N55 Form for Attachment of Earnings – What You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you have received an N55 form for Attachment of Earnings, it means a person you owe money to is trying to take it directly from your pay.

Don’t worry; you’re at the right place to learn all about it. Every month, more than 170,000 people turn to our website seeking advice on money problems.

In this article, we’ll explain:

- What the N55 form is and why you might have received one

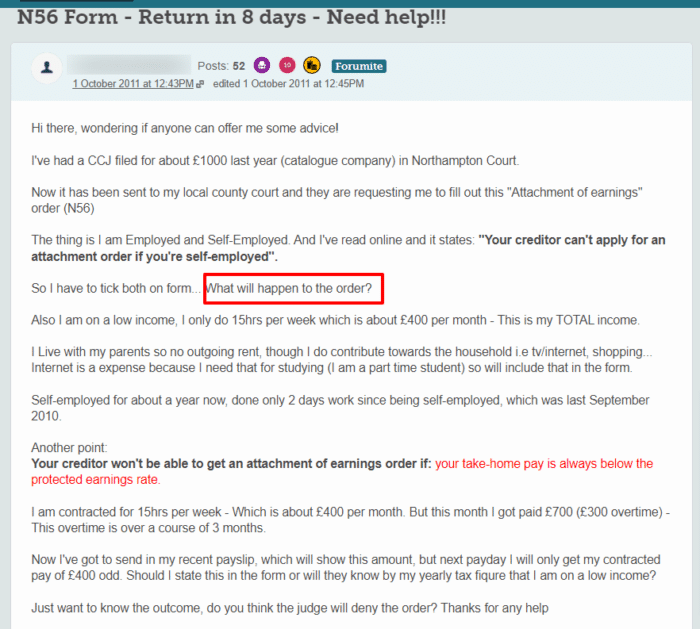

- How to reply to an N55 form using the N56 form

- The way to stop an Attachment of Earnings Order

- If this order can change your credit score

- How to get help if you’re finding it hard to pay your debts

We understand that dealing with money can be hard sometimes; some of us have been in your place before. We’re here to help you understand what’s going on with your pay.

What is an N55 form?

What is an N56 form? (Replying to form N55)

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you ignore form N55?

» TAKE ACTION NOW: Fill out the short debt form