Leaving the UK with Debt

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you considering leaving the country with unpaid debt? You’ve come to the right spot. Every month, more than 170,000 people visit our website for advice on debt issues just like this one.

In this article, we’ll cover:

- What happens to your debts if you leave the UK.

- The role of foreign debt collection agencies.

- How bankruptcy can affect you.

- Ways you might be able to write off some of your debt.

- What to do if you decide to return to the UK.

Our team includes people who have faced debt problems in the past. We understand how you’re feeling, and we’re here to help.

Stay with us to learn more about dealing with debt if you’re planning to leave the UK.

Can you leave the UK with debt?

The best way you can deal with any debts you still owe while you are abroad will depend entirely on your situation – just as it would if you were in the UK.

Nine times out of ten, you will be able to continue making payments towards your debts while you are abroad.

These should be at the amounts you have previously agreed with your creditor.

Making the payments from abroad could become a bit trickier, as you would have to do this by bank transfer.

This is a slightly more complicated process, using what’s known as an IBAN transaction, and there may be fees to pay to do this. You should contact your bank for more details.

Sometimes, doing this will be impossible, owing to international sanctions that forbid the transfer of cash from country to country.

So, leaving the UK with debt can end up being more of a headache than it might be worth.

Debts abroad

The short answer to whether you can leave the UK with debt – yes, you can.

However, there are lots of things to bear in mind. Your debt remains on your UK credit file for six years.

So, if you do go to another country and you try to open a bank account, or even start a mobile contract, you may find it hard to get these accepted owing to your unpaid debt.

Renting could also be a bit of a nightmare – if you were to try and eradicate your credit record, renting anywhere privately would quickly become impossible.

You would also not be able to get any benefits, and if you wanted to stay under the radar and have no digital financial imprint, being paid in cash would be the way to go.

This opens up a new set of issues, in that you are setting yourself up to be exploited, as you could be paid well below the minimum wage, and you may not receive proper holiday pay or sick pay.

» TAKE ACTION NOW: Fill out the short debt form

Foreign debt collection agencies

Sometimes, leaving the UK with debt will not make them go away.

There are debt collection agencies in the UK that have international links, so if you plan on leaving the UK with debt, it’ll follow you to your next destination.

This could lead to these partner companies taking action in your new home country, such as claiming assets and freezing bank accounts that you might hold in that country.

The original creditor may not even have to link up with another debt collection agency at all though.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Bankruptcy

Leaving the UK with debt might result in the creditor making you bankrupt, even if you aren’t in the UK anymore.

This could cause serious problems, as bankruptcy is recognised across borders and in most European countries.

In addition to this, many other countries across the world are also part of international agreements where their courts or insolvency services will cooperate with this bankruptcy.

So, despite being made bankrupt in the UK, you could end up paying the price in your current home country, and any assets or property you own will be under threat.

It should be noted, though, that there is no guarantee of them pursuing you in another country, but there is every chance that they might.

County Court Judgment

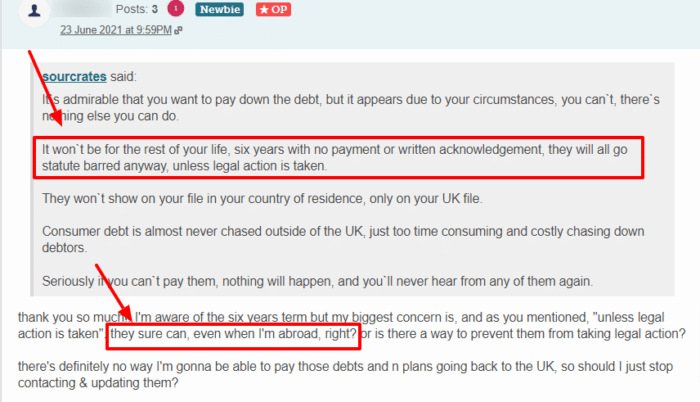

You may also think that your debt could become statute barred after 6 years away, thus meaning your debt can no longer be legally enforced.

Regardless of where you are in the world, the creditor could apply to get a County Court Judgment against you.

Also, County Court Judgments can be enforced upon your return to the UK – even after 6 years.

If you leave the UK with debt and you don’t supply your creditors with your new contact details, they will serve the legal action to your last known address.

If you do notify the creditors of your new address in your new home country, legal action can only be started in that country.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Coming back to the UK

Leaving the UK with debt will put you in a tricky position, especially if you are planning on returning at some point.

If you don’t provide a forwarding address, then there could be all sorts of things happening behind your back that you don’t know about.

The debt that you still owe could end up accruing a huge amount of interest and overdue charges, meaning that you will owe much more than you bargained for.

In addition, the creditor could apply for a County Court Judgment, which would eclipse any chance of the debt becoming statute-barred.