Moorcroft Debt Recovery HMRC – Pay or Appeal?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a letter from Moorcroft Debt Recovery about money you owe HMRC, don’t worry, you’re not alone. Every month, more than 170,000 people come to our website for information regarding debt issues.

In this guide, we will:

- Explain why Moorcroft Debt Recovery is contacting you.

- Tell you what happens if you owe money to HMRC.

- Discuss your options, like paying the debt or making an appeal.

- Share advice on how to handle debt collection agencies.

- Offer tips on when and how you can legally write off debt.

We understand that getting a letter about debt can be scary. But we’re here to help. Our team has dealt with debt collectors too, so we know what you’re going through. Let’s work together to find the best options to sort out your debt. Whether it’s setting up a payment plan or looking at ways to write off your debt, we’ve got you covered.

Let’s get started.

What happens if you owe HMRC money?

If you owe HMRC money you’ll be asked to pay. If you cannot afford to pay the amount owed without causing financial hardship, HMRC may allow you to pay the tax debt off in instalments.

When approved to spread repayments over many months, HMRC might add interest or charges to the total debt. Paying in instalments is called Time to Pay. It’s only an option if you can repay the full debt within one year and the debt is less than £30,000.

Do HMRC use third party debt collectors?

Yes, HMRC might use independent debt collection agencies to help them chase and recover unpaid HMRC debts. They’re more likely to outsource debt collection to third party debt collectors if they have been unsuccessful at contacting you.

It’s important to know what a debt collection agency is and isn’t. It’s a company that will use several contact methods to ask you to pay, often threatening court action if you don’t pay by a set deadline.

A debt collection agency isn’t a bailiff company that can take your items. Although HMRC could escalate to debt enforcement agents further down the process.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if you ignore a HMRC debt?

If you have a HMRC debt and ignore it, either because you can’t pay or hope to get away without paying (you won’t!) HMRC can use debt enforcement action.

There are several ways that HMRC could recover a debt owed to them, including taking money from your wages and bank account or using HMRC bailiffs.

Before using these methods, HMRC might chase you for payment themselves with letters and calls, or they could use a debt collection agency to chase you on their behalf.

» TAKE ACTION NOW: Fill out the short debt form

What debt collection agency does HMRC use?

HMRC only uses a selection of hand-picked debt collection agencies. They list the debt collection agencies they use on the government’s website. These are:

- 1st Locate (trading as LCS)

- BPO Collections Ltd

- Bluestone Consumer Finance Limited (trading as Bluestone Credit Management)

- Advantis Credit Ltd

- CCS Collect (also known as Commercial Collection Services Ltd)

- Oriel Collections Limited

- Past Due Credit Solutions (PDCS)

- Moorcroft Debt Recovery Ltd

Moorcroft Debt Recovery is one of the biggest debt collection companies in the UK, which we previously reviewed here.

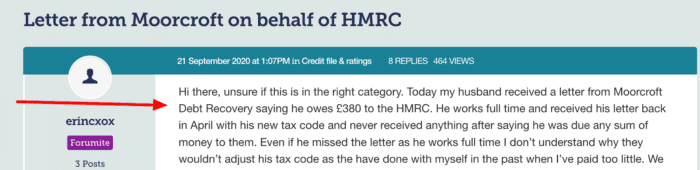

There are scores of forum posts from people discussing a letter from Moorcroft about an HMRC debt, just like this one:

Source: https://forums.moneysavingexpert.com/discussion/6192942/letter-from-moorcroft-on-behalf-of-hmrc

What happens if you ignore Moorcroft HMRC debts?

Normally when you ignore a debt collection agency, the debt collection agency must take you to court to force you to pay. But this isn’t the case with HMRC debts.

If Moorcroft has to return to HMRC to say they were unsuccessful at recovering the debt, HMRC will use more severe debt enforcement action.

They could:

- Use a HMRC enforcement officer to repossess some of your assets, which will then be sold to clear the debt. This is comparable to a bailiff service and the fees are identical, starting with an additional £75 just for notifying you that they’re planning to visit you.

- Take the money straight from your bank account as long as you owe more than £1,000 and it won’t cause you financial hardship.

- Take money from your wages by instructing your employer to send a percentage of your wage to HMRC.

- Add a charging order to your property, so some of the sale proceeds must be sent to HMRC when it’s sold.

- Take payment from your current or eventual pension

- Make you bankrupt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should you pay Moorcroft Debt Recovery HMRC debts?

To avoid the more serious and certain action taken against you listed above, you should certainly pay your HMRC debt to Moorcroft. Or ask for a Time to Pay arrangement if you will struggle to repay the full amount at once.

If you want to query the debt, it’s best to speak with HMRC as early as possible.

Want to know more about debt collection agencies?

If this is your first time dealing with a debt collection group, it’s understandable to be overwhelmed and even upset. But take a deep breath and learn more about debt collectors, including what they can and can’t do.

Knowledge is power in these situations, and MoneyNerd is here to provide just that!