Ratesetter Loans (Rate Setter) All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Update August 2020: RateSetter almost went out of business but has been acquired by Metrobank. This shouldn’t change anything from your perspective, but it’s good to know.

If you’re thinking about taking a Ratesetter loan and want to know more, this is the right place for you. This guide will explain all the details you need to understand before borrowing money.

Each month, over 170,000 people come to our website for advice on how to sort out their debt, so you’re not alone.

In this guide, we’ll explain:

- Who Ratesetter is and how they work.

- What peer-to-peer lending is.

- Key features of Ratesetter’s loans, such as APR, loan amount and repayment period, and fees.

- How to apply for a Ratesetter loan.

- How to handle unaffordable debt.

Dealing with debt can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry. We’re here to guide you through your options and help you find a solution that suits your situation.

What are the key features of Ratesetter’s loan?

It’s important to carefully analyse the key features of unsecured loans before committing. Here are the critical details of Ratesetter’s Personal Loans:

APR

Minimum APR: 3.9%

The APR for the loan is advertised at 3.9%. This is a best-case scenario.

Depending on your personal finances, the APR could go up.

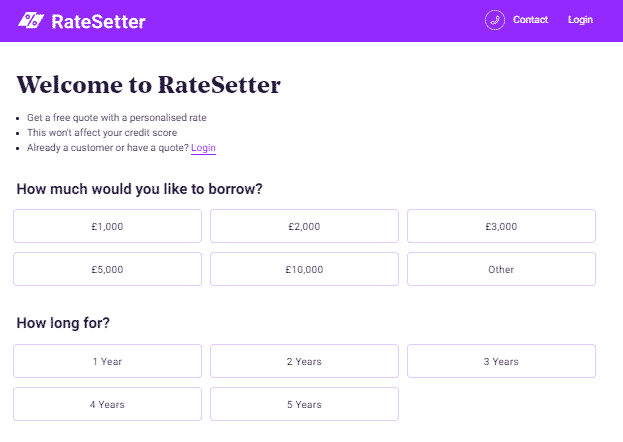

Loan Amount and Repayment Period

You can borrow between £1000 and £25,000.

The loan repayment period can be between 1 – 5 years.

Example

Here’s the representative example that they give on their website:

- Representative APR: 4.9% APR

- Loan amount: £10,000

- Interest rate: 2.3% (fixed) p.a.

- Term: 60 months

- Monthly repayments: £187.94

- Total amount repayable: £11,276.50

- Total cost: £1,276.50

Fees

There is a fee involved with this loan. T

he fee will depend on your credit profile. The loan fee is built into the APR (Annual Percentage Rate) and the fixed annual interest.

Therefore there are no hidden charges.

Information correct as of 01/04/21 (RateSetter)

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will I be accepted for a RateSetter loan?

RateSetter will assess you based on certain criteria. See if you qualify under the following loan eligibility requirements:

- Age: 21+

- Residency: UK resident for 3+ years

- Homeowner/tenant: You don’t need to own your own home

- Income: You must have a regular source of income

- Insolvency: You must have a good credit history

- Bank: You must have a UK bank account to qualify for this loan.

Information correct as of 01/04/21 (RateSetter)

Budget Advice

Before diving into the loan application process, it’s essential to assess if you can handle the repayments.

To help you manage your finances, I’ve put together this table that provides 10 budgeting tips.

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

How do I apply for a RateSetter loan?

You can apply for a RateSetter loan online.

Because of their quick loan approval process, a decision will be made within two working days of completing the online loan application.

The funds will be in your bank account the next working day.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Where are RateSetter located?

You may want to speak with the loan company in person.

If you do, finding a company with offices near your address is important. Take a look at the Ratesetter office location on a map.

Address:

6th Floor

55 Bishopsgate

London

EC2N 3AS

FCA Lending Regulations

1) Affordability rules

One of the most important regulations the FCA introduced under responsible lending practices was that the lender must ensure the loan is affordable.

This means the borrower should be able to repay the money without issue.

The regulation is vital and is one which put Wonga out of business.

If lenders don’t use stringent guidelines to ensure affordability and meet FCA compliance, they will likely face the same treatment.

With these lending regulations, borrowers should be able to make loan repayments and pay their other essential bills and food.

2) Regulation on interest and fees

Another point the FCA raised was that lenders often charged borrowers seriously high interest and fees.

They had to deal with this by introducing a cap on fees and interest.

The limits on interest and fees were (a) a 0.8% cost cap, including all interest and fees. (b) a £15 cap on default fees. (c) 100% complete cost cap, which means that you should not need to pay more than double the amount of what you have borrowed.

3) Regulations regarding the Continue Payment Authority

It is the case that most lenders will expect you to make payments using a Continuous Payment Authority (CPA). With the CPA, they have permission to go into your bank and debit money whenever they wish.

The main problem with this was getting abused by lenders, and in many cases, they were attempting to take payments over and over throughout the day.

This means that some borrowers could be paid at 9 am and find that the money has been taken from their account unexpectedly at 10 am.

Leaving them with nothing in their account to pay bills, and possibly, without food!

The new regulation regarding CPA was in two parts:

a) if lenders attempt to take money via the CPA twice and it fails, they must not try it again.

(b) they must also take the full amount of the due money; otherwise, they can’t take anything. They can only take a partial payment if you have already agreed on a plan. Such as if you have arranged a payment plan with them.

» TAKE ACTION NOW: Fill out the short debt form

Data protection registration:

Data protection registration means that this company is registered with ICO, the UK’s independent authority set up to uphold information rights in the public interest. The privacy of your data will be protected.

Registration No: Z2083390

Data controller: Retail Money Market Limited

Address:

Retail Money Market Limited

6th Floor

55 Bishopsgate

London

EC2N 3AS

Information correct as of 01/04/21 (ICO register)

RateSetter reviews

It’s important to see how other customers have rated their experience with RateSetter. Take a look at the up-to-date RateSetter user reviews on Trustpilot.

*Information correct as of 11/06/21 (Trustpilot)

How to complain about RateSetter?

Should you need to complain about RateSetter, you can use the details below to either write to them or call them.

Renu Sandhu

1 The Osiers Business Centre

Leicester

LE19 1DXL

UNITED KINGDOM

+44 02031426226

[email protected]

If RateSetter does not respond to your complaint, contact the Financial Ombudsman Service. They might be able to handle your complaint.

Information correct as of 01/04/21 (FCA)

Company information:

After researching Companies House and their website, we found the following RateSetter company details:

Date of incorporation: 13 November 2009

Company status: Active

Company number: 07075792

Company type: Private limited Company

Website: ratesetter.com

Address: 6th Floor 55 Bishopsgate, London, England, EC2N 3AS

Business Hours: Monday – Friday: 8:00 am – 6:00 pm

Phone number: +44 02031426226

Information correct as of 01/04/21 (Companies House)