Missed Payment on Car Insurance – Are You Breaking the Law?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you worried about what could happen if you miss a payment on your car insurance in the UK? You’re not alone! Each month, over 9,300 people visit our website for advice on similar matters.

In this article, we’ll help you understand:

- What happens if you miss one or more car insurance payments?

- How you might be breaking the law if you drive without insurance?

- Steps to take if you are struggling to pay for your car insurance.

- How to make sure your car insurance payments go through properly.

- Where to get help if you are having trouble with car insurance.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

I know this can be concerning, but we’re here to help you manage your can insurance. Our advice is based on facts and our experience.

How Do You Pay?

There are generally three options when it comes to paying for your annual car insurance, and we have outlined them below.

- You pay the entire year as a lump sum at the start of the year.

- You pay for your insurance in two payments, one at the start of the term, and one at the halfway mark.

- You set up a direct debit, and monthly payments are taken out of your bank balance.

The first option is the simplest, and once you have paid for the year in advance, you are covered for the whole 12 months.

But both of the next two options could, in the wrong set of circumstances, lead to you not being covered if you don’t make a payment.

The least serious thing that would happen is you find you are being chased for payment by a collection firm such as PRA Group or Cabot Financial.

The worst thing that could happen, is you end up driving illegally, as your car insurance has been cancelled.

What Will Happen if I Don’t Pay?

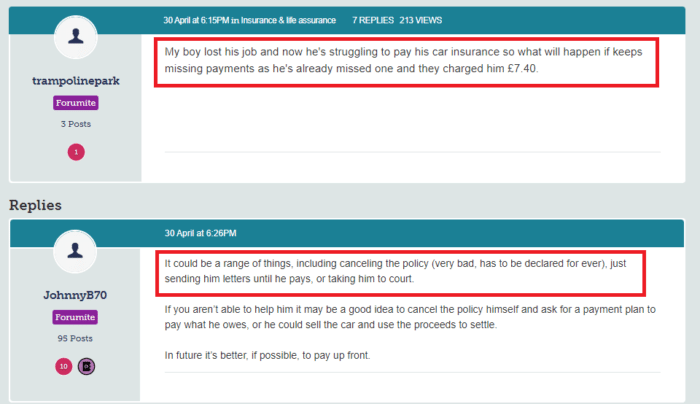

If you don’t make your scheduled insurance payment, a number of things could happen.

Depending on whether you have missed payments previously, or are already in arrears.

We have listed some of the repercussions of a missed payment below.

- Your insurance firm will contact you, asking you to make the payment.

- If you fail to make multiple payments, your car insurance could be cancelled.

- If you do not settle the debt you owe the insurer, they may pass your debt over to a collection agency such as Lowell Financial.

If your car insurance is cancelled, you will be breaking the law, as you will be driving without car insurance.

If you are caught driving without insurance, you face the prospect of getting a driving conviction.

Convicted Driver Insurance Increase

You could receive penalty points on your licence if you are caught driving a vehicle without insurance.

Unfortunately, points can increase insurance costs. Here’s the estimated average rate increase.

| Points on License | Estimated Average Rate Increase |

|---|---|

| 1 – 3 Points : This range usually covers minor offenses. Insurance rates may increase but not excessively. | 5% – 20% |

| 4 – 6 Points : This range might indicate repeat offenses or a more serious violation. Insurance premiums are likely to rise more significantly. | 20% – 40% |

| 7 – 9 Points : At this level, the driver is considered high-risk. This can lead to substantial rate increases. | 40% – 60% |

| 10 – 12 Points : Accumulating this many points might lead to a driving ban. If insurance is offered, it would likely be at a very high rate. | 60% – 100%+ |

Always Check if Your Payment Went Through

Making sure your car insurance has been paid is crucial.

If a mistake is made, or technology lets you down, you might find yourself being slapped with a driving conviction for driving without insurance.

If you are making your annual or bi-annual payment online, then you should check that you receive confirmation that the payment has actually been processed.

A minor internet hiccup could mean that payment was not actually taken.

You can always check your bank balance if you used a debit card to pay, to check if the transaction went through.

The same holds true if you pay via credit card, although you may have to wait a couple of days for the transaction to show on your credit card statement.

If you are in any doubt about whether the payment was successful or not, be sure to reach out to the insurance firm and check that they have registered the payment.

» TAKE ACTION NOW: Find the best insurance for drivers with points

What To Do if I Cannot Afford To Make the Next Payment?

In some cases, you may be fully aware that there will be a problem with an upcoming car insurance payment.

For example, if the direct debit is due to be taken out of your bank account a few days before payday, and you won’t have the funds to cover it.

Car insurance firms would much rather you make your insurance payment than go through the process of cancelling your policy and handing the debt over to a team of collection agents.

Therefore, you will usually find that they are very helpful, and would likely let you move the date of the direct debit (and all future ones) to a more suitable part of the month.

You can also talk to your insurer about making an interim payment to make up for the shortfall.

Or if you can’t make your mid-term payment, ask about switching to monthly direct debit instead.

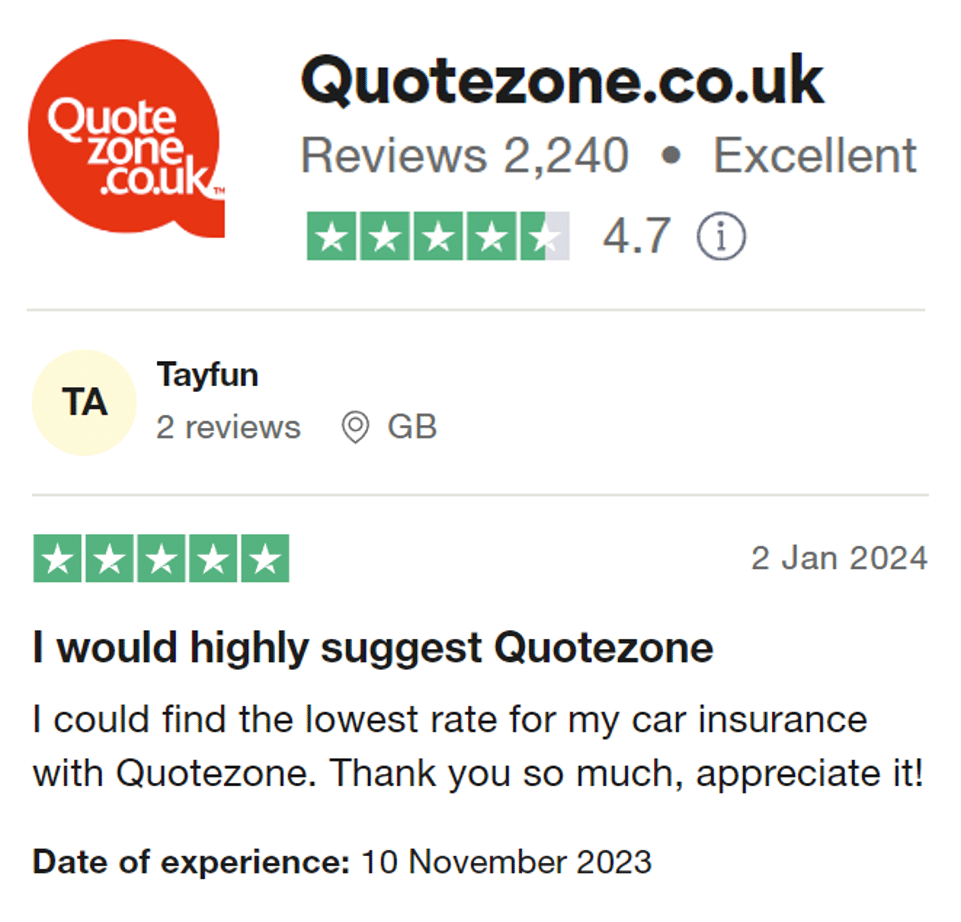

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

I Have a Direct Debit Set Up, What if My Bank Doesn’t Pay?

If you have set up a monthly direct debit out of your bank account to pay your car insurance, if you lack sufficient funds to cover this payment on the day, it will be returned.

If payment fails in this way, the bank will try twice more to make the payment, in case it was a short-term issue with bank funds. It will try once in the morning, and a second time at 2 pm in the afternoon.

If there are still insufficient funds to cover the direct debit, it will be denied. You might also have to pay a fee to the bank for not honouring the direct debit.

If you are aware of a problem with direct debit payment, you should contact your insurer straight away.

They will likely have a process in place so that you can pay the missed instalment using a debit or credit card.