Loans Secured on Property – How to & best Options

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Do you want to know about loans secured by property? Are you unsure about how they work or what might happen if things don’t go as planned? You’re in the right place. Over 6,900 people come to our website each month to find out about secured loans.

In this easy guide, we’ll talk about:

- What a loan secured by property is.

- The real cost of a bad secured loan.

- How a secured loan works.

- The benefits of secured loans.

- How to get a loan secured by your property.

We know that dealing with money can be hard, and you might be worried about making mistakes. But don’t fret – many others are in your shoes, and we are here to help. We’ll share facts and tips in a way that’s easy to understand. Let’s find out more about loans secured on property together.

Can I use my home as collateral?

You can secure a loan with a property or with home equity. In either case, your home may be repossessed if you don’t keep up repayments. Using property to secure a loan is quite common and often done so the homeowner(s) can fund home improvements or consolidate existing debts on credit cards and personal loans. However, most loans secured on a property can be used for any purpose.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

What does it mean?

A loan secured with property is a loan that uses either the property or home equity as collateral in the credit agreement. You can lose your home if you fail to repay the loan.

Securing the loan against a property is using the actual bricks-and-mortar as security, such as a first charge mortgage. The mortgage provider can repossess the home if you do not keep up with monthly payments on your mortgage.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Equifinance | 6.59% |

£219.77 |

£26,372.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.65% |

£221.61 |

£26,593.75 |

| Selina | 7.79% |

£221.86 |

£26,622.92 |

| Spring | 10.05% |

£225.78 |

£27,093.75 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Securing against home equity

Securing a loan against home equity is using the value of your home you own outright. The property can also be repossessed for the creditor to recover this amount of money.

Note: to work out the equity in your home, you need to subtract your existing mortgage from the market value for your home.

Most people who use home equity to get a secured loan do so with an existing mortgage. If the home does need to be repossessed to recover a home equity loan debt, things get a little more complicated.

Once the property is sold and money is raised, the mortgage lender gets priority over the money to pay off the mortgage debt. The remaining money is used to pay off the loan, which was secured against the home equity. If the property value stayed the same or increased, this won’t cause issues, and there might even be money left over that is given to the debtor.

What if we are in negative equity?

If the property had decreased in value and the homeowner was in negative equity, they may not be able to pay off both the remaining mortgage debt and the home equity secured loan debt. The shortfall can be so great that they end up with significant debts and may even need to file for bankruptcy.

This is why you should think carefully before securing any other debts against your home. It’s also worth bearing in mind that if you jointly own the property, then both owners typically need to give consent to get a secured loan, and both of you are equally liable for the debt.

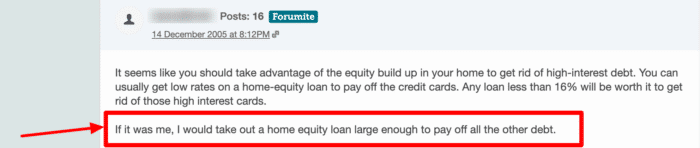

Over on the MoneySavingExpert forum, this user is advising another user who is struggling to pay their debts, and they are suggesting a home equity loan.

What is the interest rate?

Each lender will offer its own interest rates on secured loans, and the rate you are offered will be based on the loan amount, how long you want to pay it back, personal finances and your credit score.

The best rates on secured property loans are between 2% and 10%. The rate might be a fixed rate or a variable rate. The former is when the interest stays the same throughout the whole of the repayment period, and the latter is when the rate changes due to the economy or the Bank of England’s base rate – or a combination of both.

Additional fees

When looking into getting a secured loan, it is important that you consider other fees as part of the loan, such as asset valuation fees, handling fees, broker fees and other administrative costs. In my experience, people often forget about these additional fees, so you must make sure these are accounted for when you compare loans.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How do you do it against a property?

To get a loan secured on property, you must choose a secured loan that allows you to do so. There are generic secured loans that enable you to use property or property equity as security, and there are specific secured loans that allow this for certain purposes.

Which loan types?

Lots of loans are secured with property, such as mortgages, second-charge mortgages, homeowner loans and much more. There are seven types of loan that can be secured with property:

- First charge mortgage

A first-charge mortgage is a long-winded way of saying a residential mortgage. It is the first mortgage you take out to buy a property. If you buy a second property using a new residential mortgage, this is also a first-charge mortgage. It provides you with a loan to help buy the property on top of your deposit. If you don’t maintain repayments, the property can be repossessed and sold to clear the first charge mortgage.

Second-charge mortgages are second mortgages taken out on a property that already has a first-charge mortgage. These loans are secured against the value of the property you already own, also known as your home equity. If you cannot repay the loan, the lender can get their money back from your equity, which means a) seizing the property, b) selling it, c) letting the first mortgage lender get their money back first, and d) then recovering your debt from the remaining money.

- Homeowner loan

Homeowner loans are also known as home equity loans. They work in an identical way to a second-charge mortgage by borrowing against home equity.

- Home equity line of credit (HELOC)

A HELOC is the same as the previous two types of secured loans, with two key differences. The first is that the loan is not paid out a single amount. The borrower draws from the loan amount over a fixed period and, during this time, only pays interest on the loan. After the draw period ceases, the borrower starts to pay back the principal loan amount as well as an interest rate. HELOCs typically charge a variable rate, while other secured loans charge fixed rates.

- Home improvement loan

These personal loans can be secured or unsecured. They provide credit for the purpose of renovating or improving your home. It can be wise to borrow against home equity to enhance your home because this can increase its value and, in turn, increase your amount of home equity again.

Debt consolidation loans are used to pay off existing debts and merge all the money owed into this loan. You can secure the loan with home equity, but you can find them as unsecured loans, too. They can’t be used for other purposes, in whole or in part.

- Generic secured personal loan

This type of loan can be secured with different types of assets but is frequently done so with property or property equity. You can use the lump sum provided for any purpose.

Am I eligible?

Getting approved for a secured loan that uses a property as collateral will involve all of the usual checks, including an affordability assessment and a credit score check. Each lender applies their own tests and comes to an independent determination, meaning it is not possible to say if someone definitely will or definitely won’t be approved.

But before you get to this stage, you’ll need to meet the lender’s eligibility criteria on the secured homeowner loan, etc. This generally means being of a certain age – either 18+ or 21+ – and being a resident of the UK for six months of the year, i.e., a UK tax resident. But equally, you’ll need to have sufficient home equity in a property you own to apply.

Secured loans on a property may require you to take out a minimum loan amount, and you’ll need even more home equity than this because borrowing against all your equity is not possible. Most lenders will allow you to borrow against 80% (LTV ratio) of your equity at most. Poor credit history or a low credit score could reduce the available LTV ratio.

What is Loan to Value (LTV)?

LTV is a measurement within a risk assessment completed by lenders before agreeing to award mortgages. The calculation is used to determine the element of risk when lending a certain amount to you. A lower LTV ratio generally means you can get a lower interest rate because it poses less risk to the lender.

What credit score do I need?

Your credit rating is looked at when you apply for any secured loan. If your credit score is below average due to previous debt problems and payment defaults, you will either be offered a higher interest rate because you are deemed a greater lending risk, or you will be denied the personal loan.

To get approved with the best rates on offer, you need to have a good or excellent credit score, which is a different number depending on what credit reference agency you refer to. But, due to each lender applying independent tests, there is no exact credit score that works as the benchmark to be approved.

The Financial Conduct Authority allows each lender to do their own assessments but must follow guidelines as part of responsible lending.

Your whole application and finances are taken into account together.