situation.

Let’s explore your options together.

Why are Intrum Justitia Debt Collectors trying to reach you?

Intrum is trying to reach out to you as they believe you owe them a debt.

They buy debts from many other companies, so even if you’ve never heard of Intrum debt, they may have purchased your debts, and you could owe them.

Debt problems are so common these days, and debt collection has become big business, and quite profitable for some organisations, especially as making a debt purchase is becoming more and more common.

The Intrum business model is based on buying debt from customers at a much lower than the face value, sometimes even for only 20% of the real value, and they then make a profit by taking in all or some of the debt.

This is a very common practice, as several other debt collection agencies buy billions of debt annually at rock bottom prices – at an average of 10p to £1!2

The debt collection industry contains many businesses with low morals. We don’t know how Intrum group will conduct themselves with you, but we do know that many debt collectors don’t care much about you and your own personal circumstances, even if you are in dire straits.

In fact, some debt collectors will try to chase you for a debt that you don’t have to pay! Sometimes, they’ll chase you and hope that you pay off the money without checking that you have to. We go through the debt verification processes below.

Is this debt money that you owe?

Do you really owe this debt, or does it belong to someone else? This is the initial point you want to establish. Debt verification is essential – you don’t want to pay a debt that you don’t necessarily have to.

You should try to find out where the debt originated and the total amount you owe. It is highly likely that the original debt, if it does exist, has become inflated by a number of charges and interest, and it could even be substantially more than you thought you owed.

You can write to Intrum Group and ask them to send a copy of your original credit agreement. If they are not able to provide this or they refuse to do so, you have the right to refuse to pay them. Intrum must provide you with evidence, especially if you don’t recognise the debt.

You can use our free letter template to ask for evidence that you are liable for debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Intrum Justitia Debt Collectors and the legalities

The Financial Conduct Authority (FCA) introduced guidelines that debt collectors must now adhere to. In summary, Intrum Debt Collectors have a responsibility to:

If you feel intimidated by Intrum Debt Collectors and they are failing to abide by these guidelines, you would have grounds for a complaint.

Don’t want to pay?

If you owe the money, then the best course of action is to repay Intrum, especially if you are in a financial position to do so.

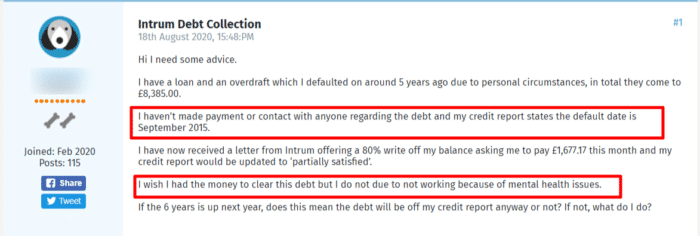

If you are unable to afford to repay the debt, or if doing so would stop you from being able to take care of your more important expenses, such as your mortgage or rent, then you should endeavour to come to an arrangement with Intrum Debt Collectors to repay it, you may even want to offer to pay them a partial repayment to clear off the debt.

In many cases, Intrum will offer you a repayment plan first.

We always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

Intrum Debt Collection is legally obligated to offer you a few different repayment plans so you can choose the best one for you. But if none of these will work, you can opt for a debt solution.

If you are in a similar position to the person in this case study, we recommend getting some advice from a debt charity.

They will be able to offer you advice and tell you what will be best if you can’t afford Intrum’s suggested payment plans.

We go through the different debt solutions available in the UK below.

» TAKE ACTION NOW: Fill out the short debt form

How Can You make a complaint?

If you think that Intrum Justitia has been unreasonable or behaved inappropriately, you can make a complaint.

You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Intrum Justitia so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Intrum Justitia may be fined. You could even be owed compensation.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Know Your Rights

In situations of debt, it’s always important to know your rights so you don’t get taken advantage of. There are many things that debt collectors can’t do, and being aware of them can help you have an edge over the situation.

To learn more, please check out our related article on this and take a quick look at the table below.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |