Network Credit Services Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

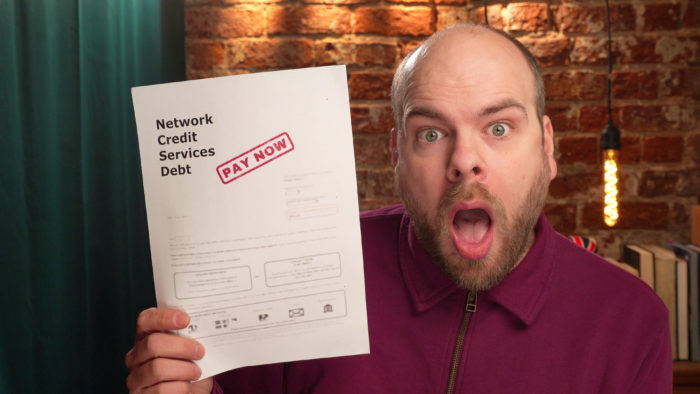

Are you feeling worried because you received a surprising letter from Network Credit Services? You may be asking yourself, ‘Should I pay the debt?’ or ‘Is this real?’

Don’t worry, you have come to the right place. Each month, over 170,000 people visit our website to seek advice on debt problems.

In this helpful article, we’ll talk about:

- Understanding who Network Credit Services are.

- Reasons why they might be contacting you.

- How to respond if you can’t afford to pay.

- Finding out if you can lessen some of your Network Credit debt.

- What could happen if you don’t pay Network Credit Services.

Our team knows how it feels to be chased by debt collectors like Network Credit Services. With our expertise, we’ll help you learn more about how to handle Network Credit Services debt in 2023.

Why Is Network Credit Services Contacting You?

Looking at the NCS website, it doesn’t seem as if they actually buy up debts and then attempt to collect them. This means that if you are contacted by the company, it is likely going to be on behalf of one of your creditors, who has engaged NCS to collect the debt on their behalf.

What Happens if You Don’t Pay Network Credit Services?

If you find that NCS is chasing you to pay a debt, this will generally start with letters and maybe phone calls, and could escalate all the way up to you being declared bankrupt. Below is a list of some of the things that might happen if NCS is chasing a debt.

- You will be sent many letters, to any address that NCS can find where you might receive a letter.

- Phone calls will be made, and these could happen in the evening, late at night or even at the weekend.

- In some cases, an evening or weekend visit to your home might be made by a debt collection agent.

- NCS may have a default entered into your credit history.

- If your debt is more than £5,000 you might have a statutory demand issued. This is the first step of your being declared bankrupt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can Network Credit Services Take You to Court or Have You Declared Bankrupt?

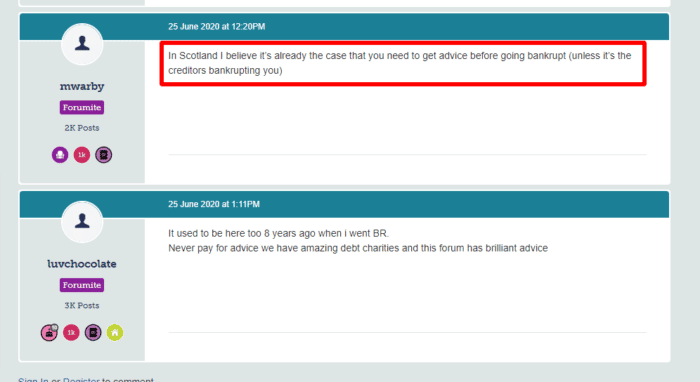

Ultimately, if you fail to pay your debt, or make any arrangement to begin paying it, then NCS will very likely take legal action against you. And this could mean that a court begins the process of declaring you bankrupt. The reason for this, is that once you are bankrupt, NCS can apply to collect funds straight out of your wages. If you are looking at bankruptcy in Scotland, you need to get some professional advice about this.

» TAKE ACTION NOW: Fill out the short debt form

There is some good news here though. A debt collection agency wants you to pay your debt. Taking you to court means an additional delay in having the debt settled. Most debt collectors will be happy to talk to you about setting up a repayment plan that you can afford. You may find that NCS is willing to settle for fairly low repayments across a longer timeframe, rather than go through the process of having you made bankrupt. You have nothing to lose by getting in touch with Network Credit Services and trying to arrange a suitable, affordable payment plan.

Where To Get Help With Debt – Your Options

If you live in Scotland, you might want to look at what the Citizens Advice Bureau has to say about the debt arrangement scheme in Scotland. There is some good information to be found that is related to dealing with debt responsibly and finding an affordable way to deal with your debt.

If you are in a lot of debt, or owe multiple creditors, you could consider something like an Individual Voluntary Arrangement (IVA). Under such a scheme, your creditors can no longer chase you for payment, and they cannot add more fees or interest to your debt.

Probably the best starting place, is to speak to a debt counsellor. They will go through your debts with you, as well as your income and outgoings, and help you work out how much you can afford to pay. They will then be able to give you some advice on how best to negotiate with your creditors or any debt collection agency that is chasing you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Network Credit Services Contact Details

| Website: | www.networkcreditservices.com |

| Phone number: | 01698 300026 |

| Email: | [email protected] |

| Address: |

Network Credit Services Units 21 – 23 Brandon House 23 – 25 Brandon Street, Hamilton, Lanarkshire ML3 6DA |