Scottish Power Prepayment Meter Debt – What to do first

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about owing money on a Scottish Power prepayment meter, this guide is here to help. Every month, more than 170,000 people turn to our website for help with their debt problems.

Citizens Advice reports a record number of people seeking help for energy debts, with almost eight million borrowing money to pay their energy bills in the first half of 2023.1 We understand the worry that comes with not being able to pay energy bills and want to reassure you that you’re not alone.

In this guide, you’ll find:

- Information about Scottish Power prepayment meters.

- Advice on what to do if you can’t pay your Scottish Power prepayment meter debt.

- An explanation of how you can be in debt with a Scottish Power prepayment meter.

- Details on emergency credit and standing charges.

- Guidance on what happens when you miss a payment on a prepayment plan.

We’ll also discuss the role of the Energy Ombudsman Service, the possibility of writing off some of your Scottish Power debt, and what happens when the emergency credit runs out. We’re here to help you navigate through this difficult time.

Let’s dive in.

What is a Scottish Power prepayment meter?

You’d have a Scottish Power prepayment meter installed in your home to monitor how much you spend on energy.

But, of course, you’ll have to pay in advance when you have this type of meter which tells you when you need to top up your credit.

In short, you can track how much you spend on gas or electricity when you have a prepayment meter.

Note: A prepayment can be installed if you have energy arrears or poor credit. It’s a way of preventing you from getting into more debt.

Prepayment meter advantages and disadvantages include it helps you stay in control of the amount of energy you use.

The disadvantage is that you have to pay upfront for your energy supply.

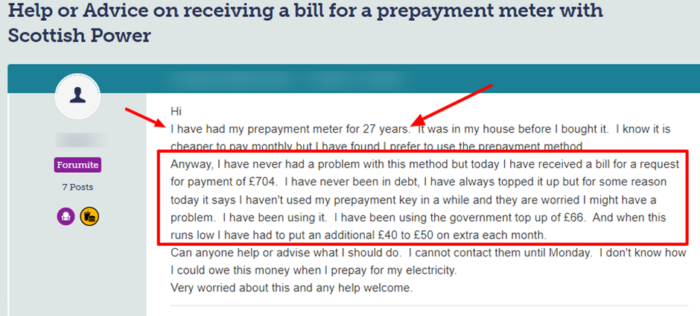

Check out this message posted by a Scottish Power customer on a popular online forum:

Source: moneysavingexpert

Energy suppliers must follow licence conditions

Energy supplies must follow Ofgem’s licence conditions and UK’s laws and regulations. These offer protection to customers on prepayment meters and customers in general.

In short, energy providers should respect an energy price cap and prepayment meters guidelines.

If you are unhappy with how Scottish Power handles the debt, file a complaint with the supplier. They must investigate your complaint.

You can even take the matter further by contacting the Ombudsman Service if things can’t be resolved.

The Role of the Energy Ombudsman Service

The Energy Ombudsman can make an energy provider correct a problem, explain what happened and offer an apology.

The Ombudsman can also make a provider pay you compensation, and their decisions are binding.

How can you be in debt with a Scottish Power prepayment meter?

You can get ‘emergency credit’ and ‘additional emergency credit’, which means you could get into debt with a prepayment meter. Moreover, the amount of credit borrowed on the meter still needs to be paid back when this happens.

When you use emergency credit, the amount is typically recovered when you top up a prepayment meter. This is part of the prepayment meter emergency credit rules.

An example is if you used a £10 emergency credit, the next time you top up £30, you’d only have £20 on the meter. This is because the other £10 goes to paying off the debt.

Another way you could get into debt with a Scottish Power prepayment meter is when you don’t top-up for a while. Even when you don’t use any energy, the standing charges still mount up.

Fuel poverty and prepayment meters can be a real issue in these difficult times, which adds to people’s energy debt problem.

What is emergency credit?

You can access emergency credit when you can’t afford to top up a Scottish Power prepayment meter. However, many people don’t realise a standing charge is applied to an account when these meters are installed.

Also, some energy providers charge a fee when you use emergency credit.

» TAKE ACTION NOW: Fill out the short debt form

Standing Charge: What is it?

As a fixed daily sum, energy providers add a standing charge to customers’ bills.

The charge is added no matter how much energy a customer uses and applies to properties even if they are not occupied for several months of the year.

What happens when I miss a payment on a prepayment plan?

As I see it, it’s always better to stay in touch with Scottish Power when you can’t pay a prepayment meter debt. Seek independent advice if you are worried or concerned about the situation.

There are different kinds of debt solutions which could get you back on track. One such example is being able to clear the amount you owe with a Debt Relief Order.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Detailed information on Debt Relief Order

A Debt Relief Order (DRO) lets you deal with personal debts you struggle to repay. You can only apply for a DRO through an approved debt advisor. Plus, you must meet specific eligibility criteria to qualify for a DRO.

The order typically lasts for twelve months. If approved, you won’t have to pay payments towards debts and interest on debts listed in the order. This lasts while the DRO is in place.

Note: Debt Relief Orders aren’t available to people who live in Scotland.

What happens when the emergency credit runs out?

When the emergency credit runs out, you could get more emergency credit. But this only really applies if:

- You suffer from a longer-term illness

- You’re disabled

- You’re in financial trouble because of your debts

- You’re a state pensioner

If any of the above applies, the energy provider should allow you to get more emergency credit when the initial one runs out.

What if I can’t pay a Scottish Power prepayment meter debt?

I suggest that you contact Scottish Power support if you can’t afford to pay back the total amount of debt on a meter. They may agree to spread the cost of the debt by paying less every week to an amount you can afford to clear the debt.

If you’re in financial trouble and cannot pay what you owe on a Scottish Power prepayment meter, don’t panic. There’s help and support for people who fall into debt.

Scottish Power has its own Hardship Fund, so get in touch with the supplier’s support team as soon as possible. Consider the Scottish Power Warm Home Discount, which is a Government-backed scheme.

An energy supplier must offer you different options to repay the debt. In addition, they must provide you with a ‘repayment plan’.

Alternatively, you could switch energy providers, but you’d need to ask the new provider first. They could agree to transfer your debt with your supply, known as Debt Assignment Protocol.

Prepayment meters are being phased out

The original date for phasing out pre-paid energy meters was 2020. However, the date is now scheduled for 2024. As such, Scottish Power Smart Meter installation could continue till then.

Energy providers are counting on customers using Smart Meters to track how much they spend.

According to the National Grid Group, UK electricity consumption will increase by around 50% by 2036. It’s estimated this figure will double by 2050.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What is a Smart Meter?

A smart meter measures the amount of energy used before automatically sending meter readings to providers by a remote connection.

There are various repayment meter top-up methods available which include at a Post Office, PayZone and any outlet that displays a PayPoint logo.

Scottish Power Contact Details

| Website: | https://www.scottishpower.co.uk/ |

| Scottish Power contact number: | 0345 270 0700 – domestic customers |

| Scottish Power contact number: | 0345 058 0002 – small business customers |

| Email: | [email protected] |

| Online chat: | https://www.scottishpower.co.uk/livechatsme |

Debt help charities and organisations

It can happen to anyone from time to time. For example, falling behind with payments due to financial hardship. Particularly over the last couple of years when Covid hit the world hard.

Seek advice from debt charities if you are struggling to pay your bills and you’ve fallen behind on a Scottish Power prepayment meter debt.

I suggest you don’t try to cope on your own or ignore the problem. It won’t go away.

The charities worth contacting if you find you can’t cope with your bills include:

You could ask for time to pay, referred to as ‘breathing space’. However, the request must be made by a recognised debt charity or organisation.

You may qualify for time to pay depending on your circumstances and the amount you owe.

My advice? Always stay in touch with Scottish Power when you owe any money. Their support team should try to set up a repayment schedule you can afford.

This would typically be smaller weekly repayment amounts! Always stay in touch with the supplier and try to pay it off sooner rather than later. In my experience, you should never ignore a Scottish Power prepayment meter debt.