Lowell Telecom on Credit Report – Who Are They?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

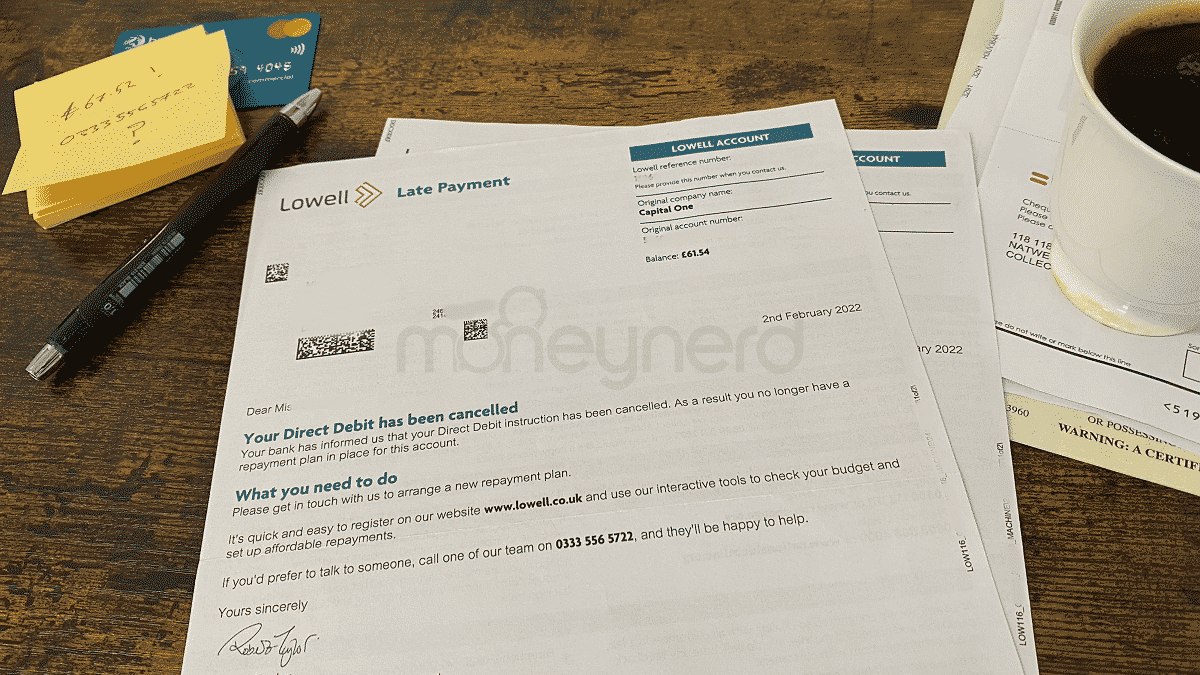

If Lowell appear on your credit report, it likely means they’ve bought a debt you owe.

We know this sounds concerning, but don’t worry, you’re not alone. Each month, over 170,000 people seek guidance from our website on debt issues.

In this article, we’ll:

- Discuss why Lowell might be on your credit report.

- Guide you on how to clear your Lowell debt.

- Explore if you can write off some Lowell debt.

- Provide Lowell Telecom contact details.

Research reveals that about 64% of adults feel stressed when dealing with current debt collectors1, and some of our team have even been there. So we understand how you feel.

We’re ready to provide you with useful information. Let’s explore your options and find the best way to deal with Lowell.

Why is Lowell on your credit report?

Once Lowell purchases a debt you owe, they become responsible for reporting the debt to credit reference agencies.

However, they cannot start reporting to credit reference agencies on the debt until they have sent you a Notice of Assignment letter. This is a letter to inform you that they’re now the company that owns your debt.

If you don’t keep up repayments on the debt or miss payments as part of a payment plan, the debt collection agency could decide to record payment defaults on your credit file.

This is why we always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

How do you clear the debt?

You can contact the company to clear your Lowell debt. But if you don’t recognise the supposed debt, you can ask Lowell to prove you owe the debt first.

We have made this easier with our prove the debt letter template.

If they don’t provide you with proof of the debt and decide to take you to court for a CCJ, you can tell the judge you requested proof and nothing was returned.

The debt was proved – now what?

If Lowell proved the debt, they could take you to court if you don’t pay.

With proof, it’s highly likely that a court would issue a CCJ against you, which is a court order for you to pay Lowell.

If you don’t pay them after a CCJ has been awarded, Lowell could ask for a special warrant. This would enable debt enforcement officers to recover the debt, possibly by coming to your home and taking valuable items to be sold.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Lowell Telecom on credit report – for how long?

If you have Lowell Telecom on your credit report, it will remain there for six years whether you do or don’t pay off the debt.

After six years, the record is automatically removed from your credit file.

During the time that it’s on your report, it will be harder to get approved for credit, or you might be approved but asked to pay a higher interest rate as part of your loan or credit card.

» TAKE ACTION NOW: Fill out the short debt form

Can you ask them to remove a default?

Yes, you can ask Lowell to remove a default on your credit file.

Lowell must agree to remove the default if you can prove they have made a mistake.

If Lowell doesn’t remove the default in good time, you can raise the issue with credit reference agencies and ask them to remove it directly instead.

But you must ask Lowell to remove it first!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Lowell Telecom Contact Details

| Website: | www.lowell.co.uk |

| Phone numbers: | 0333 556 5835 0333 556 5570 0161 968 7065 0333 344 6379 0333 556 5902 0333 556 5847 0333 556 5562 |

| Email address: | [email protected] |

| Postal address: | PO Box 1411, Northampton, NN2 1BQ |

| Office Address: | Ellington House 9 Savannah Way, Leeds Valley Park West, Leeds LS10 1AB |

| Opening times: | Monday – Thursday: 8:00 am – 8:00 pm Friday: 8:00 am – 7:00 pm Saturday: 9:00 am – 2:00 pm |

| Other addresses: | PO Box 201 Huddersfield HD8 1EP PO Box 189 Huddersfield HD8 1DY |